What’s Next For Twitter?

The big news this week is that Twitter’s CEO is out. Because of his subpar stewardship, there is going to be a major shakeup in their near future, and the media is buzzing about what may happen. We believe a big buyout is imminent and here’s why.

Well, Dick is out at Twitter, Inc. (NYSE: TWTR). Much of the media had been calling for Dick Costolo’s head for several months now.

Venture capitalist Chris Sacca, who’s an early investor in Twitter, further turned up the heat on Twitter to make changes by publicly calling out the company in a series of blog posts. Sacca has taken Twitter to task over being “too hard to use.” Sacca even provided several ways for Twitter tobetter its service and boost user experience. All of which only further fueled the head hunting for Costolo. However, Sacca’s blog posts, including the latest 8,500 word manifesto, made no mention that Costolo needed to go.

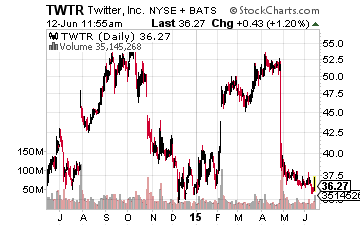

Even still, many felt it was time for a new CEO, citing slowing user growth and tepid top line growth. Shares are off 30% over the last couple months and are down more than 50% from the $75 a share price tag we saw shortly after the 2013 IPO.

Costolo’s exit is interesting since he never appeared drawn to selling Twitter. That tone could change with a new CEO. Over the past few months, many have opined on the subject of Twitter being a buyout target, including our own Bret Jensen early last week.

Stepping into Costolo’s shoes on an interim basis is Twitter co-founder Jack Dorsey, who’s also the founder of Square. Now Dorsey has been pining at a chance to get back to Twitter since he was forced out in 2008. But running both Twitter and Square will prove next to impossible. Look for him to push the CEO search rather hard.

Shares jumped as much as 10% after hours on the news but have since cooled. One big overhang being that Dorsey made comments that no changes to Twitter’s current strategy or direction would be made — which might not be an overhang at all, rather a catalyst to get the company sold.

So, is Twitter for sale?

Just the other week we said avoid the social media buyout buzz at all costs. This was mostly directed at Yelp (NASDAQ: YELP), which is down 10% since then. But Twitter is a bit different.

The beauty of Twitter is that it does have a large user base, even if many aren’t active. That’s a user base that another tech giant could find attractive. What’s more is that Twitter isn’t a huge company — with a market cap that’s just $24 billion — meaning its size isn’t prohibitive to a sale.

There are plenty of companies with enough cash to cover this price tag. Facebook (NASDAQ: FB) could easily expand its social networking with a Twitter buyout. Apple (NASDAQ: AAPL) was even floated as a Twitter suitor a few years back.

Could a merger of equals work? Twitter and Yahoo (NASDAQ: YHOO)? Not in the interim it would appear. Yahoo has its hands full trying to rid itself of a hefty stake in Alibaba (NASDAQ: BABA).

All told, Google (NASDAQ: GOOGL) is the likely kingmaker for Twitter. You have a giant tech company that’s effectively dying, with a ton of cash on the balance sheet that it could use to rekindle growth.

Google, dying?

Indeed, with the company facing some serious pressure in its core search business. Back in March, we called an end to Google’s reign, noting, “Twitter takes the idea of crowdsourcing search to another level by allowing you to expand searches beyond just your network.”

That’s where the potential Google buyout gets interesting. It looks to be one of the few ways for Google to survive the onslaught of tech companies vying for ad spending.

Recall that Sacca recently mentioned in an interview that Twitter would be an ideal fit for Google, where Google has never really understood social. If you can’t build it, buy it. It’s also worth noting that unlike a Google or Facebook, Twitter only has one class of shares (no super voting shares), making a takeover that much easier.

But absent a buyout, the focus will turn to the strategy.

If you can look past the recent CEO shakeup, and copious other management shakeups over the last year, then are things really all that bad? Ad revenues are still actually growing — even growing faster than LinkedIn (NASDAQ: LNKD).

Attracting ad dollars isn’t easy. The major users of Twitter are media people and brands, which aren’t the target audience of advertisers. Twitter hasn’t been moving fast enough to make the platform usable and enticing for everyone. But with nearly 300 million monthly active users, Twitter also has a lot of customer data and potential.

It starts with becoming Facebook. Facebook has figured out social media, for the time being. With that, Twitter has been adding video and auto-play ads, as well as boosting their direct messaging features — just last week doing away with character limits for DM (something that was overshadowed by the Costolo news). If it can be more like Facebook, getting users to engage more and stay longer, the ad dollars will surely follow. However, they might not have that long to figure it out before Google comes knocking.

Are your blue chip stocks prepared to last the next 25 years?

The economy is changing right under our feet, and there is no guarantee the blue chips of today will still be blue chips tomorrow.

Disclosure: None.

They’re the kind that are an integral part of the reliable income strategy ...

more