Morning Call For January 28, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.14%) this morning are up +0.22% on stellar quarterly earnings results from Apple and AT&T and European stocks are down -0.50% as a slide in Greek stocks leads European stocks lower. Losses in European stocks were limited after Germany's Economy Ministry raised its German 2015 GDP forecast. Greece's ASE Stock Index plunged over 6% to a 2-1/3 year low and the 10-year Greek bond yield climbed to a 3-week high of 10.485% on concern the newly elected Syriza-led coalition will challenge austerity measures imposed on Greece. Greek Prime Minister Tsipras said his new government "will not be forgiven" if it betrays its pre-election pledges to renegotiate the terms of Greece's bailout. Asian stocks closed mixed: Japan +0.15%, Hong Kong +0.22%, China -1.39%, Taiwan -0.11%, Australia +0.10%, Singapore +0.20%, South Korea unch, India -0.04%. Japan's Nikkei Stock Index rose to a 4-week high after stronger-than-expected quarterly earnings from Apple boosted Japanese technology stocks. Commodity prices are mixed. Mar crude oil (CLH15 -1.56%) is down -1.56%. Mar gasoline (RBH15 +0.73%) is up +0.72%. Feb gold (GCG15 -0.10%) is down -0.12%. Mar copper (HGH15 +0.55%) is up +0.73%. Agriculture prices are lower. The dollar index (DXY00 +0.06%) is up +0.06%. EUR/USD (^EURUSD) is down -0.25%. USD/JPY (^USDJPY) is down -0.04%. Mar T-note prices (ZNH15 +0.10%) are up +3.5 ticks.

The German Dec import price index fell -1.7% m/m, more than expectations of -1.5% m/m and the biggest monthly decline in 6 years. On an annual basis, Dec import prices fell -3.7% y/y, more than expectations of -3.4% y/y and the fastest pace of decline in 5 years.

German Feb GfK consumer confidence rose +0.3 to 9.3, better than expectations of +0.1 to 9.1 and the highest since the data series began in 2005.

The German Economy Ministry in its biannual report raised its German 2015 GDP forecast to 1.5% from an Oct estimate of 1.3%.

