Not Exactly Paradox, Reflation In Oil Deflation In Copper

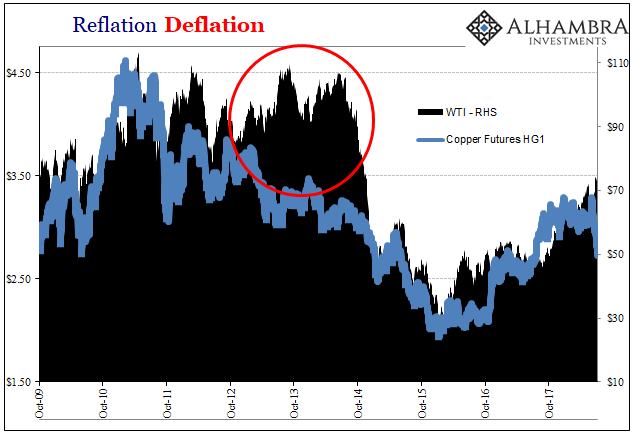

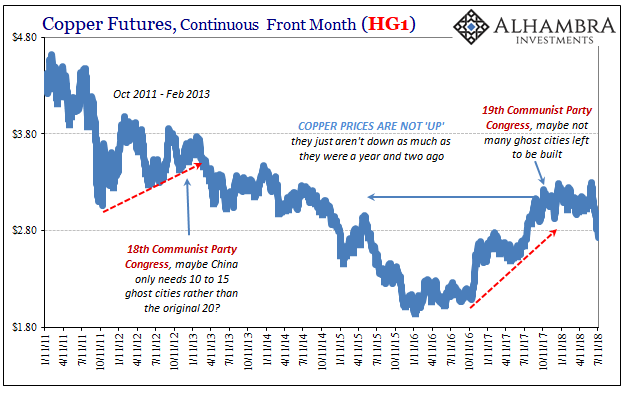

The PBOC really needn’t have conducted the last few of its RRR raises. By the time they were in the books, Chinese inflation was already well underway toward being tamed. Though their CPI wouldn’t register for a few more months still, peaking in July 2011, commodities had already turned decidedly downward.

Copper went first, hitting its high on Valentine’s Day. Oil would keep going further still, but ultimately turning around in May 2011. By the time the sharp liquidations rocked global markets (again) in late July and early August, these were already warnings as to the eurodollar erosion underneath the whole time.

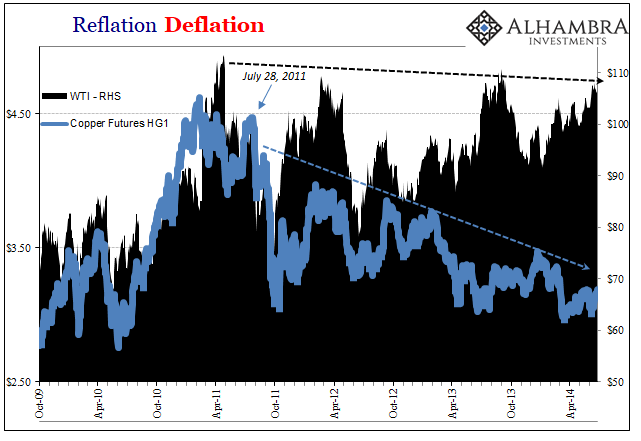

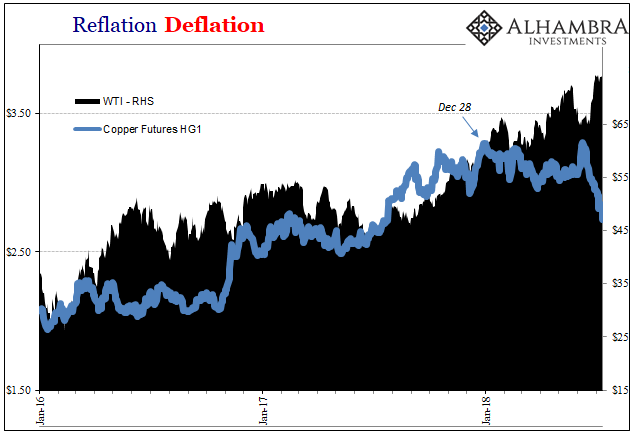

While that’s pretty straightforward, it’s what happened after that is interesting and perhaps relevant to today. From a unified deflationary front, copper and oil began to part ways later in 2011. Both rebounded from the depths of serious selloffs through October that year, but there was far more enthusiasm within the crude market than for copper.

