Morning Call For October 21, 2015

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ15 +0.46%) are up +0.46% at a 2-month high and European stocks are up +0.65% on positive carryover from a rally in Japan's Nikkei Stock Index which climbed to a 6-week high on speculation the BOJ may need to expand QE after Japan exports last month grew at the slowest pace in over a year. Increased M&A activity also gave equities a boost after Lam Research agreed to buy KLA-Tencor Corp. for $10.6 billion. Strength in European stocks was limited as Credit Suisse fell over 5% after it said will sell 6.05 billion francs ($6.3 billion) in stock to boost capital and meet regulatory requirements. Asian stocks settled mixed: Japan +1.91%, Hong Kong closed for holiday, China -3.06%, Taiwan -0.51%, Australia +0.24%, Singapore +0.22%, South Korea +0.29%, India -0.07%. China's Shanghai Composite fell back from a 2-month high and closed down over 3% on speculation the recent rally was overdone.

The dollar index (DXY00 -0.05%) is down -0.09%. EUR/USD (^EURUSD) is up +0.12%. USD/JPY (^USDJPY) is up +0.13% at a 1-week high as speculation the BOJ may need to expand QE undercut the yen.

Dec T-note prices (ZNZ15 +0.10%) are up +5.5 ticks.

The Japan Sep trade balance was in deficit by -114.5 billion yen, when expectations were for a surplus of +87.0 billion yen. Sep exports rose +0.6% y/y, less than expectations of +3.8 % y/y and the smallest increase in 13 months. Sep imports fell -11.1% y/y, a smaller decline than expectations of -12.0% y/y, but still the biggest drop in 6 months.

U.S. STOCK PREVIEW

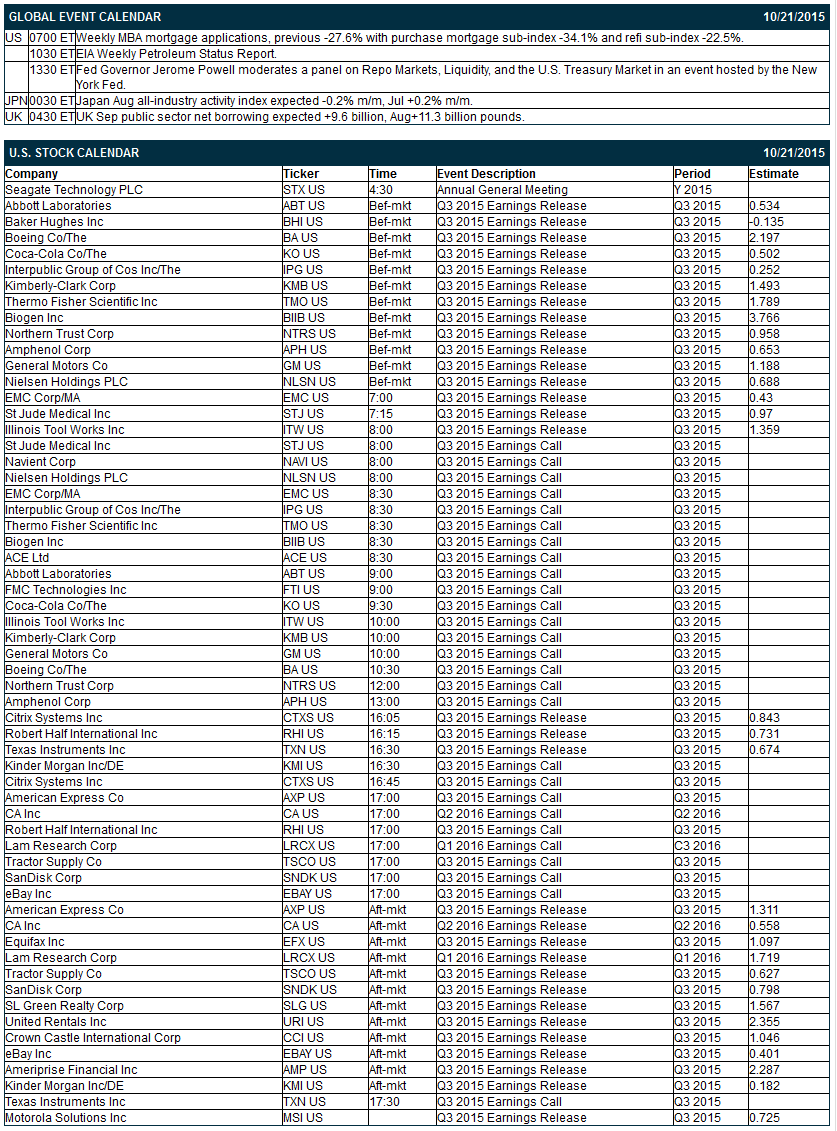

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -27.6% with purchase mortgage sub-index -34.1% and refi sub-index -22.5%), (2) Fed Governor Jerome Powell as moderator for a panel on “Repo Markets, Liquidity, and the U.S. Treasury Market” in an event hosted by the New York Fed.

