Do You Pay Rent To Blackstone: This Is Where Wall Street Is America's Landlord

By now it is common knowledge that America's biggest landlord, following a Fed-subsidized scramble for distressed and multi-famility proprties over the past 3 years, is none other than Wall Street in general, and Blackstone in particular. Why did the smartest (and soon to be bailed out) people in the room rush to build an army of rental properties in recent years? Aside from the relatively stable cash flows, which as recent years have shown can also be securitized and sold off to greater fools for when they finally go bad, the flow chart below should explain it.

As RealtyTrac further revealed a month ago, four of the largest investors involved in the single family rental market have a potential of $1.2 billion in gained equity, or a 23 percent return, on properties purchased in the last three years (and that is just among the subset of properties with sufficient sales price and valuation information available)... assuming they don't all liquidate at the same time into a bidless market of course.

Among the largest institutional investors involved in the single family rental market, Blackstone/Invitation Homes had the most purchases with price and value information available over the past three years with 14,108, followed by American Homes 4 Rent (12,811), Colony American Homes (4,935) and Fundamental REO/Progress Residential (3,208).

Now as a follow up, RealtyTrac has analyzed nearly 10 million sales of single family homes in 2012 to 2014 and the nearly 500,000 among those that sold to institutional investors (entities that bought 10 or more single family homes in a calendar year) to identify where institutional investors have purchased the most single family homes.

The report seeks to identify where the four biggest institutional investors backed by Wall Street and private equity have purchased the most and are most likely to be landlords of single family homes – both at the county level as well as the zip code level. Those top four investors are Invitation Homes (backed by Blackstone), American Homes 4 Rent, Colony American Homes and Fundamental REO.

So what did the analysis find? The short answer is in parts of Seattle, Charlotte, Phoenix, Atlanta, Tampa, Cincinnati, Raleigh, N.C., Houston, Denver, Columbus, Ohio, Sarasota-Bradenton, Fla., Raleigh, N.C., Chicago, and Winston-Salem, N.C. Among the 2,490 zip codes nationwide with at least one single family purchase by the top four institutional investors between January 2012 and October 2014, the top 50 zip codes with the highest percentage of purchases by the four largest institutional investors were in those metro areas.

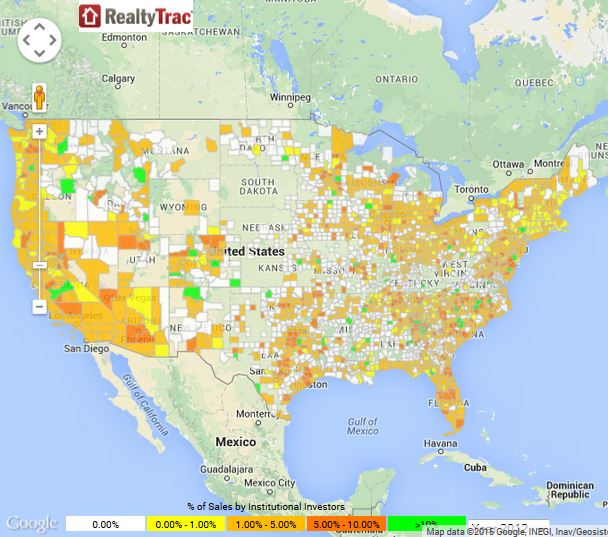

The following heat map shows the percentage of single family homes sold to these institutional investors in each of the 1,804 counties where they purchased properties nationwide in each year from 2012 to 2013.

Click here for interactive version of the map

Counties with most institutional investor purchases

Counties with the most institutional investor purchases during this time period were Maricopa County, Ariz., in the Phoenix metro area (19,133), Harris County, Texas in the Houston metro area(14,990), Mecklenburg County, N.C., in the Charlotte metro area (8,852), Tarrant County, Texas, in the Dallas metro area (8,387), Wayne County, Mich., in the Detroit metro area (8,153), and Clark County, Nev., in the Las Vegas metro area (7,991).

