The Rich, The Poor, And The Rest Of Us

I. The 1% and Ben Bernanke

Recently, the infamous former Fed Chairman Ben Bernanke was quoted explaining how he has no patience for individuals saying that his very dovish monetary policies (such as 0% rates, QE1-3, Operation Twist, and the moral hazard that came with all this) has been crippling savers and creating enormous wealth inequality.

Technically, if one has capital it’s the best time to be involved in the stock market, just take a look at the top 1%. A Berkeley economics professor, Dr. Emmanuel Sez, has showed light on what is really going on under middle American noses: over 95% of income gains since 2009 have gone to the top 1%.

But wait – there’s more. CNN reports that as of 2015 the richest 1% have as much wealth as the other 99% combined. The top 1% have seen their share of global wealth increase in staggering amounts since the 2008 collapse.

"The scale of global inequality is quite simply staggering; and despite the issues shooting up the global agenda, the gap between the richest and the rest is widening fast," said Winnie Byanyima, executive director of the international aid agency.

Now Mr. Bernanke can say what he wants, but the rest of the world is catching on (hopefully).

It goes a little something like this: 0% interest rates historically boosts asset prices i.e. stocks and real estate (here is a short documentary on the disgusting housing bubble going on in San Francisco since 2009). Add in $4.5 trillion counterfeited dollars (as the academics like to call it, Quantitative Easing or QE for short) courtesy from the Fed to the Big Banks. And what is the outcome? Massive surge in stock prices, high end luxury real estate, and record corporate bonuses and share buybacks.

Thus one can logically deduce that artificially rising asset prices makes the net wealth for the owners of all this significantly higher.

And who owns all these assets? That’s right – the top 1%.

While the stock market has made significant progress in recent years, the upward trend hasn't lured more Americans back into the stock market following the outflow seen after the 2008 financial crisis, says Justin McCarthy.

And what is the middle class left with? Ah, yes – record high student debt, bleeding labor market, record high auto loans, negative wage growth, increasing cost of living, and decreasing stock ownership for Middle Americans.

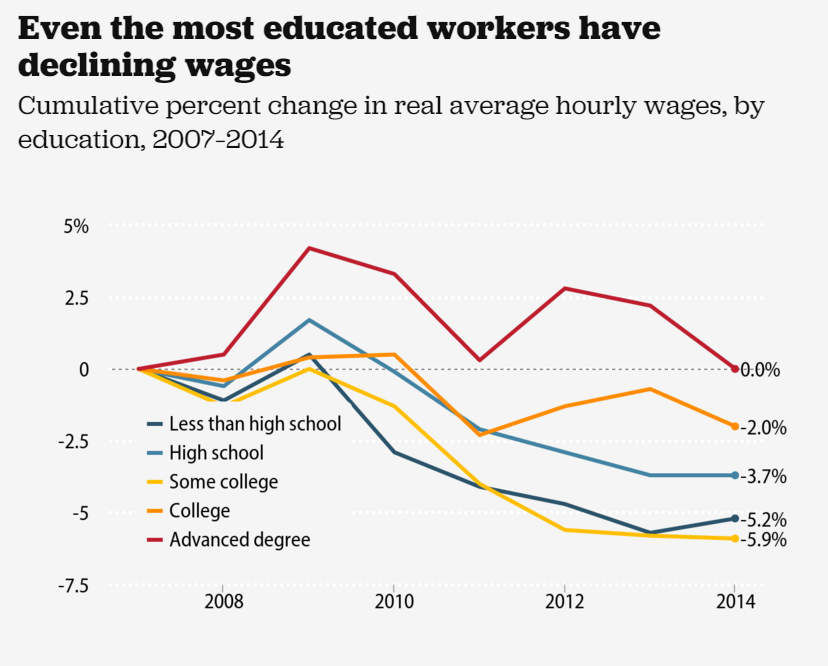

Adding salt to the wound, the fact is not only have wages not grown in the past decade, but they infact have turned negative. It makes sense, doesn’t it? The Fed pumped trillions into the system, raising the cost of living i.e. inflation, yet Middle America didn’t get this money. But some wages, even if declining, are better than no wages. The worker class should be thankful they even have jobs to go to. Most Americans gave up hence the 40 year low in the labor participation rate.

But it continues. Even if some Americans do have a poultry savings that survived after 2008, they aren’t getting any interest on it. And as long as Mr. Bernanke has anything to say about it, tough luck – he has no patience for you.

In fact, none of the Fed governors agree. To them there isn't enough inflation. And the data shows a growing recovery.

Food for thought, though, if the economy's numbers today are generated from almost 8 years of 0% rates, what would they look like with higher rates? Would the data be the same? Would stocks be as high? What would the mortgage market be like? Thus the entire "recovery" has been built on 0% rates. Wouldn't it make logical sense that without 0% rates it would be different (and for the worse)?

The New American Dream. The rich get bailed out and wealthier, the poor get slaughtered, and the middle class gets squeezed out of existence.

II. A Rate Hike – Guaranteeing a Recession

Janet Yellen and the Fed have done a good job losing credulity thus far. But come December, they may have to actually raise rates otherwise the boy has cried wolf too many times.

When it comes to the Fed, an investor needs to do as they do; not as they say.

The Fed has said time and time again that a rate hike is coming. Its next month for sure. Its absolutely coming. Yet, we haven’t seen one.

Could this just be a ploy by the Fed to hold confidence in the dollar? This makes sense – the Fed can keep easing this way while also keeping demand for dollars as investors expect a raise.

