UVXY Reverse Split Ahead: How To Position When Volatility Spikes

With only a week of trading under our belts in 2017, maintaining a core short position in ProShares Ultra VIX Short-Term Futures ETF (UVXY) has been good to the Golden Capital Portfolio thus far. In fact, shorting UVXY since its inception has been one of the greatest wealth generators in the market place. Another core holding helping to facilitate the portfolio early in the year is Costco (COST). With many retailers reporting a dismal holiday selling season last week, Costco was the outlier, reporting the following results:

- Costco's net sales grew 5.0% Y/Y to $13.07B in October.

- Comp sales +3%. U.S. +3%, Canada +7%, Other international -3%.

- Excluding the effects of gasoline prices and currency swings, comparable sales increased 3%; U.S. +3%, Canada +4%, Other international +4%.

As a buyer of COST shares last year and more recently on the pullback to $144, I’m continuing to hold shares of COST in the Golden Capital Portfolio and looking forward to the possibility of Costco announcing another one-time, outsized dividend payment to investors. The retailer has done this twice in the past. Moreover, the unique and market leading business model has found shares of COST with ever-achieving new highs. With COST and UVXY, Golden Capital Portfolio is presently up 17.8% to start the New Year.

Just as the markets don’t and won’t go up in a straight line, I don’t expect my portfolio to do so either. I’m sure, like in preceding years, the market will have fits and starts in 2017. This trading week will possibly foreshadow how the remaining month of January trades for the markets. As such, and with profits already in hand while the VIX remains complacent, I took the opportunity to lock in profits on my VelocityShares Daily 2x VIX ST ETN (TVIX) short holdings. In general, the only reason I will acquire TVIX shares is due to the lack of availability of UVXY shares to borrow short. It’s not often that this occurs, but when it does TVIX behaves as a substantial substitute for UVXY shares. So let’s discuss more broadly volatility going forward.

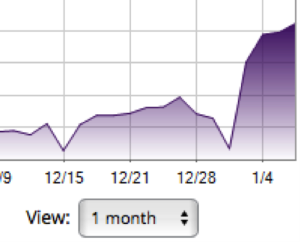

Volatility has remained complacent with very low VIX levels for an extended period of time. Barring the spike from the November 2016 U.S. elections, VIX has remained below 15 ever since. I’m no market timer and I’m no volatility event timer, but if I were to guess I would be of the opinion that an increase in volatility is just around the corner. And at what better time than as we approach a reverse split in shares of UVXY and like instruments on January 12, 2017. So why not go long some shares of UVXY? The answer is short, simple and with sound logic.

UVXY and VIX-leveraged instruments are designed short instruments. (Does not include inverse ETFs/ETNs). Being long such instruments invites intrinsic risk. The nature of volatility is such that it remains more complacent than it does volatile over time. That is the only way markets can actually work and remain liquid. But every now and then the markets will generate short bursts of volatility and create spikes in the VIX. To go long volatility and/or VIX-leveraged instruments like UVXY, one has to time a VIX event very well, for both an entry point and an exit point. Using a baseball analogy, the trader has to bat 1.000% or go 2 for 2 when trading long VIX-leveraged instruments.

What is a bit disturbing is that many traders believe UVXY is a hedge against the market when it is anything but. Since its inception in 2011, shares of UVXY have traded lower more than 60% of the time when the S&P 500 has traded lower for any given day. Understanding that UVXY is not directly correlated to S&P 500 Futures contracts, but rather S&P 500 VIX Futures contracts, is where many traders get “tripped up”. Moreover, even this explanation doesn’t complete the reasoning as to why the decay in share price is so constant. Note: Constant is defined by time, as long as time exists, over time UVXY shares will decay in price. Contango plays a significant role in price decay. For new VIX and VIX-leveraged ETF/ETN traders, an understanding of contango can be reviewed in my following articles:

- Contango Spreads Across ProShares Ultra VIX Short-Term Futures ETF (UVXY)

- Contango: The Beast Of Burden For VIX-Leveraged Buyers

In short, don’t be the trader who finds himself or herself of the belief that UVXY is correlated directly to the overall market trend. Having said that, with this article let’s further discuss the inevitable spike in the VIX, however short-lived it may be.