“The institutional investors kick-started the housing recovery by buying homes in bulk at the lowest point and holding them as rentals,” said Chris Pollinger, senior vice president of sales at First Team Real Estate, covering the Southern California market. Los Angeles County was among the top 10 for most purchases by institutional investors over the past three years, with 6,152. “As the market continues to climb, we expect these investors to start to sell off their inventory to capture the gains made in the past couple of years.”

Counties with highest percentage of institutional investor purchases

Counties with a population of at least 100,000 and the highest percentage of all single family homes in the county that were purchased by institutional investors between 2012 and 2014 included counties in Atlanta, Charlotte, Shreveport, La., Memphis, Oklahoma City, Dallas, Boise, Macon, Ga., Kansas City, Jacksonville, Fla., Flint, Mich., Houston, Phoenix, Indianapolis and Omaha.

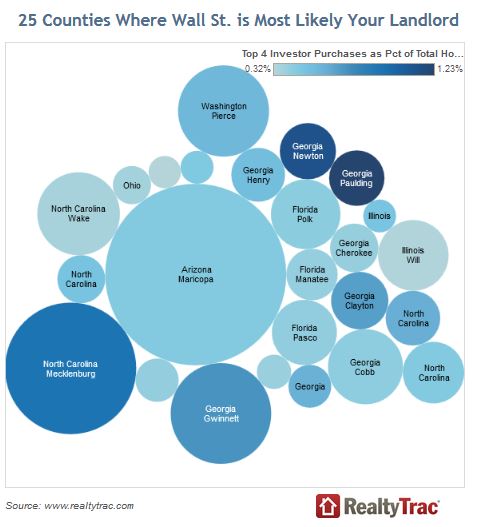

Counties with most purchases by four largest institutional investors

Secondly, we looked at purchases just by entities associated with the four largest institutional investors: Invitation Homes (owned by Blackstone), American Homes 4 Rent, Colony American Homes and Fundamental REO.

The total number of single family homes purchased by the top four institutional investors from January 2012 through October 2014 was 45,747, 0.14 percent of all single family homes in the 234 counties where the top four buyers purchased homes during that same time period.

“Our members represent the largest institutional owners of single family rental homes in the U.S. and their goal is, and has always been, to build a long–term, sustainable industry that professionalizes the traditionally fragmented single family market much the same way the multi–family market was transformed over 30 years ago,” said Matthew Beck, spokesman for the National Rental Home Council. “Our members provide high-quality housing alternatives to families who may not want or be able to purchase a home. Our residents are good neighbors and upstanding members of the community, helping to build stable neighborhoods. Recent studies have shown a growing percentage of renters are families who typically stay in their homes for an average of five years, and we’ve heard from residents that they’re active participants in their communities, sending their children to local schools, getting involved with their HOAs, coaching little league and volunteering with local civic organizations and projects among other engagements.”

Counties with the most purchases by the top four institutional investors were Maricopa County, Ariz., (4,851), Mecklenburg County, N.C., (2,548), Harris County, Texas (1,694), Cook County, Ill. (1,598), Gwinnett County, Ga. (1,496), Pierce County, Wash., (1,227), Clark County, Nev., (1,054), Wake County, N.C. (1,012), Hillsborough County, Fla., (982), and Tarrant County, Texas (980).

Counties with highest share of purchases by four largest institutional investors

The top 25 counties with a population of at least 100,000 and the highest percentage of purchases by the four largest institutional investors included counties in Atlanta, Charlotte, Seattle, Chicago, Nashville, Winston-Salem, N.C., Phoenix, Lakeland, Fla., Tampa, Sarasota, Cincinnati, Raleigh, N.C. and Charleston, S.C.

“The moon, sun and stars all aligned for large institutional investors to buy South Florida properties the past few years. Our limited land — squeezed between the everglades and ocean — growing population enticed by a no state income tax, strengthening economy and bargain priced properties that had dropped 50 percent in value, made it a compelling bet that is paying off handsomely for these bold buyers,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “The institutional investors positively impacted our market as they gobbled up much of our distressed inventory. With the expanding economy and size of our market their eventual exit will be handled and absorbed reasonably well.”

