Biweekly Economic Review

Economic Reports Scorecard

The economic reports of the last two weeks have generally been a little firmer. The Chicago Fed National Activity index, Existing home sales, Durable Goods orders, Personal Income and Outlays, the ISM Manufacturing index and Construction spending all improved month to month. None of them were however, what one could classify as particularly strong but improvement must be noted especially when it is reflected in other market based indicators (more on that later). There was still a steady stream of negative manufacturing surveys and reports and New Home sales were a disappointment. Imports and exports continue to contract and the ISM Non-Manufacturing survey was weaker, although a bit better than expected.

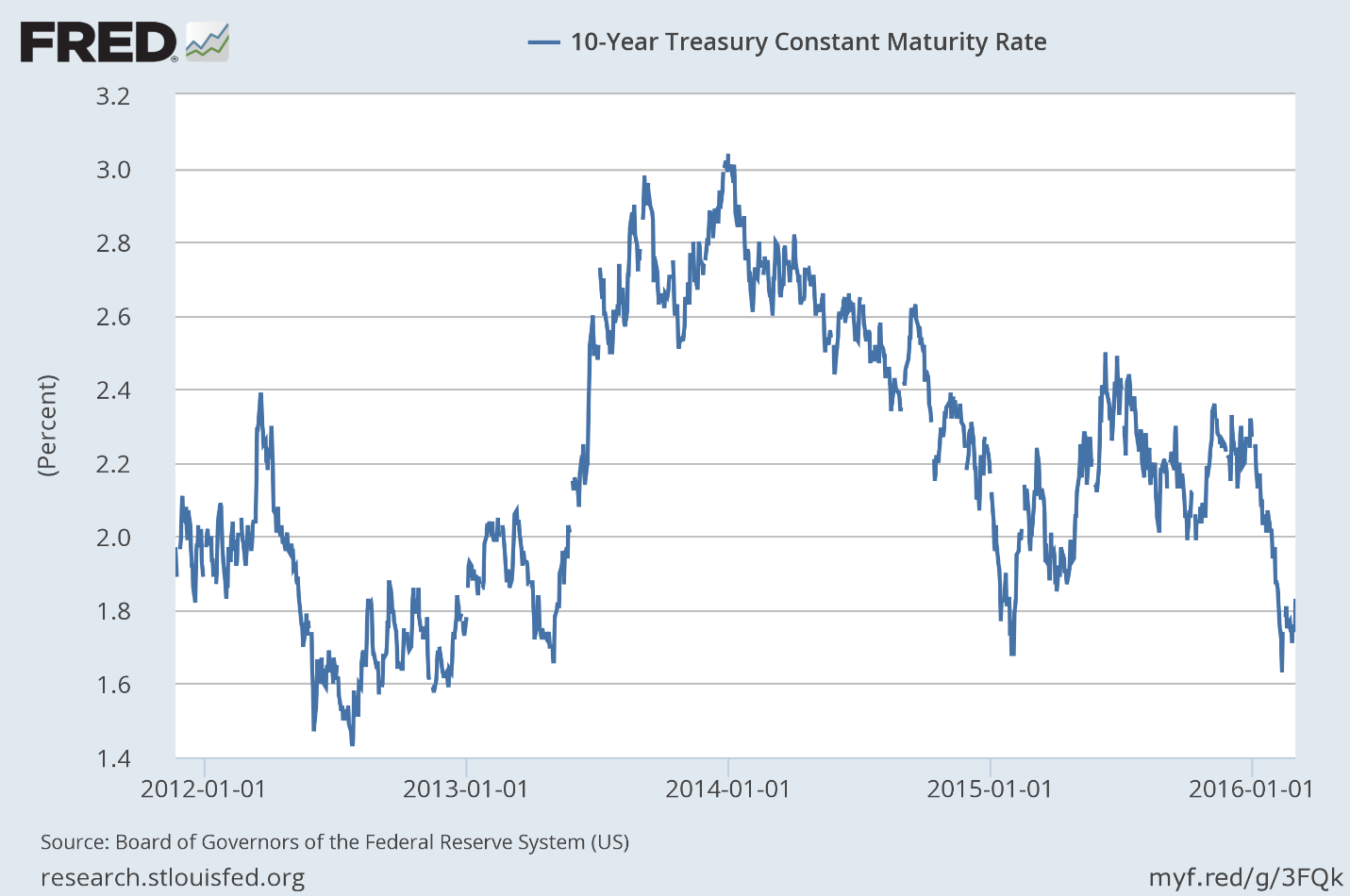

The market based indicators we follow offer a bit of a mixed interpretation of the data. The yield curve continued to flatten and TIPS yields fell as well with the 5 year maturity trading at negative yields near the end of February and into early March. The nominal 10 Year Treasury yield actually ticked a bit higher in the last week on the heels of the better than expected economic data. This action has pushed inflation expectations slightly higher over the last week. So the Treasury markets are painting a picture of slightly lower real growth expectations with slightly higher inflation. Not exactly a combination that inspires much confidence in our policymakers.

Yield Curve Continues to Flatten

Real Yields – TIPS Yields – Are Falling Again

Nominal 10 Year Treasury Yield Firmed In The Last Week

Inflation Expectations Rose

While Treasuries offered a mixed picture, credit spreads were pretty clear. As the economic data and oil prices firmed credit spreads narrowed considerably. The only tranche that didn’t have a significant move was at the junkiest end of the curve. CCC spreads narrowed slightly but there is still considerable concern about lower rated bonds.

