Deflationary Signs Emerge As Trump’s Trade War Heats Up

Mercantilist elements in Keynesian policies are definitely inapplicable to countries [with flexible exchange rates]. Tariffs worsen employment and output. …Robert Mundell, Nobel Economic Prize Winner, 1999

While the initial impact of retaliatory tariffs is a one-time spike in prices, the longer lasting effects are deflationary. There will be direct effects of imposing tariffs on specific imports, but this should not be confused with inflation, a situation in which all prices move up in a sustained fashion over time. Instead, we can anticipate recessionary forces taking hold and generating a downward bias in prices. If anything, tariffs are a dead loss to the economy, adding to the cost of basic materials and selected consumer products without any economic valued added.

Economists have long known that a trade war has negative consequences both for importers and exporters. The dynamics are very clear. In the short run, newly protected U.S. industries such as steel and aluminum will gain market share, but this comes at the expense of the American consumer buying less of the higher finished goods.

It is well understood that a nation curtailing imports deprives its trading partners of the ability to buy exports. China loses income because of U.S. tariffs, thus weakening a major trading partner. Since neither country can buy the same amount of the other's goods prior to the tariffs, overall demand falls and employment shrinks. Systematic retaliatory tariffs eventually lead to reduced investment, not increased investment as the Trump mercantilist would have one believe.

A U.S.- led tariff war has a direct impact on the U.S. dollar. We have already witnessed depreciation of the Canadian dollar and the Mexican peso, a sure sign that traders anticipate a decline in their respective national incomes. If nothing else, U.S. trading partners now have less money with which to purchase U.S. exports.

But what about the United States? Reports are now emerging of the trade war hurting basic U.S. industries. Soybean prices have reached a 10-year low, along with other basic agricultural exports as China raises tariffs. Harley-Davidson plans to move production to Asia and BMW warns that exports from its U.S. operations will be hurt by in tariffs imposed by the EU.[1] Rather than lose lucrative export markets, U.S. companies will be forced to relocate operations in order to jump the EU tariff wall.

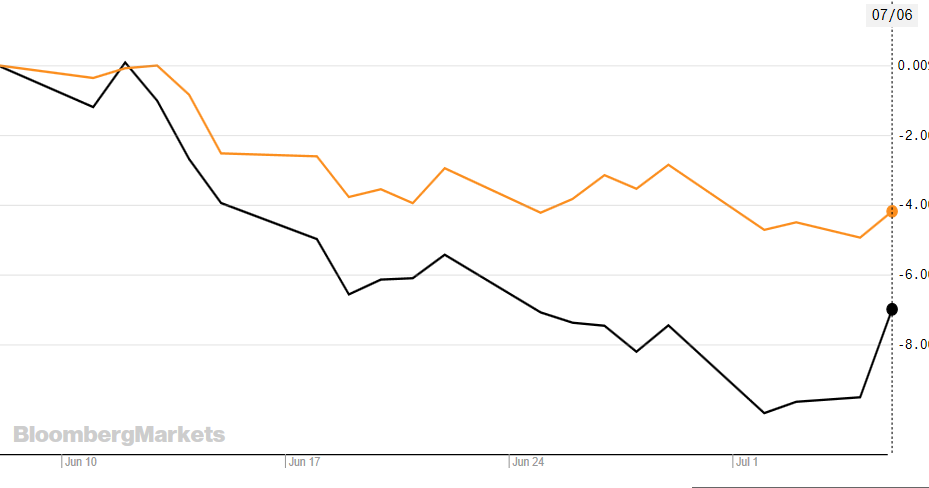

The canary in the coal mine is the fall in industrial and agricultural products, heavily dependent on trade with Asia (Figure 1). As the Chinese yuan falls and tariffs are raised on U.S. imports, exporters will suffer and, with no amount of domestic support forthcoming, major components of the U.S. economy will bear the full brunt of the trade war. This is not lost on the Europeans or the Chinese who have targeted tariffs to hit the U.S. heartland.