U.S. STOCK PREVIEW

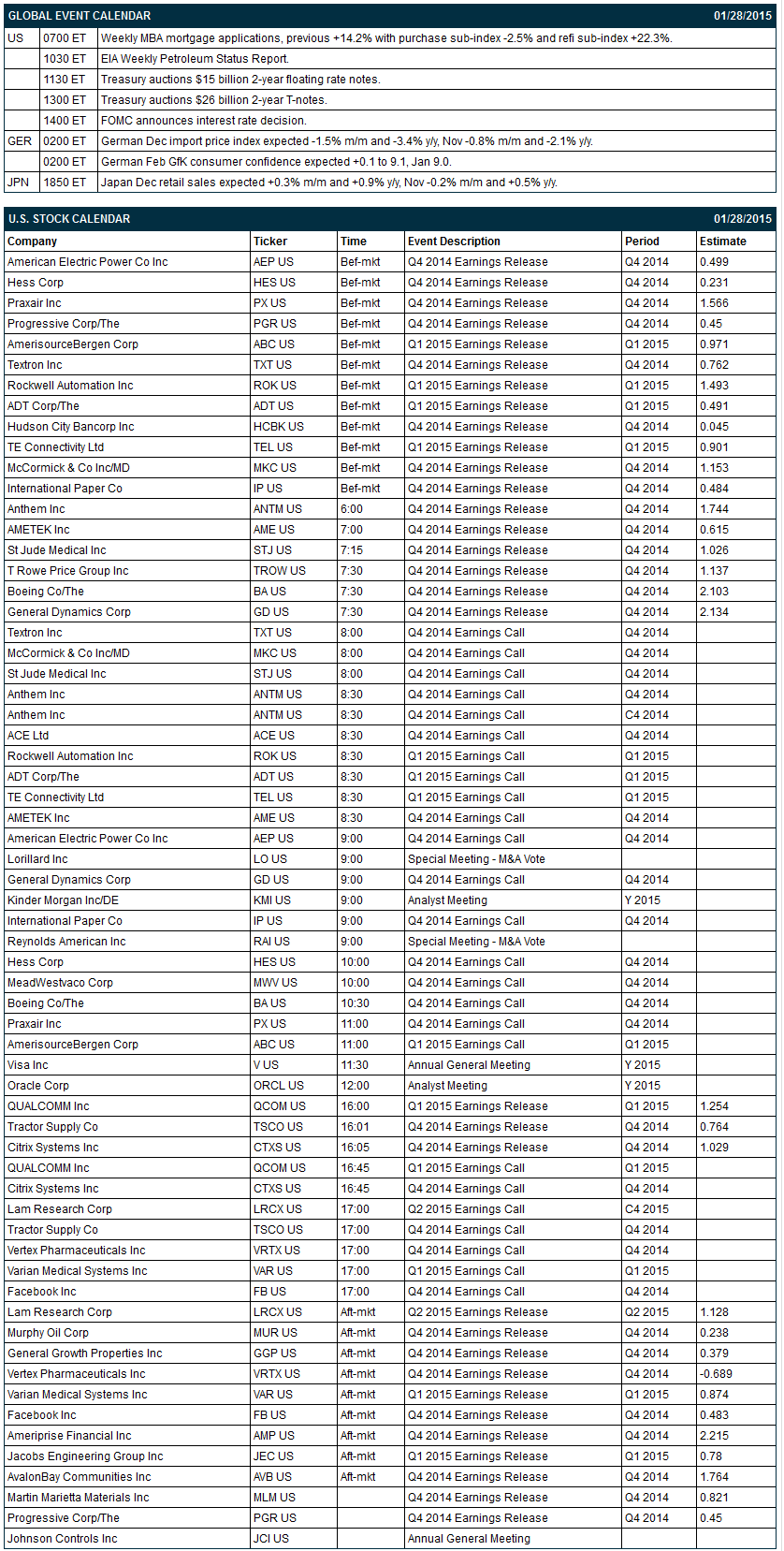

The market consensus is that the FOMC at its 2-day meeting that ends today will leave its interest rate and policy guidance unchanged. The Treasury today will sell $15 billion of 2-year floating rate notes and $26 billion of 2-year T-notes in auctions that were delayed from yesterday due to the massive snowstorm that hit the East Coast.

There are 31 of the S&P 500 companies that report earnings today with notable reports including: Facebook (consensus $0.48), Boeing (2.10), St Jude Medical (1.03), Rockwell Automation (1.49), Textron (0.76), General Dynamics (2.13), Citrix (1.03), Murphy Oil (0.24), Ameriprise (2.22). Equity conferences today include: Phacilitate Immunotherapy Forum on Mon-Wed.

OVERNIGHT U.S. STOCK MOVERS

International Paper (IP -1.50%) reported Q4 EPS of 53 cents, higher than consensus of 48 cents.

Apple (AAPL -3.50%) jumped 7% in after-hours trading after it reported Q1 EPS of $3.06, well above consensus of $2.60.

PolyOne (POL -0.50%) reported Q4 adjusted EPS of 36 cents, better than consensus of 34 cents.

Total System (TSS -1.84%) reported Q4 adjusted EPS of 58 cents, higher than consensus of 53 cents.

VMware (VMW -2.24%) climbed over 3% in after-hours trading after it reported Q4 EPS of $1.08, more than consensus of $1.07, and then authorized an additional $1 billion stock buyback.

Ultra Petroleum (UPL +1.04%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Western Digital (WDC -3.32%) reported Q2 adjusted EPS of $2.26, higher than consensus of $2.10.

International Game (IGT -0.29%) reported Q1 EPS of 19 cents, below consensus of 25 cents, and then said it will not provide fiscal 2015 financial guidance

Freescale (FSL +0.65%) reported Q4 adjusted EPS of 42 cents, above consensus of 33 cents.

