Negative Interest Rates Until 2021?

Fed’s Upside Options May Be Limited

While the market believes the Fed will try to hike rates again sometime in the coming months, the long-term outlook for interest rates continues to remain tame by historical standards. It may be very difficult for many countries to reverse negative interest rate policies. From CNBC:

Equity valuations between Japanese and European banks will converge with quantitative easing (QE) programs and negative interest rate policies set to continue for the long term, according to a team at JPMorgan. “QE reduces lending rates to negative and we are going to expect negative lending rates until 2021,” Kian Abouhossein, head of European banks equity research at JPMorgan told CNBC.

Central Banks And The Next Bear Market

The market is well aware of the “propping up” tactics being used by global central banks. Therefore, it is possible the next bear market will catch many investors off guard. This week’s video looks at one hypothetical path for stocks in the event central banks lose control.

Fed’s Flip Flops Have Confused Markets

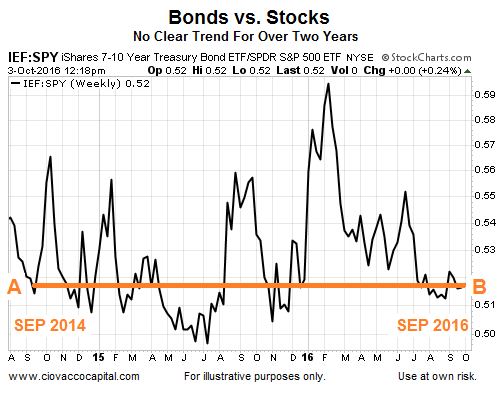

The Fed has done a lot of talking about raising interest rates over the past two years. Despite the almost non-stop jawboning from policymakers, the U.S. central bank has raised rates just one time. The ever-changing Fed stance has created a lot of confusion for stock and bond investors. As shown in the chart below, wild swings have occurred in the demand for bonds (IEF) relative to stocks (SPY) over the last two years, but the ratio has made no progress between points A and B.

(Click on image to enlarge)

Demand For Negative Yield Increases

If global market participants were confident the Fed was going to raise interest rates several times in the coming months, it is likely to demand negative-yielding bonds would be dropping. Rather than declining, the recent trend has shown increasing demand for defensive fixed income. From Bloomberg:

The unprecedented worldwide surge in the market for bonds that are certain to lose money if held to maturity regained strength last month. The total face value of negative-yielding corporate and sovereign debt in the Bloomberg Barclays Global Aggregate Index of investment-grade bonds jumped to $11.6 trillion as of Sept. 30, up 6.1 percent from a month earlier.

Recession Could Move Fed Below Zero

Given the long-term outlook for rates remains tame and based on historical moves from the Fed, it is possible the U.S. central bank will take rates into negative territory during the next recession, according to Marvin Goodfriend, who was an economist and policy advisor at the Federal Reserve’s Bank of Richmond from 1993-2005. From CNBC:

“In eight of those recessions, the Fed had to push the short rate 2.5 percentage points below the long term rate. Today, the 10-year rate in the U.S. is 1.5 percent,” Goodfriend noted, saying that would indicate that during the next recession, the Fed would need to cut rates as low as minus 1 percent at a minimum. “In five of those recessions, the Fed had to push the federal funds rate 3.5 percentage points below the 10-year bond rate,” he said. “So if that happens this time around, we would have to push the federal funds rate to minus 2 percent.”

Could Be A Rough Ride In Months Ahead

The Fed has tried to raise rates numerous times in 2016 but has backed off when the financial markets reacted in a negative manner. It remains to be seen if the Fed will pull the trigger on a rate hike before year-end. Regardless of how things play out, as long as the markets believe a rate hike remains a realistic possibility, we can expect volatility to be the norm, rather than the exception.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more