More troubling for the longer run is the uncertainty facing many domestic industries. Do they raise prices to cover the higher costs of inputs, e.g. steel and aluminum, or face profit declines? The Administration, almost daily, threatens its trading partners with additional tariffs. Manufacturers are holding off further business capital investment, watching from the sidelines as the trade wars become more political with each passing day.

(Click on image to enlarge)

Figure 1 Industrial (gold) and Agricultural (black) Commodity Indices

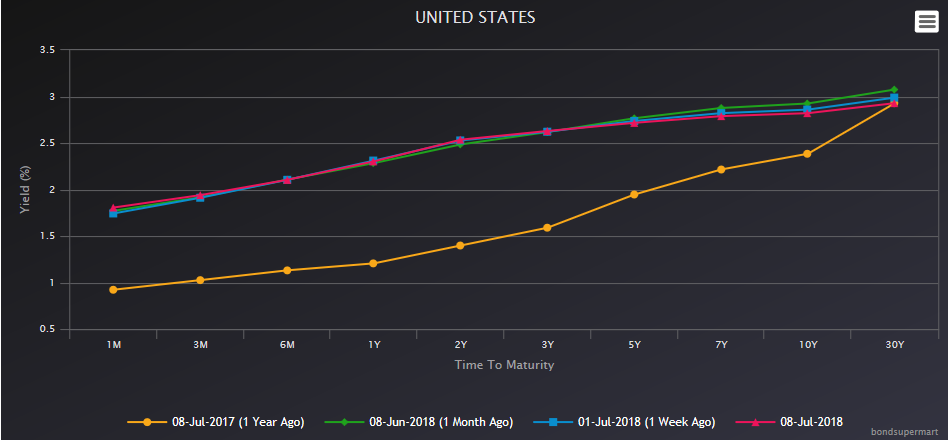

Although the stock market continues to brush aside the implications of the trade war, the bond market is well aware of the deflationary forces that will be at play over time. Figure 2 compares the US Treasury yield curve from 2017 to 2018. Much has been written about how to interpret the flattening yield curve. The Fed Chairman does not give much heed to the yield curve as a sign that a recession is on the horizon. Not everyone is as sanguine as the Fed. The bond market in 2017 displayed all the earmarks of an expanding economy, as the 30yr-2yr spread was about 175 bps, providing plenty of room for the Fed to hike rates without tilting the curve. Today, that spread has narrowed dramatically to 50 bps. Investors in the long end of the spectrum are not encouraged about the U.S. growth prospects, in no small measure because of the trade war unleashed by Trump.

(Click on image to enlarge)

Figure 2 Flattening Yield Curve

[1] Greg Ip, WSJ, July 9, 2018

It is still not clear to me why we needed the tariffs. was this done in exchange for some sort of compensation? Or as favors to personal friends?

CLEARLY we need another ballot choice for our elections, that choice being "NONE of the above." Choosing the lesser of the evils is excessively painful in the longer term.

US chief trade negotiator, Robert_E._Lighthizer was a long time lobbyist for the steel companies and so not surprising he convinced Trump to go after steel imports. As a Canadian, I am incredulous that Canadian steel exports to the US were hit with a 25% tariff---on the grounds that Canada is a national security threat! It happens that Canadian steel exports to the US equal US steel exports to Canada. Where is the sanity in that decision to hit Canada?

Peter Navarro, Trump's chief advisor on trade, has gone on record as saying that countries will not retaliate against the US because they need the US market. Arrogance and a total misreading of the degree to which other countries will go to lengths to protect their industries.

First, you are correct, and second, it seems that it was a "buddy " deal. I suspected some sort of deal to help out friends, you described it, thanks! And please note that I NEVER claimed that any degree of integrity was part of, or had any impact on, the tariff decisions. Also, I did not vote for the guy. His integrity seemed to be a bit lacking.

I did find this article educational and interesting.