Extend And Pretend

The title for this week’s report, “Extend and pretend”, comes from a recent commentary in the Financial Times regarding China’s massive rise in its debt, debt to GDP, and the bad bank loans outstanding and building1. The phrase, however, could just easily apply to the US stock market as well as its main support beam – central bankers’ monetary activism.

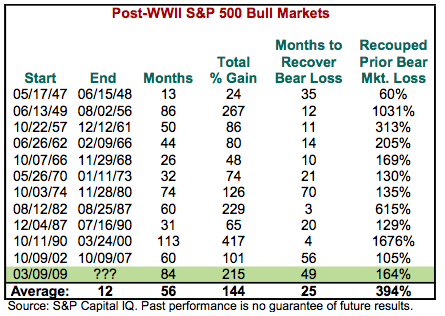

Regarding the US equities markets, “Extend and pretend” refers to the recent run to near all-time highs and the valuation argument made, supporting the rise against the backdrop of unprecedented economic conditions2, a bull market that is on the verge of jumping to a second place in length of time only to the 1990s technology fueled decade3, an uncertain and unprecedented US presidential election cycle, and enough global uncertainty and instability to choke a horse that says all is quite alright and acceptable.

As for the “Extend and pretend” factors involved with central banks, last week ECB president, Mario Draghi, doubled down on its extend policy to “do whatever it takes” – even if it means going far beyond the ECB’s mandate and allow other public policy decision-makers a free pass on not having to do their elected and/or appointed job.

As for the FT commentary and numerous related commentaries regarding China’s explosive run up in debt, the following highlights the situation quite well:

- “Every major country with a rapid increase in debt has experienced either a financial crisis or a prolonged slowdown in GDP growth,” Ha Jiming, Goldman Sachs chief investment strategist.

- “Economists say it is difficult for any economy to deploy productively such a large amount of capital within a short period, given the limited number of profitable projects available at any given time. With returns spiraling down, more loans are at risk of turning sour.”

Investment Strategy Implications

My most recent commentary featured the “one way out” that the current US stock market situation can be resolved favorably: corporate profits must rise at a rate at or near their cost of capital4, which is roughly 11% per year. Given that so much cost cutting has taken place over the past decade, therefore, one can only conclude that bottom line corporate profits’ growth must come from top line (sale/revenues) growth. In an excess supply/insufficient demand world, it is hard to see just how that all happens unless there is a major shift in fiscal policy both in the US and worldwide.

Therefore, when it comes US equities “Extend and pretend”: extend the increase in price, pretend that what should be of prudent concern is not.

***

1 China’s bad banks swell as defaults spread

2 Most notable of which is central bank actions, which included exploded balance sheets and wide spread negative interest rates.

3 Which included, you may recall, Y2K related fixes. Also, note that table noted above is up to March 2016, which means in May of this year the second place slot will be secured.

4 This is due, in large part, to the fact that US stocks are more than fully valued. Therefore, a P/E expansion is not likely.

Disclosure: Accounts managed by Blue Marble Research may presently hold a long/short position in the above mentioned issues and their inverse comparables.

Not sure China has a limited amount of projects. And besides, the Chinese buy bad paper off the banks to prevent a bad downturn, unlike our crusty old Fed.