Morning Call For April 20, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 +0.18%) are unchanged as a nearly 2% decline in Intel in pre-market trading undercuts technology stocks. Also, energy producers are lower and weighing on the overall market as crude oil (CLM16 -1.48%) falls -1.77% in early trade after Kuwait oil workers ended their 3-day strike. Sings of increased M&A activity limited declines in equities after a consortium led by Apex Technology and PAG Asia Capital acquired Lexmark International for $3.6 billion. European stocks are up +0.23%, led by a rally in mining stocks, as both BHP Billiton Ltd. and Rio Tinto Group climbed 3% as the price of iron ore rose after BHP cut its iron ore production forecast for its Australian operations. Asian stocks settled mixed: Japan +0.19%, Hong Kong -0.93%, China -2.31%, Taiwan 01.38%, Australia +0.52%, Singapore -0.06%, South Korea -0.25%, India +0.11%. Chinese stocks tumbled on speculation of reduced stimulus from China's central bank after PBOC research bureau chief economist Ma Jun said that future policy operations will pay attention to heading off macroeconomic risks. Japan’s Nikkei Stock Index rallied to a 3-week high after Japanese trade data showed Japan exports and imports fell less than expected last month.

The dollar index (DXY00 +0.05%) is up +0.10%. EUR/USD (^EURUSD) is up +0.11%. USD/JPY (^USDJPY) is up +0.02%.

Jun T-note prices (ZNM16 -0.01%) are up +1 tick.

PBOC research bureau chief economist Ma Jun said that future policy operations, while observing the need to continue to support growth, will also pay attention to heading off macroeconomic risks, especially an over-expansion of corporate leverage. This suggests that the PBOC is satisfied with the results of its current easing measures and may not add to them as that risks creating bubbles in financial markets.

German Mar PPI was unch m/m and fell -3.1% y/y, weaker than expectations of +0.2% m/m and -2.9% y/y, with the -3.1% y/y fall the largest year-on-year decline in 6 years.

Japan’s Mar trade balance was in surplus by 755.0 billion yen, narrower than expectations of a 834.6-billion-yen surplus. Mar exports fell -6.8% y/y, less than expectations of -7.0% y/y and Mar imports fell -14.9% y/y, a smaller decline than expectations of -16.6% y/y.

U.S. STOCK PREVIEW

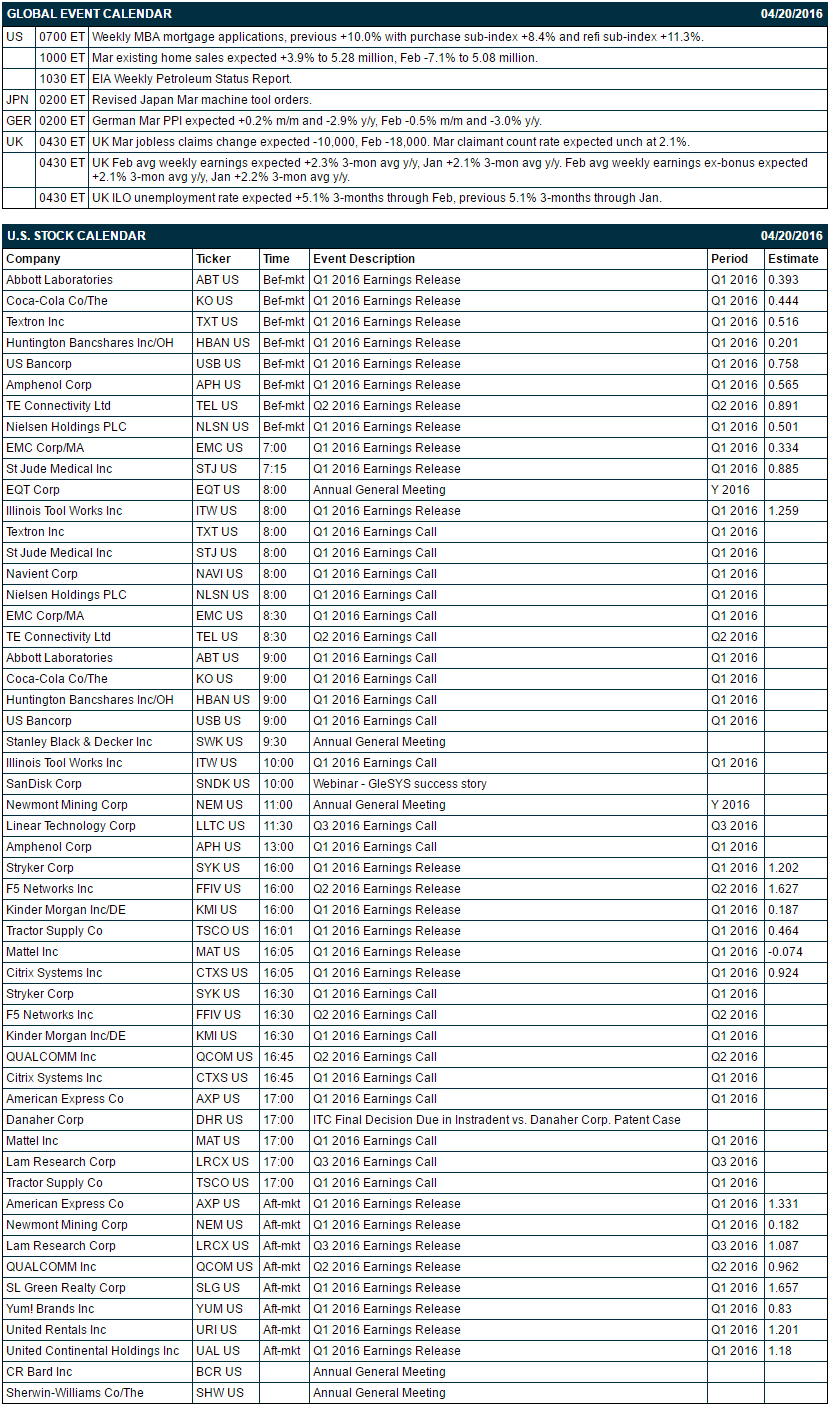

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +10.0% with purchase sub-index +8.4% and refi sub-index +11.3%), and (2) Mar existing home sales (expected +3.9% to 5.28 million, Feb -7.1% to 5.08 million).

