Morning Call - 11/10/2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.10%) this morning are up +0.11% and European stocks are up +0.47% after better-than-expected China Oct exports signal signs of strength in the global economy. Asian stocks closed mixed: Japan -0.59%, Hong Kong +0.83%, China +2.54%, Taiwan +1.54%, Australia-0.45%, Singapore +0.44%, South Korea +1.31%, India +0.02%. China's Shanghai Stock Index climbed to a 2-1/2 year high after China Oct exports rose more than expected and after regulators said that the Hong Kong and Shanghai bourses will allow trading on each other's stock exchanges from Nov 17, which will give foreign investors unprecedented access to China's equity market. Commodity prices are mixed. Dec crude oil (CLZ14 +0.11%) is up +1.36%. Dec gasoline (RBZ14 +0.36%) is up +1.66%. Dec gold (GCZ14 -0.22%) is down -0.21%. Dec copper (HGZ14 -0.36%) is up +0.20%. Agriculture prices are mixed ahead of this morning's USDA Nov WASDE crop production report. The dollar index (DXY00 -0.35%) is down -0.33%. EUR/USD (^EURUSD) is up +0.24% after an unexpected increase in Eurozone Nov Sentix investor confidence. USD/JPY (^USDJPY) is down -0.33%. Dec T-note prices (ZNZ14 +0.16%) are up +7.5 ticks at a 1-week high on carry-over from Friday's rally on the smaller-than-expected increase in U.S. Oct non-farm payrolls.

The China Oct trade balance widened to a surplus of +$45.41 billion, a bigger surplus than expectations of +42.00 billion. Oct exports rose +11.6% y/y, better than expectations of +10.6% y/y. Oct imports rose +4.6% y/y, less than expectations of +5.0% y/y.

China Oct CPI rose +1.6% y/y, unchanged from Sep but right on expectations and the smallest pace of increase in 4-3/4 years. Oct PPI fell -2.2% y/y, a bigger drop than expectations of -2.0% y/y and the fastest pace of decline in 7 months.

Eurozone Nov Sentix investor confidence unexpectedly climbed +1.8 to -11.9, better than expectations of -0.1 to -13.8.

UK Oct Lloyds employment confidence fell to 0 from 10 in Sep, the lowest in 7 months.

U.S. STOCK PREVIEW

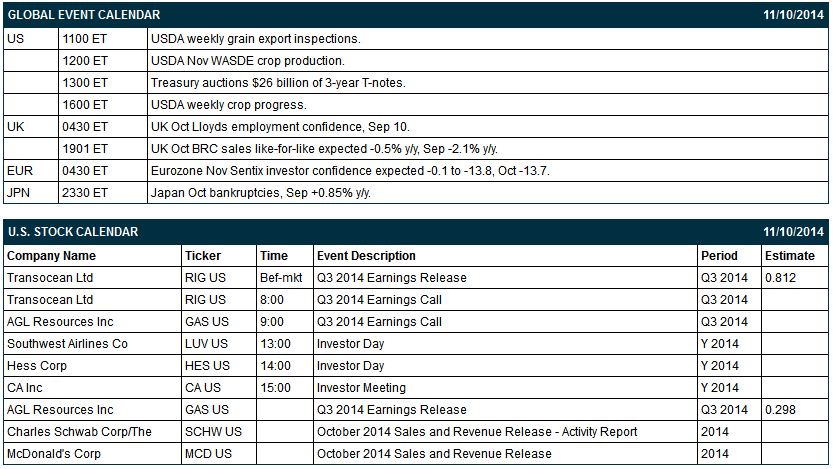

The Treasury today will sell $26 billion of 3-year T-notes. There are no U.S. economic reports today. There are 2 of the S&P 500 companies that report earnings today: Transocean (consensus $0.81), AGL Resources (0.30).

Equity conferences today include: Robert W. Baird & Co. Inc Industrial Conference on Mon-Tue, Airshow China 2014-Media Days on Mon-Tue, RBC Technology, Internet, Media & Telecommunications Conference on Mon-Tue, Cowen and Company Global Metals, Mining and Materials Conference on Tue, Needham Next-Gen Storage/Networking Conference on Tue, Morgan Stanley Global Chemicals & Agriculture Conference on Tue-Wed, Stephens Inc Fall Investment Conference on Tue-Wed, Jefferies Global Energy Conference on Tue-Wed, Credit Suisse Health Care Conference on Tue-Thu, J.P. Morgan Ultimate Services Investor Conference on Wed, Mexico Investors Forum 2014 on Wed, Pacific Crest Consumer Innovations Technology Investor Forum on Wed, Bank of America Merrill Lynch Banking & Financial Services Conference on Wed-Thu, Wells Fargo Securities Technology, Media & Telecom Conference on Wed-Thu, Goldman Sachs Global Industrials Conference on Wed-Thu, Bank of America Merrill Lynch Global Energy Conference on Wed-Fri, Edison Electric Institute Financial Conference on Thu, UBS Building & Building Products CEO Conference on Thu, SunTrust Robinson Humphrey Financial Technology, Business & Government Services on Thu, NOAH Conference 2014 on Thu, Goldman Sachs Technology and Internet Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

