The Financial Side Of Hell

Back in September, the IMF issued a generic warning about EM corporate debt. The organization had estimated that total borrowing had exploded, from about $4 trillion in 2004 to $18 trillion in 2014; and perhaps even more than that. Concerns over such bloat typically focus offshore, and not without good reason. However, that understates the true degree of risk since even EM debt held onshore in whichever country is still exposed to external financing factors. In other words, domestic EM debt markets are just as susceptible to euro/dollar decay as offshore holdings.

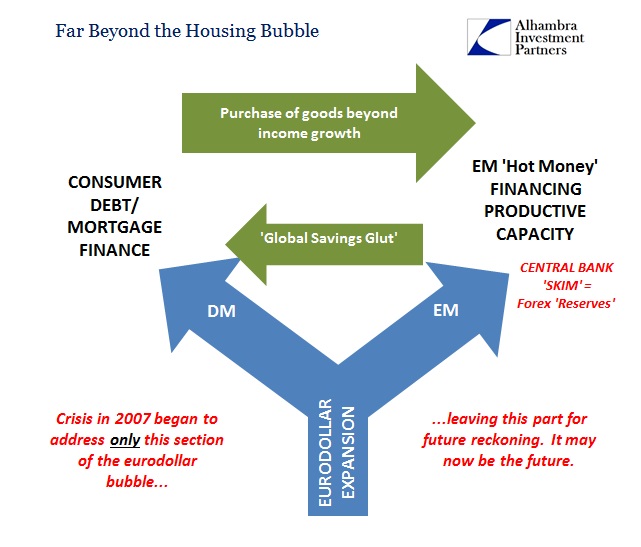

That leaves EM’s with two distinct financing issues: the first as direct in the form of what everyone calls “hot money” but is really the mood of the global “dollar short”; the second is the plumbing onshore within EM markets often provided by euro/dollar banking (though, it should be pointed out, not strictly via euro/dollars; euro/euros, euro/yen, etc., are all a part of the network of funding commitments that have supported the massive rise in debt). From an internal EM perspective, the implications are straightforward – credit crunch. Looking instead outside to the ether of 21st century global wholesale finance, the questions have no easy answers even though they are the same that have been asked over and over since 2007.

We have already found evidence both direct and indirect for the first. EM’s as a whole are struggling and likely as a result of dramatically scaling back in especially “dollar”-based financing. More straightforward, in February the BIS estimated that dollar credit to EM nations had fallen for the first time since the Global Financial Crisis (as they call it) in 2009. Such a result is far from surprising given the financial mess experienced especially since the middle of last year. “Global turmoil” is much more than a convenient FOMC escape clause. I wrote in February:

Such warning [the IMF in September] was perhaps a bit too late, as China and Brazil in particular have already suffered just those kinds of “runs.” What we need to explore, somehow, is the manner in which they form and propagate outside of local EM terms. In other words, “breakdown in markets” is not limited to currency “flight” but rather, as I think we have seen much of already, total monetary withdrawal – systemic euro/dollar declines. In fact, I think it evident by currency (including the yen; Japanese banks supplying euro/dollar resources to Chinese corporates and financials) and by wholesale dynamics we have already seen all of that, meaning what we are really after is how far it could really run.

The reason for that concern is as stated above – sheer volume. There are trillions upon trillions in exposure that is owned or at least supported (even indirectly) by funding mechanisms and conduits littered all throughout the DM world. Since banks haven’t exactly been forthcoming about any of it, markets stop asking questions and start trading on even fuzzy perceptions.

What we do know is not all that comforting. In February 2014, for example, analysts at, ironically, Deutsche Bank estimated that European banks alone, “have loaned in excess of $3 trillion to emerging markets, more than four times U.S. lenders and putting them at greater risk if financial market turmoil in countries such as Turkey, Brazil, India and South Africa intensifies.” Again, that is just European banks and it only counts direct lending, not bond flotations, securities or any of the myriad other forms of possible financial and funding commitments. Curiously, the analysts do not mention their own bank on their list, even though just months later in May 2014 Deutsche Bank took its sudden capital raise as an excuse to increase its commitment to US junk debt and, of course, EM fixed income of all kinds including market-making activities.

Inferring a substantial exposure starting point is not a big intuitive leap especially on the European banking side. In other words:

The word, again, is contagion. Specific banks may not be directly exposed to this EM corporate mess, which is all the more messy via these currency channels, but they have links indirectly through wholesale and euro/dollar functions to the banks that are.

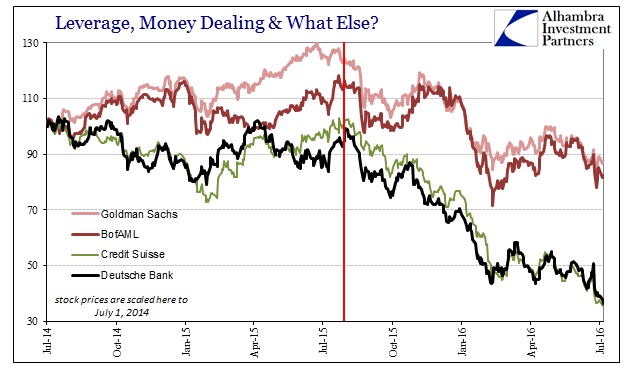

You don’t hear the word echo throughout the financial media at all like you did in 2011 when Greece and PIIGS were the platform of concern, or even subprime back in the first iteration of all this. Contagion may be banished as a discussion topic, but all the symptoms and experiences are once more right in front of us – with Deutsche Bank and Credit Suisse at the forefront. Bank stocks are certainly trading that way, with European banks leading into the more troubling scenarios even as the media struggles to pin Brexit on it.

