Higher Wages: Good For You, Not Good For Stocks

The documentation of the endless march of asset markets higher has become passé; the illustration of the markets’ overvaluation redundant and tiresome. After years in which these same arguments have been made, without any discernable correction, the sober voices of warning have been discredited and discounted. The defenders of higher valuations have grown more numerous, more vocal, and more bulletproof.

I recently commented in a forum on cryptocurrencies…something to the effect that while I see blockchain as being a useful technology – although one which, like all technologies, will be superseded someday – I don’t expect that cryptocurrency in any of its current forms will survive because they don’t offer anything particularly useful compared to traditional money, and moreover have a considerable trust hurdle to overcome due to the numerous errors, scandals, and betrayals that have plagued the industry periodically since MtGox. Whatever you say about ‘traditional’ money, no one worries that it will vanish from your bank account tomorrow due to some accident. I don’t see anything particularly controversial about that statement, although reasonable people can disagree with my conclusion that cryptocurrency will never gain widespread acceptance. However, the reaction was aggressive and unabashed bashing of my right to have an opinion. I hadn’t even uttered an opinion about whether the valuation of bitcoin is a bubble (it obviously is – certainly there’s no sign of the stability you’d want in a currency!), and yet I almost felt the need to run for my life. The bitcoin folks make the gold nuts look like Caine in the TV show “Kung Fu”: the epitome of calm reasonableness.

But, again, chronicling the various instances of bubble-like behavior has also become passé. It will all make sense after it’s over, when the crowd recovers its senses “slowly, and one by one” as Mackay had it about 170 years ago.

Today though I want to address a quantitative error that I hope is hard to argue with. It has become de rigeur throughout this…let’s call it the recent stages of an extended bull market…to list all of the reasons that a continued rally makes sense. I always find this fascinating because such enumeration is almost never conducted with reference to whether these things are already “in the price.” On the weekend money shows, I heard several pundits opine that the stock market’s rally was likely to continue because “growth is pretty good, at around 3%; interest rates are relatively low; inflation is relatively low; government has become more business-friendly, and wages seem to be going up again.” As I say, it seems to me that most of this should already be in the market price of most securities, and not a cause for further advance. But one of those items is, in fact, a bearish item.

Make no mistake, wages going up is a great thing. And it’s nice to hear that people are finally starting to note that wages are rising (I pointed this out in April of 2016, citing the Atlanta Fed’s macroblog article on the topic, here. But not everyone reads this column, sadly). The chart below shows the Atlanta Fed’s Wage Growth Tracker, against Median CPI.

So wages are going up for continuously-employed persons, and this is good news for workers. But it’s bad news for corporate earnings. Corporate margins have been very high for a very long time (see chart, source Bloomberg), and that’s partly because a large pool of available labor was keeping a lid on wages while weak global demand was helping to hold down commodity input prices.

Higher wages are, in fact, a negative for stocks.

The argument for why higher wages seem like they ought to be a positive for stocks goes through consumption. If workers are earning more money, the thinking goes, then they can buy more stuff from companies. But this obviously doesn’t make a lot of sense – unless the worker is spending more than 100% of his additional wages in consumption (which can happen if a worker changes his/her savings pattern). If a worker earns $10, and spends $9 buying goods, then business revenues rise by less than wage expenditures and business profits fall, all else being equal.

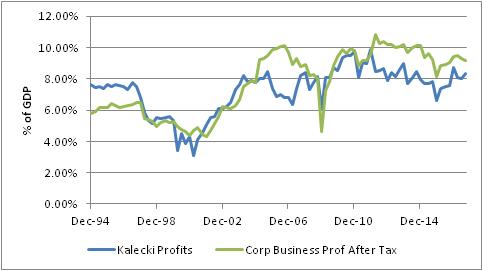

This shows up in the Kalecki profits equation, which says that corporate profits equal Investment minus Household Savings minus Government Savings minus Foreign Savings plus Dividends. (Look up Kalecki Profit Equation on Wikipedia for a further explanation.) Rearranging, Kalecki profits equal Investment, minus Government Savings (that is, surplus…so currently the deficit contributes to profits), minus Foreign Savings, plus (Dividends minus Household Savings). So, if workers save some of their new, higher earnings then corporate profits decline. The chart below shows how the Kalecki decomposition of profits tends to track pretty well with reported business profits (source: Bloomberg).

Now, profit margins have been high over the last year despite the rise in wages (not because of it) because the personal savings rate has been declining (see chart, source Bloomberg).

If wages continue to grow, and workers start to save more of their earnings (paying off credit cards perhaps?), then it means that labor is taking a larger portion of the pie compared to the historically-large portion that has been going to capital. This is good for workers. It is not good for stocks.

