VIX-Leveraged Instruments Continue To Drive Profits When Used As Intended

On January 3, 2017 I offered readers and investors my plans for continued triple digit returns on capital invested in 2017. The article My Plans For Success In 2017 Continue To Involve VIX-Leveraged ETFs/ETNs served to outline how I would continue to allocate roughly 20% of Golden Capital Portfolio investable capital in shares of ProShares Trust Ultra VIX Short-Term Futures ETF (UVXY), VelocityShares Daily 2x VIX ST ETN (TVIX) and/or iPath S&P 500 VIX Short-Term Futures ETN (VXX). Since this publication, some of these instruments have executed a reverse split with TVIX set to execute a reverse split in the coming days. Additionally, since January 3rd, I have reduced my capital exposure to UVXY shares. Entering the year with 20% of capital outlays in UVXY short positions, I have reduced this core position to 15.4% within the Golden Capital Portfolio. The first reduction came at $26.90 a share and the next reduction came at $19.05 a share. Even with this curtailment of exposure, I have managed a series of short trades to accommodate for any would be loss of gains from the $26.90 to $19.05 share price decay. Many of these trades are posted in real time through my Twitter feed. Alongside these various trades I offer an up-to-date snapshot of Golden Capital Portfolio performance as depicted below:

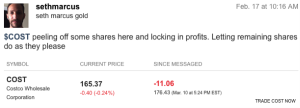

After capturing a 167% return on capital deployed in 2016, FY17 is on track to eclipse 2016’s returns. Year-to-date, Golden Capital Portfolio is up 41.2% with a couple of weeks still to go in March/Q1. While shorting Vix-leveraged instruments has and continues to be the key drivers of success for Golden Capital Portfolio, picking the right stocks and managing the investment has also proven to bolster the portfolios performance. As an analyst covering the retail sector, picking a good retail investment has been quite the obstacle. But as I outlined in November of 2016, Costco (COST) would likely achieve new all-time trading highs based on the retailer’s fundamental performance and moat around its business. In the article titled Costco Shares Have Been Poorly Received By Investors, I alerted investors to my stake in the company as well as my outlook for share price appreciation. Having added this position at $144 a share to Golden Capital Portfolio, taking a hefty profit at $154 and in February at $176 proved wise. In February, shares of COST did reach an all-time trading high for which I alerted investors/traders and followers to my decision for taking profits on Stocktwits as depicted below.

What would be optimal and as I’ve thoroughly reviewed Costco’s most recently reported results, is if shares were to retrench back to $160-$163. It’s in that price range that I would begin considering to recapture my previous share ownership level. Investors witnessed Costco report a miss on the top and bottom line in their Q2 2017 results. Having said that, the revenue miss was slight, even as the company grew sales 5.7% year-over-year. The headwinds surrounding profits haven’t alleviated in 2017 with gas price deflation and currency headwinds ever-present. But within the Costco business model also remains the ability for the retailer to leverage it’s membership fees. It’s been roughly 5 years since Costco raised its membership fees and as such, the company outlined its plans to do so in 2017.

The Company also announced that, effective June 1, 2017, it will increase annual membership fees by $5 for U.S. and Canada Goldstar (individual), Business, and Business add-on members (“Primary” Members). With this increase, all U.S. and Canada Goldstar, Business and Business add-on members will pay an annual fee of $60. Also effective June 1, annual fees for Executive Memberships in the U.S. and Canada will increase from $110 to $120 (Primary membership of $60, plus the Executive upgrade of $60), and the maximum annual 2% reward associated with the Executive Membership will increase from $750 to $1,000. The fee increases will impact around 35 million members, roughly half of them Executive Members.

The increase in membership fees should place a floor under the stock as membership fees generate the bulk of the retailer’s profits. It’s one of the reasons Citigroup actually raised its price target on the name from $184 to $196 a share.

There are many retailers to invest in, but few have proven to grow earnings and revenues the way Costco has over the years. I’ve reported most recently on J.C. Penney (JCP), Macy’s (M) and Target (TGT). While none of these retailers will become a long-term investment in the Golden Capital Portfolio, one has been chosen for a short-term trade, TGT. The reason I chose TGT is due to the company’s 20%+, warranted share price decline.The decline stems from both missing its Q4 2017 guidance and issuing 2017 guidance to exhibit low-single digit sales comps declines and EPS guidance below what it achieved in 2014. I believe despite these shortcomings and expected underperformance in 2017 when compared to previous years, the share price is nearing a bottom and will likely exhibit a dead cat bounce near-term. As such, a trading opportunity exists for which to participate. Make no mistake; shares of TGT will not likely express strong returns for anybody deciding to hold the instrument long-term and as exampled in the 5-year chart performance.