This is the second half of what I wrote yesterday, namely that the euro/dollar bubble phase was really two bubbles. We had some reckoning with the first, the part that went primarily toward DM mortgage finance and suffered a near fatal experience. In some ways it was fatal, as is there is only more evidence now that the euro/dollar system will never be restored and can only become more unstable. Even with all that tracing to just the first version of those bubbles, there has yet to be any accounting of the second, which is, I believe, what we are really describing here.

Since July 2014, both DB and CS stock are down more than 60%, results which aren’t exactly surprising given this framework. What is perhaps more notable is how concerns over primarily European exposure seems to have infected to some unknown extent banking all over the world, including the US. In the past, I have suggested that US bank stocks, in particular, have been vastly underperforming due to re-evaluations of central bank promises and the conditions those promises supposedly would lead to. I still think that is the case, but also that such rethinking is in every way linked to overall euro/dollar questions such as these. In other words, it is again “contagion.”

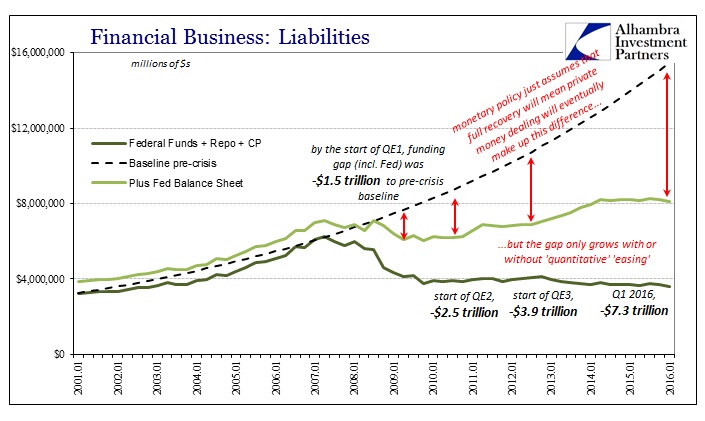

There is clear systemic suspicion throughout global banking, one that extends to questions about balance sheet exposures but also, I believe, funding risk. It is a highly curious result given what those central bank promises meant in these narrow circumstances; that “contagion” should not even be possible after so much monetary “accommodation” for so long in so many places. Just as monetary policy must be re-examined in the wake of a global economy that so little resembles what it “should”, so too must bank risk be recalculated under those very same terms.

EM risk where QE was still believed potent and efficient is minimal, if through nothing more than the robust recovery that would deliver actual low volatility. EM risk where QE is at best questionable is an entirely different paradigm. Thus, the lessons learned from 2008 (and to some extent in 2011) once again apply – that if DB is hobbled by its own EM exposure direct and/or indirect, that is far more than a problem for DB and the German government that would surely nationalize it. In short, if DB has big EM risks, then so do all American banks in addition to European; the “dollar” suffers systemically.

I think that accounts for what we see above in the almost “tiering” of bank stock performance. Those primarily European institutions more directly in line of being exposed suffer the most, leaving still the rest of the globally-connected banking system as potentially indirect casualties to yet another funding disaster – one that is, as calculated here, far beyond any capability of any central bank. For all the talk since 2008 of dealing with systemically important institutions, it never really amounted to much more than bluster and show; it seems even stock investors have caught on.

I have been writing for some time that “something” changed in the middle of last year. In reality, it seems several “somethings” did. The global economy took another turn lower and has yet to pull out; mainstream commentary went from speaking of trivial or “transitory” risks to openly questioning even the dominant narrative; even policy across the world has shifted, where some central banks went back to futilely spinning their balance sheets, while the Fed is at least more open with its increasingly obvious confusion. And at the middle of all that is what more and more appears to be the unwelcome resurrection of “contagion.” The euro/dollar is still dependent upon the big euro/dollar banks to roll the dollar short forward no matter how slowly and labored of late; if one really stumbles they all do.

There was always another half, a greater “half” no less, of the euro/dollar bubble left to clean up. Perhaps it was always inevitable, though for a time it looked like slow and steady or the “new normal” might just be enough to get by without having to account. The “rising dollar”, though, exposed so much fallacy that maybe there really was no other way. Brexit was a symptom; it has always been “dollar.” I don’t think it ever ends until we can stop using the quotation marks.

Disclosure: None.

All debt is in trouble unless the dollar and the US economy grows no matter how cheap the borrowing is. Sadly, even the dumbest market participant is starting to figure this out, and the author is right, banks will hit problems as well. QE helps out the few, but doesn't solve the problem and creates other problems, especially since it is 1) suppose to be short term, 2) it is not reversible without causing even worse downturns than it prevented 3) it solves nothing long term, 4) it gives unfair privilege to the few and is open to profiteering and market distortion 5)it is not sustainable and leads to slow growth as people debate when it will cease rather than how much it helps.

Indeed, hellish may be a appropriate word for this. It is weird to see that in housing and the stock market, both are outpacing growth and inflation due to the actions of the Federal Reserve. As for ordinary things, they are biased towards getting cheaper as housing costs rise well above inflation due to the Federal Reserve fueling more upper income inflation to prevent deflation on the low end which is a bit stupid, but that is apparently what they are.

I find it a bit humorous their planned economy socialist leanings are creating the worst income distribution in modern US history. Who would have thought a socialist Federal Reserve head would be so good for elite bankers and so bad for the rest of Americans by halting growth and biasing things towards those who get zirp and everyone else who doesn't. Sadly, this will lead banks as well as the public into a worse future, not a better one. We need a economy that responds to the market and grows, even if it means downturns and TBTF banks failing rather than a no growth, planned economy which leads to inevitable collapse.