Yahoo (YHOO -2.93%) jumped 8% in after-hours trading after it reported Q4 EPS of 30 cents, higher than consensus of 29 cents, and then said its Board of Directors authorized a plan for a tax-free spin-off of the company's remaining holdings in Alibaba Group (BABA) into a newly formed independent registered investment company.

Illumina (ILMN +0.78%) reported Q4 non-GAAP EPS of 87 cents, better than consensus of 78 cents.

Stryker (SYK -0.24%) reported Q4 adjusted EPS of $1.44, less than consensus of $1.45, and then lowered guidance on fiscal 2015 adjusted EPS to $4.90-$5.10, below consensus of $5.14.

Juniper (JNPR -1.44%) climbed over 3% in after-hours trading after it reported Q4 EPS of 41 cents, above consensus of 31 cents.

AT&T (T -1.12%) rose 2% in after-hours trading after it reported Q4 EPS of 55 cents, right on consensus, although Q4 revenue of $34.40 billion was above consensus of $34.26 billion.

Amgen (AMGN -0.53%) rose 2% in after-hours trading after it reported Q4 EPS of $2.16, better than consensus of $2.05.

Electronic Arts (EA -2.14%) reported Q3 EPS of $1.22, well above consensus of 92 cents, and then raised guidance on fiscal 2015 EPS to $2.35, above consensus of $2.09.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.14%) this morning are up +4.50 points (+0.22%). The S&P 500 index on Tuesday closed sharply lower: S&P 500 -1.34%, Dow Jones -1.65%, Nasdaq -2.58%. Negative factors included (1) the unexpected decline in U.S. Dec durable goods orders by -3.4% and -0.8% ex-transportation, weaker than expectations of +0.3% and +0.6% ex-transportation, and (2) concerns about corporate earnings after disappointing results from Microsoft, Caterpillar, Procter & Gamble, and DuPont. Stocks recovered from their worst levels after U.S. Dec new home sales surged +11.6% to 481,000, stronger than expectations of +2.7% to 450,000 and the most in 6-1/2 years, and after Jan consumer confidence (Conference Board) climbed +9.8 to 102.9, stronger than expectations of +2.6 to 95.5 and the highest in 7-1/3 years.

Mar 10-year T-notes (ZNH15 +0.10%) this morning are up +3.5 ticks. Mar 10-year T-note futures prices on Tuesday closed higher. Closes: TYH5 +5.00, FVH5 +3.00. Bullish factors included (1) the unexpected decline in U.S. Dec durable goods orders, and (2) increased safe-haven demand for T-notes after stocks plunged. Gains in T-note prices were limited after U.S. Dec new home sales and Jan consumer confidence were both stronger than expected.

The dollar index (DXY00 +0.06%) this morning is up +0.052 (+0.06%). EUR/USD (^EURUSD) is down -0.0029 (-0.25%). USD/JPY (^USDJPY) is down-0.05 (-0.04%). The dollar index on Tuesday closed lower: Dollar index -0.780 (-0.82%), EUR/USD +0.01421 (+1.26%), USD/JPY -0.588 (-0.50%). Bearish factors included (1) the unexpected decline in U.S. Dec durable goods orders, which may prompt the Fed to delay interest rate hikes, and (2) short-covering in EUR/USD after Swiss National Bank Vice President Danthine said “we’re fundamentally prepared” to intervene again in the currency markets.

Mar WTI crude oil (CLH15 -1.56%) this morning is down -72 cents (-1.56%) and Mar gasoline (RBH15 +0.73%) is up +0.0100 (+0.72%). Mar crude oil and Mar gasoline on Tuesday closed higher: CLH5 +1.08 (+2.39%), RBH5 +0.0463 (+3.44%). Bullish factors included (1) a weaker dollar, and (2) the surge in U.S. Jan consumer confidence to the highest level in 7-1/3 years, which may lead to an increase in consumer spending and energy demand.

Click on picture to enlarge

Disclosure: None.