Morning Call For Thursday, August 17

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.16%) this morning are down -0.13% and European stocks are down -0.29% as weakness in energy stocks drags the overall market lower. Sep WTI crude oil (CLU17 -0.34%) is down -0.21% at a 3-week low on concern the global oil glut will persist after EIA data on Wednesday showed U.S. crude production had increased to a 2-year high. A 2% decline in shares of Wal-Mart in pre-market trading is also pressuring the overall market after the company forecast lower than expected full-year adjusted EPS. Tensions between the U.S. and North Korea continue to subside after South Korean President Moon Jae-in said the U.S. has agreed not to take any military action against North Korea without first getting South Korea's approval. Asian stocks settled mixed: Japan -0.14%, Hong Kong -0.24%, China +0.68%, Taiwan +0.77%, Australia -0.10%, Singapore -0.31%, South Korea +0.61%, India +0.08%.

The dollar index (DXY00 +0.40%) is up +0.38%. EUR/USD (^EURUSD) is down -0.63%. USD/JPY (^USDJPY) is down -0.04%.

Sep 10-year T-note prices (ZNU17 -0.09%) are down -5.5 ticks.

The Japan Jul trade balance was in surplus by +418.8 billion yen, wider than expectations of +327.1 billion yen. Jul exports rose +13.4% y/y, stronger than expectations of +13.2% y/y. Jul imports rose +16.3% y/y, weaker than expectations of +17.1% y/y.

U.S. STOCK PREVIEW

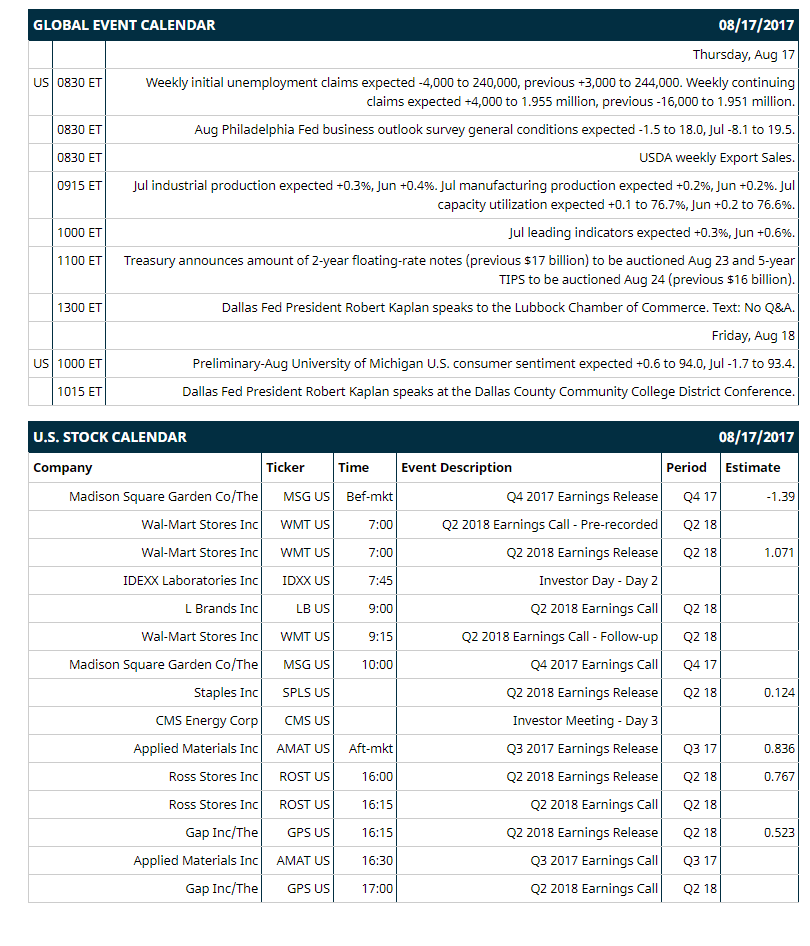

Key U.S. news today includes: (1) Weekly initial unemployment claims (expected -4,000 to 240,000, previous +3,000 to 244,000), Weekly continuing claims (expected +4,000 to 1.955 million, previous -16,000 to 1.951 million), (2) Aug Philadelphia Fed business outlook survey general conditions (expected -1.5 to 18.0, Jul -8.1 to 19.5), (3) USDA weekly Export Sales, (4) Jul industrial production (expected +0.3%, Jun +0.4%), Jul manufacturing production, (expected +0.2%, Jun +0.2%), Jul capacity utilization (expected +0.1 to 76.7%, Jun +0.2 to 76.6%), (5) Jul leading indicators (expected +0.3%, Jun +0.6%), (6) Treasury announces amount of 2-year floating-rate notes (previous $17 billion) to be auctioned Aug 23 and 5-year TIPS to be auctioned Aug 24 (previous $16 billion), (7) Dallas Fed President Robert Kaplan speaks to the Lubbock Chamber of Commerce. Text: No Q&A.

Notable Russell 1000 earnings reports today include: Madison Square Garden (consensus -$1.39), Wal-Mart $1.07, Staples $0.12, Applied Materials $0.84, Ross Stores $0.77, The Gap $0.52.

U.S. IPO's scheduled to price today: None.

Equity conferences this week: None.

OVERNIGHT U.S. STOCK MOVERS

Wal-Mart (WMT +0.26%) fell 2% in pre-market trading after it said it sees full-year adjusted EPS of $4.30-$4.40, the midpoint below consensus of $4.39.

Target (TGT +3.61%) was upgraded to 'Buy' from 'Neutral' at MKM Partners with a price target of $69.

Alibaba Group Holdings Ltd (BABA +1.11%) climbed almost 3% in pre-market trading after it reported Q1 revenue of $7.40 billion, better than consensus of $7.19 billion.