There are 25 of the S&P 500 companies that report earnings today with notable reports including: American Express (consensus $1.33), Abbott Labs (0.39), Coca-Cola (0.44), Kinder Morgan (0.19), Citrix (0.92), Newmont Mining (0.18), Yum Brands (0.83).

U.S. IPO's scheduled to price today: American Rental Associates (ARA).

Equity conferences during the remainder of this week include: American Academy Of Neurology Meeting on Mon-Wed, American Association for Cancer Research Meeting on Mon-Wed, Rx Sample Management and logistics Summit on Tue-Wed.

OVERNIGHT U.S. STOCK MOVERS

Intel (INTC -0.16%) lost nearly 2% in pre-market trading after it said Q2 net revenue will be about $13.5 billion, below consensus of $14.2 billion, and said it will cut 12,000 jobs, or 11% of its workforce.

Halliburton (HAL +2.69%) declined 1% in pre-market trading as the price of crude oil is down -1.77% in early trade.

Lexmark International (LXK +0.99%) jumped over 10% in pre-market-trading after it was acquired by a consortium led by Apex Technology and PAG Asia Capital for $3.6 billion.

Boeing (BA +0.54%) slipped 2% in pre-market trading after Bank of America downgraded it to 'Underperform' from 'Neutral.'

Yahoo! (YHOO -0.52%) climbed over 1% in after-hours trading after it reported Q1 adjusted Ebitda of $147 million, above consensus of $115.9 million.

Intuitive Surgical (ISRG -0.52%) gained nearly 2% in after-hours trading after it reported Q1 adjusted EPS of $4.42, better than consensus of $4.33.

Global Payments (GPN -0.42%) rose over 1% in after-hours trading when it was announced that it will replace GameStop GME in the S&P 500 at the end of trading on Friday, April 22.

Discover Financial Services (DFS +1.15%) climbed 4% in after-hours trading after it reported Q1 EPS of $1.35, better than consensus of $1.29.

VMware (VMW -0.44%) jumped over 10% in after-hours trading after it reported Q1 adjusted EPS of 86 cents, higher than consensus of 84 cents, and said it authorized a $1.2 billion stock buyback program.

Woodward (WWD +0.04%) slid over 2% in after-hours trading after it reported Q2 adjusted EPS of 65 cents, below consensus of 66 cents.

Interactive Brokers Group (IBKR -0.55%) rose nearly 4% in after-hours trading after it reported Q1 comprehensive EPS of 60 cents, well above consensus of 47 cents.

Manhattan Associates (MANH +0.51%) gained over 7% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $1.73-$1.76 from a February 2 estimate of $1.69-$1.72, above consensus of $1.71.

CalAmp (CAMP +1.69%) fell over 7% in after-hours trading after it said it sees fiscal 2017 adjusted EPS from continuing operations of $1.15-$1.35, below consensus of $1.43.

MARKET COMMENTS

June E-mini S&Ps (ESM16 +0.18%) this morning are unchanged. Tuesday's closes: S&P 500 +0.31%, Dow Jones +0.27%, Nasdaq -0.62%. The S&P 500 on Tuesday rose to a 4-1/2 month high and closed higher on strength in energy-producer stocks as crude oil rallied 3%, on a rally in commodity producers after silver surged +4.4% to a 10-1/2 month high, and on a decent start to Q1 corporate earnings season. Stock prices were undercut by the-8.8% decline in U.S. Mar housing starts to a 5-month low of 1.089 million, weaker than expectations of -1.1% to 1.166 million.

June 10-year T-note prices (ZNM16 -0.01%) this morning are up +1 tick. Tuesday's closes: TYM6 -4.50, FVM6 -4.00. Jun T-notes on Tuesday closed lower on reduced safe-haven demand for T-notes with the rally in he S&P 500 to a 4-1/2 month high, on the rise in the 10-year T-note breakeven inflation expectations rate to a 2-week high, and on hawkish comments from Boston Fed President Rosengren who said "we will be raising rates faster than what's reflected in the financial markets."

The dollar index (DXY00 +0.05%) this morning is up +0.096 (+0.10%). EUR/USD (^EURUSD) is up +0.0012 (+0.11%). USD/JPY (^USDJPY) is up +0.02 (+0.02%). Tuesday's closes: Dollar Index -0.514 (-0.54%), EUR/USD +0.0045 (+0.40%), USD/JPY +0.39 (+0.36%). The dollar index on Tuesday closed lower on the weaker-than-expected U.S. Mar housing starts report and on strength in EUR/USD after the German Apr ZEW expectations index rose more than expected to a 4-month high.

June WTI crude oil (CLM16 -1.48%) is down -75 cents (-1.77%). June gasoline (RBM16 -0.66%) is down -0.0107 (-0.71%). Tuesday's closes: CLM6 +1.28 (+3.11%), RBM6 +0.0428 (+2.94%). Jun crude oil and gasoline on Tuesday settled higher on a weaker dollar, the third day of the Kuwaiti oil workers strike that has slashed Kuwait oil production by 50%, and the rally in the S&P 500 to a 4-1/2 month high.

Disclosure: None.