Be Careful With A Long VIX Strategy

Three trading weeks have been logged in the New Year and with that… still no signs of increasing volatility to the degree that VIX-leveraged instruments are found appreciating in price. So who’s long volatility? Unfortunately, many make the mistake of going long volatility with the hopes of catching a major VIX-event spike. And these spikes do happen as indicated in the chart of the VIX below:

Do you like carrots? If you go long volatility that’s the foregone conclusion given that these intermittent spikes are nothing more than a carrot luring would-be traders into a long volatility trap. “But if you time it right you can capture a 40, 50, even 100% move in VIX-leveraged ETFs”. If you time it right they say, if you time it right. The problem with this kind of participation is that you’ll never encounter a single trader who has timed it right, meaning got in at the very beginning of a VIX-event and got out at the very top of the VIX-event be it a 40, 50, or even 100% move. It’s the timing that’s the problem, but most traders can’t focus on the timing issue given what is presented in the chart shown. That carrot is a strong lure, especially when surrounded with other biased perspectives one chooses to incorporate into their desired outcome. An example of this carrot/bias combination is perfectly outlined in an article found on Seeking Alpha titled Is The VIX Finally Ready To Climb?

Within that article, the author erroneously violates most every key principle regarding volatility market participation. Most obviously, the long volatility position is one with intrinsic risk that the author has taken and puts forth as a viable investment thesis to capture capital returns. Along the lines of seeking out a VIX-event, the author denotes his bias with three main catalysts and one minor catalyst noted below.

- January Tax Selling

- USD Index

- Interest Rates

- Low level VIX

Moreover, and most unfortunately, the author has chosen to go long VIX-leveraged ETFs during a period of outsized contango whereby the likely share price appreciation for these instruments is abnormally low. But nowhere in the article is that discussed, considered or seemingly contemplated. Having said that, the anonymous author does not make readers aware of this additional risk to a long volatility position.

My preferred method for putting on a long position is through ETFs such as VXX, TVIX or UVXY.

In a follow-up to this article under consideration, the author is found losing faith and capital in his long VIX-leveraged investment. In the article, VIX Update: How Low Can The VIX Go?, the same author states the following:

Currently, I still maintain a long VIX ETF position, but my resolve is diminishing as we get further into January without even a minor S&P pullback. This position has been a loser since first initiated, and has not done much better since I reduced my position last week. I am inclined to keep the position on through the end of the week as I am still hopeful for at least a small pullback over the next few days as we have Trump nominee confirmation hearings taking place as well as the president-elect's first press conference scheduled for tomorrow.

What I would urge readers/investors to consider with regards to the author’s comments is the continuation of biased perspectives used to support the carrot he desires to capture. I’ve extrapolated the newly offered biases as follows:

- Trump nominee confirmation hearings

- President-elect’s first press conference

This continuation of seeking out more bias to support an already disproven long volatility investment/trade is an example of why traders should not go long volatility. But that carrot, it proves to dissuade traders from giving up and keeps them in the long volatility trade even as losses compound. Hence, the trap has been successful! Regarding these publications under examination, the worst has come to pass for the author in the way of a UVXY reverse split of 1:5. ProShares enacted a reverse split on about a dozen of their VIX-leveraged instruments on January 12, 2017. Any losses carried through the reverse split from a UVXY position, as proposed by the author’s disclosures, would now need to capture an even bigger volatility spike and share price appreciation. More than likely, however, the author has given up on the trade given his identified sentiment.

VIX-leveraged ETFs are designed, without flaw of construction or natural human interaction, to decay in price over time. In short, these instruments and volatility in all forms are meant to be shorted by traders/investors. Many traders/investors are thrown off by the term “short” with regards to VIX-leveraged instruments and will always favor traditional, long trading/investing activities when engaging these instruments. They always assume shorting carries the greatest of risk. If we take a traditional equity like Apple Inc. (AAPL), one would think shorting shares or options is an intrinsically dangerous trading thesis for this traditional equity. Now if we apply the same sentiment to VIX-leveraged instruments, the inverse applies whereby going long is the most dangerous trading thesis, as these instruments are designed to decay in price. There is no design or construction with AAPL shares; AAPL shares ebb and flow with the fundamental and financial performance of the company. There is no such fundamental and financial quality in a VIX-leveraged ETF/ETN.

Let’s face facts, which can be easily reviewed in ProShares’ designated S-1s for VIX-leveraged instruments, going long is going wrong. Ha, that rhymes! I’m a poet and I didn’t…ok we’re not going to go there!

The VIX is hovering at extremely low levels. The major indices are near record high levels. A new president has taken office. Earnings season is upon us. Interest rates are rising. Commodity prices are rising. Consumer spending is “iffy”. Retailers are reeling with painful brick and mortar shortcomings. All the aforementioned are facts and possibly reasons, no probably reasons for a near-term VIX-event. So why not go long the likes of UVXY or TVIX now?

- VIX-leveraged ETFs are designed, without flaw of construction or natural human interaction, to decay in price over time.

- Do you really think you will time both an entry and exit point profitably?

- If you do incur a profit from the long side, did you establish a long-term discipline for utilizing VIX-leveraged instruments?

That last bullet point proves to also be the undoing of many who go long VIX-leveraged instruments. In other words, they get a lucky taste of success by going long profitably and believe they can duplicate the experience in the future. But VIX-leveraged instruments are akin to a Las Vegas casino when used from the long side. The longer you keep participating from the long side, the more the House wins. Hence, no discipline was established and you’ve demonstrated using an instrument contrary to its design.

Having said that, eventually there will be a VIX-event and VIX-leveraged instruments will appreciate in price. But rather than trying to time such an event, traders/investors would be better off waiting for this event and deploying short positions into such a spike in volatility. Referring back to the chart of the VIX, such volatility events last little more than a couple of weeks at most before resuming the natural decay or trend toward complacency. For a VIX-leveraged strategy during a VIX-event, readers can review my outlined strategies in the article UVXY Reverse Split Ahead: How To Position When Volatility Spikes. The strategies noted within the article have been favorable since the inception of VIX-leveraged instruments.

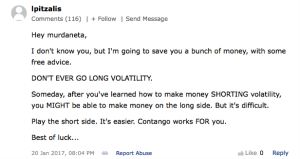

By no means does this article aim to denigrate an investor and author’s participation with VIX-leveraged instruments. To the contrary, I offer my analysis and education regarding these instruments as they are often promoted, published and proliferate with great error. What I do enjoy seeing, however so remotely, is that there are an increasing number of traders/investors whom recognize that one should not go long volatility as demonstrated by a comment on an article in Seeking Alpha.

Unfortunately, the comment from this individual is attached to an article outlining that one should look for an opportunity to go long volatility. It’s a give and take I guess and to some degree, “that’s what makes a market”.

Presently and as always outlined in my dedicated VIX-leveraged ETF series of articles, I maintain a short position in shares of UVXY and have done so since 2012 for a variety of reasons. The main reason is indicated in my portfolio capital appreciation chart below via Scottrade.

Certainly this chart won’t always adjust in the manner shown, especially during a VIX event, and as I dedicate a good portion of my investing capital to shares of UVXY short. But ultimately, the chart will always appear w/this directional uptrend over time, based on the construction of UVXY and the nature of volatility to express greater complacency than fear long-term.

Disclosure:I have no position in any equity mentioned within this article

Thanks for sharing