The longer term trend for spreads though is still wider despite the recent narrowing. A rally like this even as the economy approaches recession is not atypical. The lack of participation by the CCC bonds is probably a bit of a warning not to get too excited – defaults are still likely to rise in coming months.

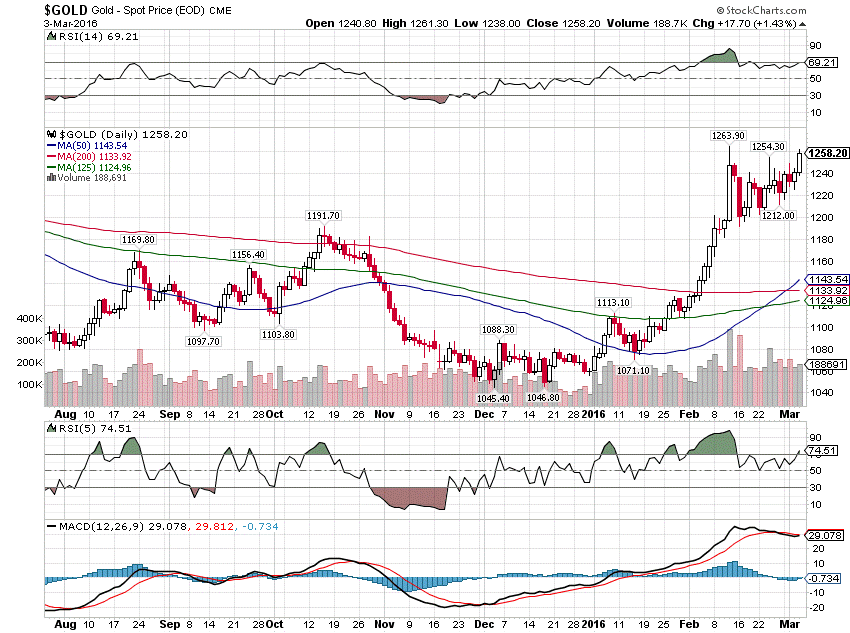

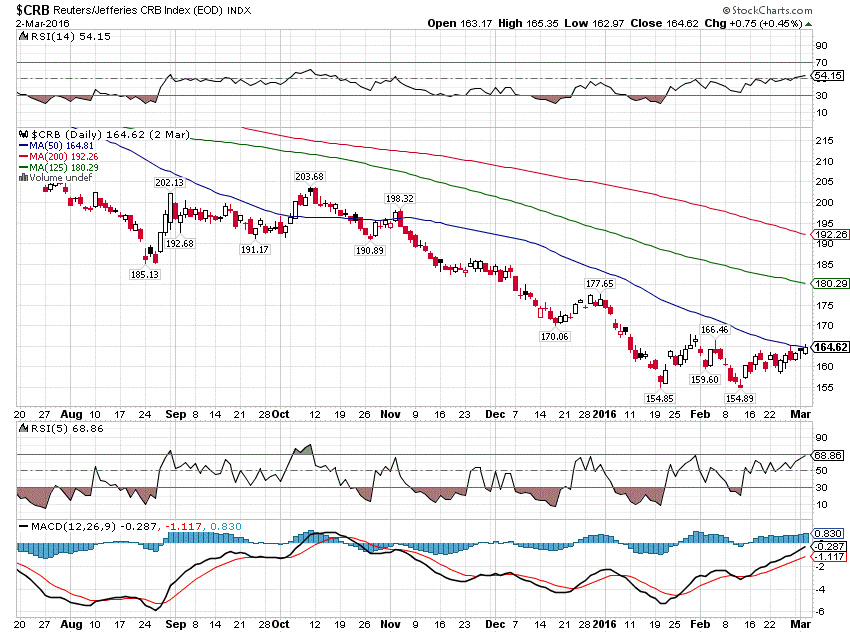

Better economic expectations are also hard to find in the US dollar index which still appears to be in a topping process. With real yields turning negative, gold is the new beneficiary of capital flows. I do wonder when other commodities will follow gold. If central banks continue to try and devalue against each other – to no avail since they are all pursuing easy money policies – then their currencies will eventually devalue against real assets. Real estate would also seem a likely beneficiary of negative interest rates.

Dollar Index Is Topping

(Click on image to enlarge)

Gold Gets A Boost From Negative Real Rates

(Click on image to enlarge)

General Commodities Have Stabilized But Haven’t Started Up – Yet

(Click on image to enlarge)

Needless to say, but a falling dollar, rising gold and rising commodities are generally not good for real US economic growth. It does appear that’s where we’re headed though. With a weak economy and no fiscal response, the world’s central banks continue to push the envelope and the Fed will be forced to follow or at least they will feel compelled to do so. It appears that market participants are starting to get concerned that whatever they do, it will turn out to be inflationary. Not exactly what most people are expecting.

Disclosure: None.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe ...

more

The real picture is YoY not week to week, especially leading in March which is typically always better than prior. The worrisome picture is the continued rise in housing against a drop in everything else reminiscent of the last downturn. Not only does high rent and housing deprive people the ability to spend money and worsens credit scores, it also often leads to gross inaccuracies of wealth and leads to overleveraging. This is almost always the case of horrible Federal Reserve policies which have been in operation for years now.

Given the massive investment in gambling on real estate trusts and the massive re-influx of flippers, cash purchases, and low money down players banks will once again get hit even though they dump much of the future bad home loans on taxpayers through Fannie and Freddie Mac.