While the TGT dividend has helped alleviate some aspects of the dreadful share price performance, there have undoubtedly been better stocks to choose from in the market over the last 5-year period. I wouldn’t expect shares of TGT to make any dramatic retracement above $60 a share over the next 3-6 months and as such my price target object remains $58-$59 a share over that time period and for this trade. A stop limit order has been placed at $51.50 a share to define my risk to capital allocated for this trade.

Sorry JCP and M, while your share prices are far more attractive than in previous quarters, the fundamental outlook for your respective retail operations are perceived to be in greater doubt than that of Target/TGT presently. J. C. Penney is coming off a year in which the retailer reported negative sales growth in 3 out of 4 quarters. Management has also offered it believes sales would come in at the lower end of expectations in the Q1 2017 period. In my most recent analysis on J.C. Penney titled J.C. Penney's Go-Forward Strategy: Haven't We Seen This Movie Before?, I discuss the retailers many initiatives and their potential impact on future sales. Unfortunately, what I'm forced to recognize with these initiatives is that many of them actually curtail gross margins and/or require ample marketing spend to entice the consumer. Simply remodeling of stores and placing new merchandise is not a recipe for success and often times it has been the case that such actions do not increase a retailer’s consumer demographic reach. While J.C. Penney may in fact grow its appliance business market share at the expense of HH Gregg and Sears Holdings (SHLD), the total percentage of net sales from this operation has no ability to offset declines in its core categories. 2017 will likely prove to be a strong appliance, beauty and e-commerce year for J.C. Penney, but the retailer will have to show stabilization in its core apparel business in order to return to net revenue growth. While J.C. Penney has offered a slight improvement to EBITDA in 2017 and on a YOY basis, most retail names are not garnering investor sentiment in favor of profits, but rather sales and akin to online retailers like Amazon.com (AMZN). It was only a matter of time.

As it pertains to Macy's, I have been bearish on the company and it’s restructuring efforts since January 15 2016 and as I offered in the article Macy's Taking Cue From Peers Who've Seen Mixed Results. In referring to “how to value a retail stock”, I offered the very same sentiment then, as I do today. My warning for investors hoping to see Macy’s monetize its real estate assets was that the lure of higher earnings from this venture would be fleeting and not impact the share price over time. The analysis has been proven that investors realize post any real estate monetization benefits, Macy’s would be left to manage its depressing core business. As such, even though the retailer has sold certain assets and closed a number of retail locations, the share price has only faltered further. Like J.C. Penney and Target, Macy’s is being valued according to its sales and sales outlook, not EPS and/or profits. Moreover, regarding Macy’s takeover/buyout rumors, I have been highly skeptical. I offered my skepticism and bewilderment in the article Macy's May Be Acquired, But It Begs For Greater Logic. I sincerely hope that an acquirer can be found for Macy’s as the company seems to be doing very little to adjust to the ever-changing retail landscape. Long-term shareholders would likely welcome any bid over $40 a share at this point and based on the retail sector sentiment.

The Golden Capital Portfolio also owns shares of Facebook (FB), Microsoft (MSFT), Intel Corp (INTC) and Fitbit (FIT) to name a few. Like our position in shares of UVXY, I have reduced exposure to these names and locked in profits, all but Fitbit that is. FIT shares likely won’t do much in 2017 and regardless of the market’s direction based on the company’s outlook and current share price valuation. I look at shares of FIT as a long-term play at this point and as results will need to bottom over the next 12-18 months. All of Fitbit’s significant metrics are set to decline in 2017 as offered by management. The company has saturated its distribution channels and found itself in an environment where true demand is far less for its products than previously understand by management and its retail partners. No matter what the retailer reports, be the reporting positive in nature, the stock will likely not express any meaningful share price appreciation that is sustainable in 2017. More than likely, any share price appreciation will be shorted and/or sold. It is for this and other reasons I don’t plan to add more capital to the name until the Q4 2017 period rolls around. This is the typical cycle for a hardware stock to go through, as it has been exampled by hardware peers many a time before.

As we enter the last couple of weeks of the 1st quarter I’m expecting market participants to attempt a run at S&P 500 2,400. Having said that, I’m none to sure of how volatility will play out over the next two weeks. In looking at the open interest for VIX and VIX-leveraged options, there has been a significant increase in “protection” with the major averages at recent highs. This has served to keep certain VIX-leveraged instruments in a tight trading range. Having said that, investors/traders would be wise to keep cash on-hand in case volatility increases near-term for which to put more capital to work.

Disclosure: I am long TGT, COST, FB, INTC, MSFT. I am short UVXY and VXX