COT Black: Futures Curve Twisting

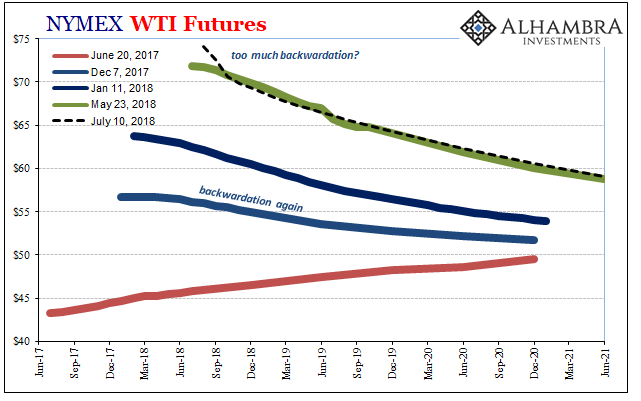

There is an interesting, ongoing academic debate about what shape the crude oil futures curve “should” take. Quite naturally, it seems backwardation is the market baseline. Most people, I think, presume otherwise because of their familiarity with commodities like gold. Backwardation in that market implies a physical shortage.

Unlike that precious metal, crude oil is a usable commodity whose value deteriorates over time. This doesn’t mean the stuff spoils in storage, rather the longer it remains siloed away the more costs are incurred to keep it there. The market’s incentive is for front-end use, thus backwardation in futures.

Historically speaking, however, the curve has only been in this condition about half of the time. We are roughly as likely to encounter contango in WTI futures as backwardation. What that might suggest is in some ways simple logic; it is a dynamic marketplace where things are always changing, often in very big ways as we’ve seen over the four years since the last time backwardation was evident.

Even when there is backwardation in the curve as there is now, how much is the right amount? It’s a trick question unanswerable for the same reason there isn’t such a thing as market equilibrium. Any equalizing point, should one actually exist, would only exist for the shortest of timeframes. What might be perfectly balanced contango one minute is improperly imbalanced structure the next.

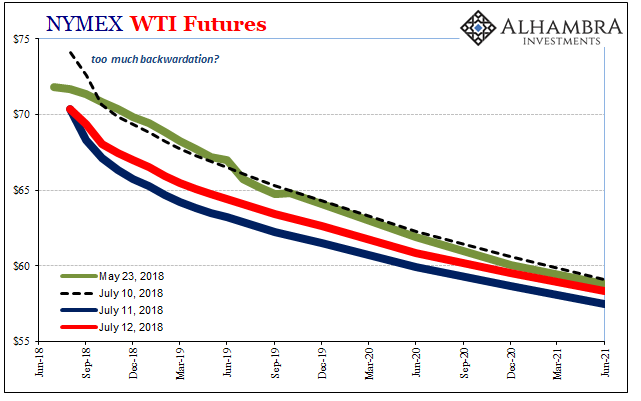

With all that in mind, briefly, the WTI curve has been noticeably twisted the past few days of this selloff. Prior, going back to May, spot oil prices were rising much, much faster than futures. The very front end was jumping out of line with the back end, producing a pretty blatant extreme of backwardation.

(Click on image to enlarge)

Was that too much? Who knows. During the selloff particularly yesterday the curve flattened out again. In trading today, the twist continued where the front month price was actually down while most other parts of the futures curve were up nearly all by $1.25 or more.

In short, the curve has shifted noticeably flatter.

(Click on image to enlarge)

All this by itself doesn’t tell us very much. We have to search for some context to anchor any interpretations, which aren’t very solid even when doing that.

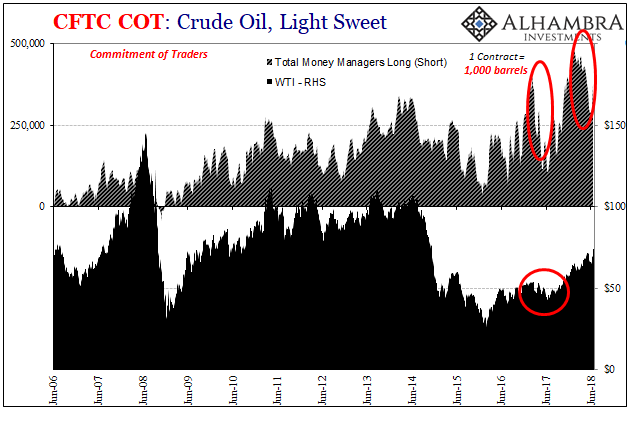

The Commitment of Traders (COT) report for WTI futures would seem to suggest growing disillusionment with further oil price rises. That would be consistent with most of recent gains being taken at the extreme front end. It doesn’t, of course, suggest why it’s been this way.

(Click on image to enlarge)

Money managers who up until the “rising dollar” had basically set the price of oil had been extremely optimistic about its direction earlier in 2018. That had meant a record long position the week of the stock market liquidations at the end of January. Balanced against them were swap dealers who were record short to an even greater level, only some of which could be chalked up to liquidity providing activities.

(Click on image to enlarge)

That long position on the MGR side persisted but grew no more until the first week in May. Then the net long collapsed with a low posted the week of June 5 (the week following the collateral calls on May 29). It was during this period where backwardation deepened in the futures curve.

Swap dealers by contrast appear to have remained committed not just to their net short position but also the size of it. So far it hasn’t resulted in renewed oil price weakness, but it could offer an explanation for the recent twisting of the curve. If there was a physical drain of oil inventory of sufficient size but one that was judged (by the market) to be temporary, it might account for the strangeness of the curve behavior (which then wouldn’t seem all that strange).

In that way, it would be something like the eurodollar curve inversion; things might look positive right now, but there’s a growing sense it might not last very long.

That’s a bit of an intuitive leap, though, and not one specifically drawn from just the data presented here. There are several assumptions contained within it, starting with some subjective idea of how much backwardation there should be right now. No one actually knows for sure.

It could just as well be futures market participants are righting the curve from an extreme back to more balanced backwardation the past two days. Interpretations aren’t limited at this point.

Thus, I choose to view these shifts in the context of what’s been going on elsewhere in terms of renewing deflationary pressures. That may just be my own bias, particularly as I suspect, as noted yesterday, oil is as likely to converge down to copper at some point as the other way around. A pessimistic view appears more warranted (I know, when isn’t it?)

Like everything else, time will tell once we get a new “equilibrium.”

Disclosure: None.