There are 31 of the S&P 500 companies that report earnings today with notable reports including: GM (consensus $1.19), AMEX (1.31), Abbott Labs (0.53), Boeing (2.20), Coca-Cola (0.50), Northern Trust (0.96), Citrix (0.84), Texas Instruments (0.67), eBay (0.40), Kinder Morgan (0.18), Motorola Solutions (0.73).

U.S. IPO's scheduled to price today: Dimension Therapeutics (DMTX), Multi Packaging Solutions (MPSX).

Equity conferences today include: Private Wealth Latin America and The Caribbean Forum on Wed.

OVERNIGHT U.S. STOCK MOVERS

KLA-Tencor Corp. (KLAC +1.39%) surged 19% in pre-market trading after Lam Research agreed to buy the company for $10.6 billion.

Tupperware Brands (TUP +0.33%) reported Q3 adjusted EPS of 79 cents, better than consensus of 71 cents.

Coca-Cola (KO +0.71%) reported Q3 EPS of 51 cents, above consensus of 50 cents.

Twitter (TWTR unch) was downgraded to 'Underweight' from 'Equalweight' at Morgan Stanley.

Terex (TEX +5.13%) fell almost 5% in after-hours trading after it reported Q3 adjusted EPS of 58 cents, below consensus of 62 cents.

FMC Technologies (FTI +0.62%) reported Q3 adjusted EPS of 61 cents, better than consensus of 58 cents, although Q3 revenue of $1.55 billion was below consensus of $1.67 billion.

IRobot (IRBT +1.66%) fell over 5% in after-hours trading after it reported Q3 EPS of 42 cents, well above consensus of 23 cents, but then lowered guidance on fiscal 2015 sales to $610 million-$615 million from a previous forecast of $625 million-$635 million, below consensus of $628.4 million.

Discover Financial Services (DFS -0.49%) climbed nearly 1% in after-hours trading after it reported Q3 EPS of $1.38, higher than consensus of $1.33.

Chipotle Mexican Grill (CMG -1.81%) dropped over 8% in after-hours trading after it reported Q3 EPS of $4.59, less than consensus of $4.62.

Yahoo! (YHOO -2.00%) slid over 1% in after-hours trading after it reported Q3 adjusted EPS of 15 cents, weaker than consensus of 16 cents.

Rush Enterprises (RUSHA -1.21%) reported Q3 EPS of 48 cents, better than consensus of 47 cents.

Intuitive Surgical (ISRG -1.13%) jumped nearly 8% in after-hours trading after it reported Q3 adjusted EPS of $5.24, well above consensus of $4.22.

Pinnacle Financial (PNFP +2.21%) reported Q4 EPS of 66 cents, higher than consensus of 64 cents.

Packaging of America (PKG -1.20%) reported Q3 EPS of $1.26, below consensus of $1.28.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ15 +0.46%) this morning are up +9.25 points (+0.46%) at a fresh 2-month high. Tuesday's closes: S&P 500 -0.14%, Dow Jones -0.08%, Nasdaq -0.54%. The S&P 500 on Tuesday retreated from a 2-month high and closed lower on the unexpected -5.0% decline in U.S. Sep building permits to a 6-month low of 1.103 million and the reduced chances for an ECB QE expansion after the ECB's Bank Lending Survey said that Q3 credit standards eased for the sixth consecutive quarter. Stocks found support from the +1.14% rally in China's Shanghai Composite to a 1-3/4 month high and the +6.5% increase in U.S. Sep housing starts to 1.206 million, stronger than expectations of +1.4% to 1.142 million.

Dec 10-year T-notes (ZNZ15 +0.10%) this morning are up +5.5 ticks. Tuesday's closes: TYZ5 -13.00, FVZ5 -7.75. Dec T-notes on Tuesday fell to a 1-week low and closed lower on negative carryover from a slide in German bund prices to a 3-week low and on the stronger-than-expected U.S. Sep housing starts report.

The dollar index (DXY00 -0.05%) this morning is down -0.087 (-0.09%). EUR/USD (^EURUSD) is up +0.0014 (+0.12%). USD/JPY (^USDJPY) is up +0.15 (+0.13%) at a 1-week high. Tuesday's closes: Dollar Index -0.015 (-0.02%), EUR/USD +0.0019 (+0.17%), USD/JPY +0.34 (+0.28%). The dollar index on Tuesday closed lower on strength in EUR/USD after ECB Governing Council member Noyer said the ECB's current bond buying pace is "well calibrated," which signals he sees no need to expand QE, and after the ECB's Bank Lending Survey reported that Q3 credit standards on loans to companies eased for the sixth consecutive quarter.

Dec crude oil (CLZ15 -1.27%) this morning is down -58 cents (-1.25%) and Dec gasoline (RBZ15 -0.75%) is down -0.0083 (-0.64%). Tuesday's closes: CLZ5 -0.36 (-0.78%), RBZ5 +0.0132 (+1.04%). Dec crude oil and gasoline on Tuesday settled mixed. Gasoline prices found support from a weaker dollar and expectations that Wednesday's EIA report will show gasoline supplies fell -1.0 million bbl. Crude oil fell on expectations that Wednesday's weekly EIA report will show a +3.5 million bbl increase in crude inventories and a +500,000 bbl increase in Cushing crude oil stockpiles.

Click on image to enlarge

Disclosure:None.