Click here for interactive version of the above map

The average estimated 2014 median household income in these 25 counties was $56,153 compared to national average of $54,948 among all 589 counties with a population of 100,000 or more and sufficient income data. The average fair market rent for a three-bedroom property in these 25 counties was $1,192 in 2014 compared to average $1,203 among all 557 counties nationwide with a population over 100,000 and sufficient rental data. The average median sales price in October 2014 for these 25 counties was $149,168 compared to $193,380 among all 519 counties nationwide with a population over 100,000 and sufficient home price data.

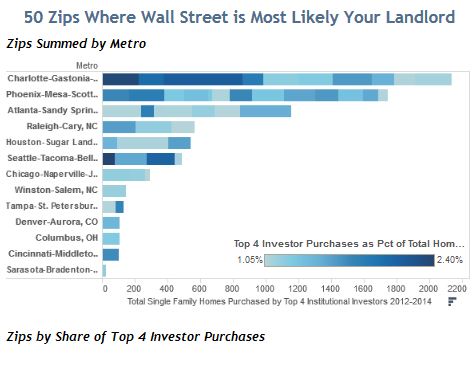

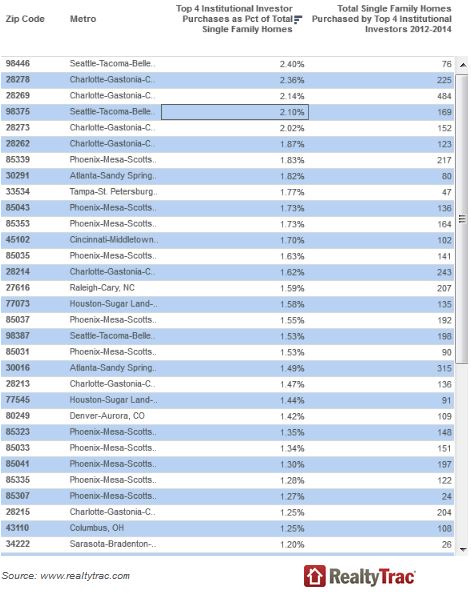

Zip codes with highest share of purchases by four largest institutional investors

Among 2,490 zip codes nationwide with at least one single family purchase by the top four institutional investors between January 2012 and October 2014, the top 50 zip codes with the highest percentage of purchases by the four largest institutional investors were in Seattle, Charlotte, Phoenix, Atlanta, Tampa, Cincinnati, Raleigh, N.C., Houston, Denver, Columbus, Ohio, Sarasota-Bradenton, Fla., Raleigh, N.C., Chicago, and Winston-Salem, N.C.

“We have certainly seen an impact from institutional investors in the Colorado market. Real estate is based on supply and demand, and with the strong influx of institutional investors we have seen the lower-end market and mid-market have a substantially higher spike in value from the increased competition than would have been experienced without investors coming into the market,” said Greg Smith, owner/broker at RE/MAX Alliance, covering the Denver market. “Most recently we have seen a slowdown in investors in the market place, which should open up some opportunities for the more traditional buyer.”

Click here for interactive version of charts above

The average estimated 2014 median household income for these 50 zip codes was $55,882 while the average fair market rent for three-bedroom in 2014 in these 50 zip codes was $1,344.

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more

Very interesting and insightful. It is rather sad that so many people lost their homes in the last hyped bank market and now so many homes are now owned by the TBTF banks that perpetrated the fraud as well as companies such as this. Still, hopefully there will be good times again and all those who lost their homes or wanted ones can get them at a reasonable price again. Sadly this probably won't happen as banks, Fannie Mae, Freddie Mac, and Institutional investors are dead set to keep the property markets up and prevent the glut in housing to open up the market. Likewise, Fannie and Freddie pretty much control the low and mid range market much like a communist government controls housing. Socialism at its best has made a strong foothold in American property. Strangely its to the benefit of the few at the cost to the many, just like it was in Russia, N Korea, and everywhere else socialist/communist ideas take root.