Bulls Keep Buying Into The Close

Good stuff for bulls as resistance levels get ticked off on the advance. There breathing room for many indices and a chance for consolidation. Nit pickers could point to light volume, but it would be hard for buyers to be coming in here given the sequence of gains.

The Nasdaq 100 still remains tagged to resistance. Can it break tomorrow or will sellers make an appearance. All I know is yet another short trade of mine is stopped out. I should add, I haven't touched my investment account. I would be looking to buy if I had the funds available.

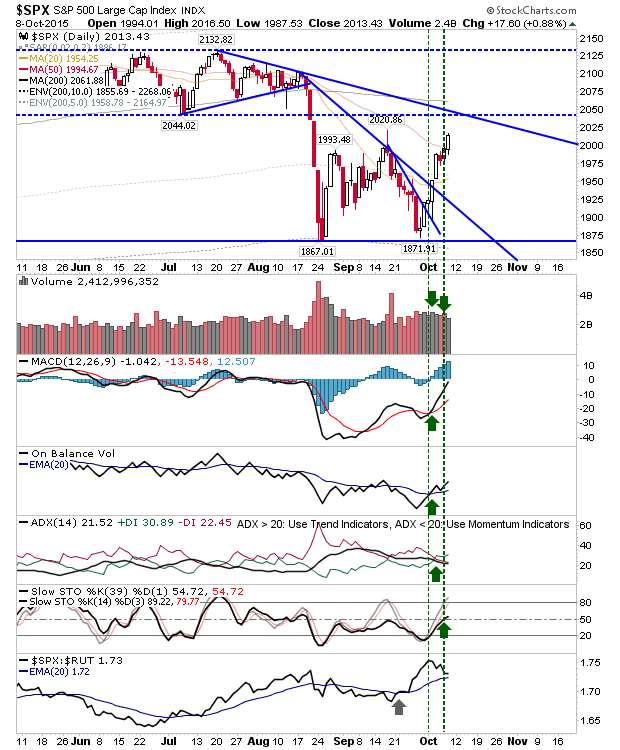

The S&P made a decisive push past its 50-day MA. Next resistance is up at 2,044. Technicals are nicely in favour of bulls.

It's the Russell 2000 turn to test its 50-day MA, but today's gain keeps the relative performance advantage against the Nasdaq (although not quite yet the S&P).

Tomorrow, look for more of the same. Every time I think an intermediate top is in place I'm undone by a closing surge of buying. While this can't continue, it does put a big distance on the low; firming up a bottom of substance.

Disclosure: None.

The best way to manipulate the market is at the close or shortly after the opening. However, the close is usually used by financial companies and those with big stakes in the stock market to help maintain their balance sheet. The big buying bulges are usually the Fed or some government who want to halt a decline or stimulate a run. Both should be taken with an ounce of incredulity.