Over the next several years, copper would continue to display the deflationary trend while WTI sort of went sideways to slightly lower. The result was a pretty stunning dichotomy, this divergence from the two most important economic commodities around. That it lasted as long and got as far apart as it did I believe tells us something useful.

(Click on image to enlarge)

(Click on image to enlarge)

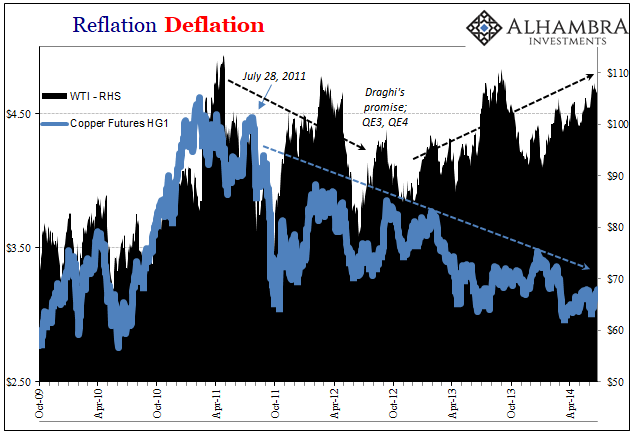

I don’t think it was quite as I’ve drawn and described them above, either, particularly the oil part. Rather, this post-2011 period should be divided further still into two separate trends; one more consistent with copper and the other moving opposite to it.

(Click on image to enlarge)

The net result is the overall sideways pattern of crude oil peaks, but it’s a very different interpretation given what’s in between.

Recall what was going on in 2012 beyond central bankers and their constant activity. Europe fell into outright recession. The US only narrowly avoided one. China experienced a sharp slowdown that pushed its economy from one looking like it would easily achieve pre-crisis growth levels to one where there was serious doubt as to when that couldhappen.

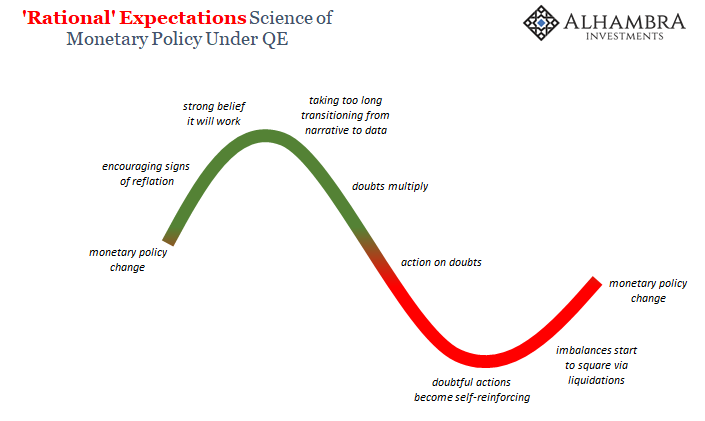

Oil prices in the summer of 2012 seemed to have priced full and robust recovery from the 2012 break. Buying, literally, Draghi’s promise and Bernanke’s repeated QE’s the oil market was moving into “global growth” a year and more before it became a mainstream economic idea. Discounting, but discounting what exactly?