Those who participate with VIX-leveraged instruments from the short side, long for greater volatility given the understanding that post a VIX event, these instruments decay precipitously in price. UVXY being the most popular VIX-leveraged ETF that it is, the instrument can exhibit extreme price swings with volatility and volume spikes. As volatility spikes and shares of UVXY appreciate, shorts layer in positions at higher prices. It’s for this reason that placing limit orders in the pre-market, good for the day, is a “best practice”. This practice allows a trader to lock in a certain number of shares at a defined price for the trading day. Remember, shares to borrow short are only of value if they are available; utilize best practices. Additionally, the trader can modify the limit order price as trading persists through the day.

Another best practice for shorting UVXY, previously noted, during a VIX event is to layer short positions. Shorting UVXY should never be done with one order and at one determined price. In the past, shares of UVXY have spiked more than 100%, albeit before crashing by several hundred percent with the application of a reverse split. As such, traders should define incremental price gaps to layer in short positions. For example:

- UVXY share price $35 short

- UVXY share price $38 short

- UVXY share price $42 short

Traders will notice the increasing share price, but also the increasing incremental price gap from which to layer in additional short positions. From $35 to $38 being a $3 price gap and from $38 to $42 being a $4 price gap and so on and so on as the VIX event peaks. VIX events have typically lasted no longer than a few weeks. Again, the nature of the VIX is to remain complacent far longer than it exhibits outsized volatility.

As the share price of UVXY increases and traders layer in more short positions, another best practice is to increase the quantity of shares shorted as the price appreciates. Two strategic disciplines are being exercised here through this best practice. The first discipline is capital preservation or risk management if you will. The second discipline is “max positioning”. Max positioning is the act of positioning for greatest profit potential. The nature of UVXY being to decay in price over time, the greater quantity of shares shorted at peak price appreciation affords the trader the greatest profit potential longer-term. Positioning example:

- UVXY share price $35 short 200 qty.

- UVXY share price $38 short 300 qty.

- UVXY share price $42 short 500 qty.

As we layered short positions into defined incremental price gaps, to achieve max positioning, traders should increase the quantity of shares shorted throughout the layering process. This best practice helps to achieve the greatest profit potential.

Now let’s discuss another best practice known as liquidity preservation. None of the best practices noted above are of value if they are not expressed with consideration to liquidity. Knowing that UVXY can appreciate by greater than 100%, traders should position to provide liquidity against such a possibility. The layering process helps traders to best understand there levels of liquidity when shorting into a VIX event, as traders can see the draw on their cash balance and account for liquidity and future shorts to be layered. For every layered position, a trader shorting UVXY and like instruments should perform a liquidity analysis on their position to understand at what future price and quantity the next layer would be best allocated.

Lastly, don’t get “called in”. Besides not understanding how to utilize UVXY as they have been designed and intended for use, many traders don’t understand how to prevent having a short positioned closed-out/called-in. Many trading platforms/brokerage houses can and will call-in positions without notifying the trader, as is the right of the brokerage house. It’s for this reason that traders should research which brokerages shy away from the practice of calling-in short positions. After all, if Jim Chanos can hold short positions for years, why can’t the average trader on the street? Fact is that the average trader can do just that, with the right brokerage and with some long-term positioning.

Scottrade is a trading platform that I’ve used for the last 17+ years, never once having a short position called-in. With the borrow cost-to-carry generating fees for a brokerage like Scottrade, maintaining a long-term short position incentivizes the brokerage to facilitate short positioning. Maintaining a long-term short position also incentivizes the brokerage to maintain some levels of short inventory for greater positioning consideration. There are a many reasons traders offer with regards to avoiding shorting VIX-leveraged instruments, but for the most part they are erroneous or found wanting for greater due diligence. As a trader becomes more experienced with these best practices, exercising them will become more intuitive.

This week, shares of UVXY will reverse split at 1:5, which will greatly change the quantity of shares owned for all participating traders. Longs carrying losses through the reverse split will find their profit goal requiring an even greater percentage move than prior to the reverse split, as they will have fewer shares. But for all UVXY traders, it’s probably a good idea to maintain cash on-hand for a near to mid-term VIX event. It’s been a while since a VIX event of great value has presented itself for traders and UVXY shorts.

Disclosure:

Page3 is very helpful. Thx Seth

Most welcome, glad you found it informative!

Amazing & Accurate analysis as ALWAYS... From The BEST in the Busness

Too kind Nick but thank you for taking the time to read. Hopefully the analysis and strategy outlined will be to your benefit.

Interesting photo choice @[Nick Despo](user:36546). What does it mean?