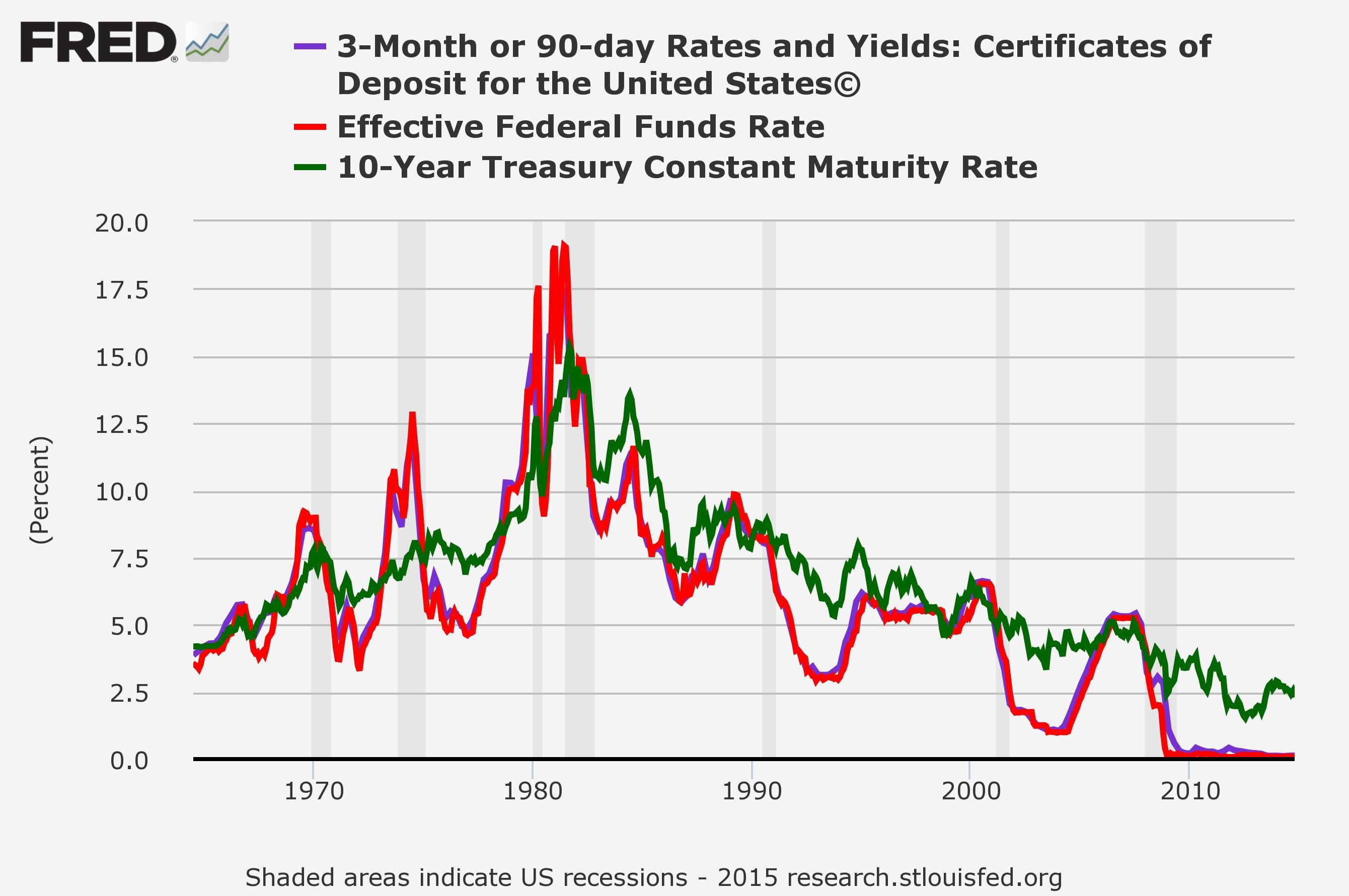

But every single time a rate rise occurred, a recession soon followed. Observe the following image:

The shaded vertical lines are recession periods. Notice how what precedes each recession, rates are trending upwards. And each time after the recession rates go lower than they were before the rate hike started. Until 2008 where rates have been at 0.

Hypothetically, if the Fed didnt hike rates, soon after the economy would plunge into a recession and then judging from what the chart shows - negative rates will follow. In fact, there is already talk that the Fed will go negative with its Fed Funds Rate.

The street has already decided that the Fed will raise rates this December - one must wonder how many times can someone be burned by the same flame. But the contrarians will expect no rate rise. This author expects negative rate rises sooner than later.

Sure, the Fed could raise rates by a whopping .25%, but as the chart explains expect them to immediately go lower than before.

Conclusion? Long gold. Short the Central Banks.

This is a column I wrote in my recent first newsletter issue.

The fact that the 1% owns this much wealth is obscene beyond belief.

Would it make sense for gov't increase capital gains taxes? The gov't can't really take the money that the %1 already have, but they can take the gains that they make off of capital gains from QE. In short, fiscal policy should be aware of the effects of monetary policy (QE) and who it benefits. Fiscal policy should address any unfairness in the market and could redistribute the fairness.

Getting a tax bill passed through a Republican Senate and Congress would be another issue for another day..

I would like to see a wealth tax, not every year, but once in awhile to even things out.

once a month would be best.

Why once a month?

Bernanke is a thief and justifies it by voodoo economics.