(Click on image to enlarge)

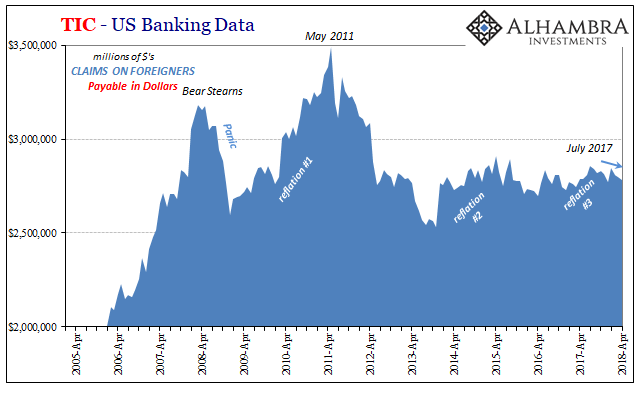

But if there was a story behind oil, there was actual money behind copper. As we know from a plethora of sources, the eurodollar system was finished off for good by July 2011. While there had been some moves toward partial restoration up until that point, Brian Sack’s August 9, 2011, bewildering acknowledgment of the vast and suddenly obvious difference between QE’s product of bank reserves and effective global “dollar” liquidity. This became standard market practice going forward even if standard orthodox interpretation kept on anyway.

In other words, copper followed the effective “dollar” while oil signaled reflation based on misconstrued perceptions of monetary policy effectiveness. This lasted as long as it did largely because economic events seemed to back that version; the European and US economies in 2013 began growing again.

For the underlying global monetary system, however, it wasn’t ever growth at least not in the way that would have been required; or is required now. The positive numbers in GDP as well as any number of other economic accounts, including employment figures, kept up the illusion until the middle of 2014.

Why 2014?

I think a lot of the timing had to do with Asia. For all Bernanke’s bluster and Yellen’s suitably more cautious if still confidence, the Chinese economy, in particular, was experiencing none of this global growth pickup priced into WTI and other crude benchmarks. Once that became reflected more and more as reality especially in CNY’s sudden turn around early on in 2014, the stage was set for convergence.

Either the global economy would truly pick up at that point, which would have required functional monetary growth way, way beyond irrelevant bank reserves, or the story behind global growth would disappear in a shockingly fast poof.

That’s what ultimately happened, of course, though to this day it still doesn’t register that way officially (“transitory” factors including a “supply glut”). Oil collapsed down to where copper already was; the story of QE and the ECB dissipated into a very different functional, really dysfunctional, eurodollar environment.

(Click on image to enlarge)

We may be facing a similar crossroads in 2018. There is no quantitative science here, meaning that depending upon where and how you draw each chart it could give you a slightly different take on what’s happened to this point. To my eye (the chart above), copper started moving away from oil around the end of last year.

Ineffective monetary terms, that makes sense given what was going on at that time as far as offshore liquidity conditions (repo, global basis, LIBOR, etc.) The killer (six months later and markets still haven’t retraced) liquidations followed less than a month later. Signals of rising and serious liquidity risks have abounded since each one seemingly escalating further past the last. Now negative economic signals are really starting to flash.

For copper, it hasn’t exactly been like 2011 plunging in more obvious deflationary fashion. But that may be nothing more than a function of its already low level. Unlike six years ago, none of the commodities have really come back all that much. From a longer-term perspective, copper is still down big as the eurodollar system is still going nowhere (on its good days).

(Click on image to enlarge)

Oil, by contrast, seems to be sticking to the global growth story all over again, now with “synchronized” boldly attached in the middle. Today’s trading with both commodities down big is one of the few times this year they have been behaving in direct correlation.

On a smaller scale, then, what is proposed is the same utter difference; on the one hand, we have the economic story that on the other isn’t supported by monetary reality. It’s reflation in sentiment against a sharply different basis in effective money. It worked last year because reflation had mildly gripped both sentiment and money.

Though these deflationary turns and economic downswings are involved processes, I don’t think it takes three years this time for the distance between these two vital commodities to be resolved. I have to believe eventually oil catches down to copper, however much lower that might be still. There are again too many signs, including this one commodity, aligned in that same increasingly doubtful direction again.

(Click on image to enlarge)

Disclosure: None.