WhiteWave Foods (WWAV -1.41%) reported Q3 EPS ex-items of 27 cents, better than consensus of 26 cents

Grainger (GWW +0.02%) was downgraded to 'Sell' from 'Hold' at Deutsche Bank.

Abercrombie & Fitch (ANF -16.62%) was downgraded to 'Neutral' from 'Buy' at Janney Capital.

British Petroleum (BP +0.45%) was downgraded to 'Neutral' from 'Overweight' at JPMorgan Chase.

Citigroup reiterated a 'Buy' rating on Nike (NKE -0.87%) and raised its price target on the stock to $107 from $93.

PulteGroup (PHM +1.84%) was upgraded to 'Buy' from 'Neutral' at BofA/Merrill Lynch.

Target (TGT +3.68%) was upgraded to 'Buy' from 'Hold' at Stifel.

Eaton Vance (EV +17.00%) was downgraded to 'Neutral' from 'Buy' at Sterne Agee.

Transocean (RIG -0.70%) reported Q3 adjusted EPS of 96 cents, much better than consensus of 83 cents.

Boeing (BA -0.10%) and SMBC Aviation Capital announced an order for 80 737 MAX 8s, valued at more than $8.5 billion at list prices,

Berkshire Hathaway (BRK-A +0.08%) reported Q3 EPS of $2,876, better than consensus of $2,594.

PointState Capital reported a 6.4% passive stake in Synergy Pharmaceuticals (SGYP +6.04%) .

Abingworth reported a 15.5% passive stake in Sientra (SIEN -1.64%) .

AT&T (T +0.55%) acquired Mexican wireless company Iusacell for $2.5 billion.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.10%) this morning are up +2.25 points (+0.11%). The S&P 500 index on Friday posted a record high and closed higher: S&P 500 +0.03%, Dow Jones +0.11%, Nasdaq -0.09%. Bullish factors included (1) an unexpected -0.1 point drop in the U.S. Oct unemployment rate to a 6-1/3 year low of 5.8% versus expectations of unch at 5.9%, and (2) a rally in energy producers after oil prices rose. Negative factors included (1) the +214,000 increase in U.S. Oct non-farm payrolls, less than expectations of +235,000, and (2) concern that lackluster wage growth may dampen consumer spending after U.S. Oct average hourly earnings rose +0.1% m/m and +2.0% y/y, less than expectations of +0.2% m/m and +2.1% y/y.

Dec 10-year T-notes (ZNZ14 +0.16%) this morning are up +7.5 ticks at a 1-week high. Dec 10-year T-note futures prices on Friday rebounded from a 1-month low and closed higher: TYZ4 +19.00, FVZ4 +11.50. Bullish factors included (1) the smaller-than-expected increase in Oct non-farm payrolls and weaker-than-expected Oct hourly earnings, which may push back the timing for Fed rate hikes, and (2) dovish comments from Chicago Fed President Evans who said the biggest risk is prematurely restrictive monetary policy and that the Fed must be “patient” in removing accommodation.

The dollar index (DXY00 -0.35%) this morning is down -0.285 (-0.33%). EUR/USD (^EURUSD) is up +0.0030 (+0.24%). USD/JPY (^USDJPY) is down-0.38 (-0.33%). The dollar index on Friday closed lower. Closes: Dollar index -0.370 (-0.42%), EUR/USD +0.00787 (+0.64%), USD/JPY -0.638 (-0.55%). Negative factors included (1) the smaller-than-expected increase in U.S. Oct non-farm payrolls, which may keep the Fed from raising interest rates, and (2) strength in EUR/USD which recovered from a 2-year low and closed higher after German Sep exports showed the largest growth rate in 4-1/3 years.

Dec WTI crude oil (CLZ14 +0.11%) this morning is up +$1.07 a barrel (+1.36%) and Dec gasoline (RBZ14 +0.36%) is up +0.0354 (+1.66%). Dec crude and Dec gasoline on Friday closed higher. Closes: CLZ4 +0.74 (+0.95%), RBZ4 +0.0051 (+0.24%). Bullish factors included (1) a weaker dollar, and (2) signs of U.S. economic strength that may lead to increased energy demand after the Oct unemployment rate unexpectedly fell to a 6-1/3 year low.

Disclosure: None