Interesting read, I never though about it in this way, but I am still having a hard time wrapping my head around this concept. I don't see how higher wages can be a bad thing. I mean I understand the author's math, "all other things being equal." But there are always other variables at play, aren't there? But now I am doubting myself. This will take more time to ponder!

Good article and a surpringly good comment thread. Thanks.

Actually it will cause rotation into areas that grow from increased spending and that can raise prices with inflation. It also may aid the beaten down commodities market. The rest of the stock market will hurt as mentioned in this article, especially the service sector.

Good insight.

A real eye opener of a read. The relationship of wage increase on stocks was completely counter intuitive to me.

"I don’t expect that #cryptocurrency in any of its current forms will survive because they don’t offer anything particularly useful compared to traditional money."

@[Michael Ashton](user:12172), great article and I agree with everything you said, though you forgot one point with your quote above. #Cryptocurrencies like #bitcoin do offer one extremely useful benefit over traditional money. It's untraceable. Criminals and those who wish to hide their activities will pump millions into crypto currencies for this very reason alone. $BITCOMP

My main concern is if you loose your password, it gets hacked or changed, or your account gets taken by government action you loose a lot of money. It has happened to many people and will happen to many more. It is far from a passive investment. It will get safer and easier, but not in its current form.

That's true! I would even concede billions rather than millions. But to displace the dollar, that needs to be tens of trillions. I don't think (and I may be wrong!) that you can build a currency on dark commerce alone.

You are correct. Billions at least. I don't expect #cryptocurrencies to displace the dollar any time soon foro all the reasons you mentioned, but I see it being an alternate currency that isn't going anywhere

I see it as a speculative trading vehicle. I don't see them ever really being currencies (the crypto folks would scream that they already are, but they're a long way from being actual money).

i suppose it would depend on what's definition of what money actually is. If you can be used to buy items, or if people would give you a different currency for it, would not that be enough to qualify? It would it my book.

Well, by that definition a subway token is money (or was, back when they had subway tokens!). You could buy a newspaper in a bodega with one, and of course a subway or bus ride, and people would definitely give you money for it. Its value in units of goods was also vastly more stable than bitcoin. I think you need a higher standard; for example, you can buy just about ANY item with it (you can't, with bitcoin, at least not yet) regardless of size, and the value is reasonably stable over time. Store of value, medium of exchange, unit of account, right?

You make a fair point. I can't use #Bitcoin everywhere yet, but at the pace it's going, more and more stores will accept it. And you are right, I would not consider a subway token a currency, though I admit I had no idea you could purchase anything with it other than a subway ride - that was before my time! You are older than you look (joking).

Ha! I remember when they started to phase out tokens, I refused to switch because you couldn't use a metrocard for anything else. Therefore, it was inferior to the token in my pocket. However, once they started discounting the metrocard, it overcame that option value pretty easily.

Recently I found a subway token in my home. Took me a split second to recognize it for what it was. I wonder if it's a collectible now.

I'd rather have the good ol' dollar or even #gold than a #bitcoin. But I'd rather have a bitcoin over the currency of some of the more unstable regimes in the world.

I'd rather have a knish over the currency of some of the more unstable regimes in the world! Bitcoin is certainly on the Zdollar-knish-USdollar continuum somewhere, but probably to the left of knish. At least I can eat a knish and know what it's worth.

Incidentally, I'm not trying to sound argumentative...just to be provocative about what money is and whether bitcoin is there yet. Maybe it will be someday, but yesterday it went from 10000 to 11500 to 9000 to 10000. So it rallied 11.5%, fell 22%, and then rallied 11% to finish the day. That's not something I'm keeping in my wallet, although it may be fun to trade.

You didn't come off as argumentative at all. Personally I've warned all my friends away from #Bitcoin (and now I have to feel their wrath). But I stil say it's too unstable. Governments could ban it, hackers could steal it, a new "in" digital currency could surplant it, there are so many variables. And it's not like the FDIC will bail out anyone who loses their bitcoins. If it's gone, it's gone. Remember people, this is not a tangible object.

That's how I feel. I am not a fan of thinking of gold as a currency, and currently think gold is a bit overpriced...but gold has it all over Bitcoin. IMO

You are a funny man @[Michael Ashton](user:12172), I have been reading your work here for a long time but had no idea you had such a sense of humor. I like it!

Thanks! You should have read my private comments when I used to write for clients of a bank or dealer. I was definitely less reverent. Occasionally got me into trouble. Writing for a 'net audience has tamed my prose somewhat.