Cisco Systems (CSCO +0.78%) slid nearly 2% in after-hours trading after it predicted Q1 net income will be 48 cents-53cents, the midpoint below consensus of 52 cents.

L Brands (LB +1.28%) dropped almost 6% in after-hours trading after it reported Q2 comparable sale were down -8%, weaker than consensus of -7%, and then said it sees Q3 EPS of 25 cents-30 cents, below consensus of 36 cents.

Aerie Pharmaceuticals (AERI -0.38%) rose 4% in after-hours trading after Valeant Pharmaceuticals, a third-party manufacturer for AERI's Rhopressa and Roclatan drugs, said the FDA confirmed that "manufacturing uncertainties" related to Valeant's facility in Tampa, FL, have been resolved. Valeant Pharmaceuticals (VRX +1.80%) gained 1% in after-hours trading as well.

NetApp (NTAP +1.05%) lost over 1% in after-hours trading after it said it sees Q2 adjusted EPS of 64 cents-72 cents, the midpoint below consensus of 69 cents.

Financial Engines (FNGN -0.29%) slid almost 4% in after-hours trading after it announced that selling stockholder, Warburg Pincus LLC, had agreed to sell 4.1 million shares of FNGN's common stock in a registered underwritten secondary public offering.

Briggs & Stratton (BGG +1.22%) lost over 2% in after-hours trading after it reported Q4 adjusted EPS of 46 cents, weaker than consensus of 53 cents, and then said it sees full-year EPS of $1.31-$1.48, below consensus of $1.62.

Vipshop Holdings Ltd (VIPS -0.63%) dropped 6% in after-hours trading after it reported Q2 revenue of $2.58 billion, less than consensus of $2.59 billion.

Immunomedics (IMMU -3.23%) fell over 6% in after-hours trading after it reported a Q4 loss per share of -48 cents, wider than consensus of -12 cents.

Lakeland Industries (LAKE -1.57%) tumbled 10% in after-hours trading after it announced that it intends to offer shares of its common stock in an underwritten public offering, although no size was given.

Voyager Therapeutics (VYGR +1.05%) rallied nearly 4% in after-hours trading after it was raised to a new 'Outperform' at Evercore ISI with a price target of $21.

TherapeuticsMD (TXMD +2.06%) rose over 2% in after-hours trading after it announced the publication of the manuscript detailing results of the Women's Health Initiative Observational Study of vaginal estrogen use in postmenopausal women.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.16%) this morning are down -3.25 points (-0.13%). Wednesday's closes: S&P 500 +0.14, Dow Jones +0.12%, Nasdaq +0.16%. The S&P 500 on Wednesday closed higher on carry-over support from a rally in European stocks on growth optimism after Eurozone Q2 GDP rose +0.6% m/m, right on expectations, and on strength in retailers after Target and Urban Outfitters reported better-than-expected quarterly earnings. Gains were limited as energy stocks fell after crude oil prices fell -1.62% to a 3-week low.

Sep 10-year T-note prices (ZNU17 -0.09%) this morning are down -5.5 ticks. Wednesday's closes: TYU7 +11.50, FVU7 +6.00. Sep 10-year T-notes on Wednesday closed higher on the weaker than expected U.S. Jul housing starts and building permits, and on dovish comments from Atlanta Fed President Bostic said He's "worried about the inflation number" and that the Fed should "wait and see" before it raises interest rates again.

The dollar index (DXY00 +0.40%) this morning is up +0.352 (+0.38%). EUR/USD (^EURUSD) is down -0.0074 (-0.63%) and USD/JPY (^USDJPY) is down -0.04 (-0.04%). Wednesday’s closes: Dollar Index -0.312 (-0.33%), EUR/USD +0.0032 (+0.27%), USD/JPY -0.48 (-0.43%). The dollar index on Wednesday fell back from a 3-week high and closed lower after the minutes of the Jul 25-26 FOMC meeting said that “many" members saw some "likelihood that inflation might remain below 2% for longer than they currently expected," which may delay further Fed tightening. Another negative for the dollar was the comments From Atlanta Fed President Bostic who said he's "worried about the inflation number" and that the Fed should "wait and see" before raising interest rates again.

Sep crude oil (CLU17 -0.34%) this morning is down -10 cents (-0.21%) and Sep gasoline (RBU17 -0.70%) is down -0.0104(-0.67%), both at fresh 3-week lows. Wednesday's closes: Sep WTI crude -0.77 (-1.62%), Sep gasoline -0.0159 (-1.01%). Sep crude oil and gasoline on Wednesday dropped to 3-week lows and closed lower after EIA data showed U.S. crude production in the week of Aug 11 rose +0.8% to 9.502 million bpd, a 2-year high, and after EIA gasoline stockpiles unexpectedly rose +21,999 bbl, more than expectations of a -900,000 bbl decline. A bullish factor was the -8.94 million bbl decline in EIA crude inventories to a 1-1/2 year low, a bigger decline than expectations of -3.5 million bbl.

Metals prices this morning are mixed with Dec gold (GCZ17 +0.59%) +8.0 (+0.62%), Sep silver (SIU17 +0.59%) +0.095 (+0.56%) and Sep copper (HGU17 -0.30%) -0.005 (-0.17%). Wednesday's closes: Dec gold +3.2 (+0.25%), Sep silver +0.226 (+1.35%), Sep copper +0.0705 (+2.45%). Metals on Wednesday closed higher with Sep copper at a 2-3/4 year high due to a weaker dollar and concern about future copper output after Freeport McMoRan said copper production at its Grasberg mining complex in Indonesia may be curtailed due to flooding and landslides there.

Disclosure: None.