To Log Or Not To Log, Part IV

<< Read More: To Log Or Not To Log, Part I

<< Read More: To Log Or Not To Log, Part II

<< Read More: To Log Or Not To Log, Part III

Do stock price indices follow a random walk? No, but log stock price indices do…kind of.

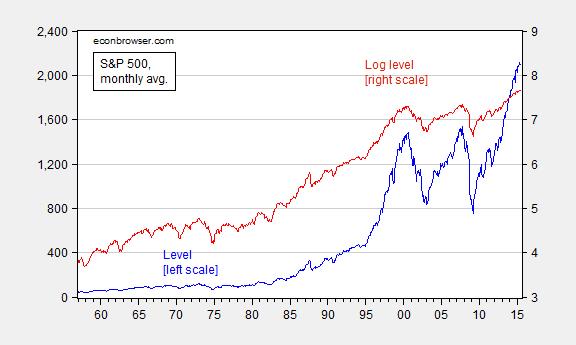

Here’s a graph of the Standard and Poors 500 price index, level (blue) and the log (red).

Figure 1: S&P 500 stock price index (blue, left scale) and log (red, right scale). Source: FRED, and author’s calculations.

Both processes look nonstationary, but the levels process more so (technically, “explosive”). Which one is the more appropriate to examine? A little theory might be helpful. Consider an asset pricing model for stocks. Ignoring dividends,

Pt = (EtPt+1)/(1+i)

Where P is the stock price, i is an interest or equity discount rate, and Et(.) is an expectations operator, conditional on time t information. Notice if errors are normally distributed, then the price level at t+1 is a multiple of that at time t (imposing an auxiliary assumption that the interest rate is constant and nonstochastic). Assume instead expectations errors are log-normally distributed (where p denotes log(P)). Then:

pt = Etpt+1 – ln(1+i)

pt+1 ≈ pt + i + et+1

Where et+1 is a true innovation. If one runs a regression in levels, the coefficient on the lagged variable is 1.04, and the process appears explosive. In logs, one obtains:

pt = 0.0052 + 1.0000pt-1 + ut

Adj.-R2 = 0.999, SER = 0.035, Nobs = 702, DW = 1.47.

The coefficient on lagged (log) price is not statistically significantly different from one.

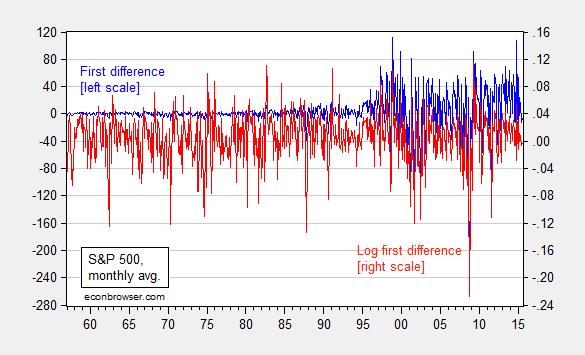

Another hint about what specification is more appropriate comes from inspection of the first differences. Figure 2 depicts both.

Figure 2: First difference of S&P 500 stock price index (blue, left scale) and first difference of log (red, right scale). Source: FRED, and author’s calculations.

The log first differences exhibit much less heteroskedasticity, and the distribution is less fat-tailed.

Note that in neither levels nor logs are these classic random walks (where the residuals are true innovations). The errors reject the no serial correlation null and no ARCH effects. But less so for the logs specification.

Digression: Great post from David Giles, on retrieving elasticities from different specifications (h/t Mark Thoma).

Disclosure: None.