United Parcel Service Stock Analysis

With the stock market still continuing its position at very high points – it has left us dividend value investors to find little-to no room to make a move. There have been flashes of companies taking a few steps back, such as Target (TGT) and Apple (AAPL), but what other companies are out there that may have not been in the public news, but that still look attractive right now? Well, I received a package in the mail the other day and had a conversation about what industries may be benefiting from low oil prices? What about shipping companies? Better yet… what about United Parcel Service (UPS)? Let’s find out.

Intro to United Parcel services, Inc.

There are 2 major players in the ground shipping, if you exclude the USPS – that is United Parcel Services and FedEx (FDX). Before we get into UPS, we wanted to bring in the background:

From Google Finance, “United Parcel Service, Inc. is a package delivery company. The company is a provider of global supply chain management solutions. It delivers packages each business day in over 220 countries and territories. The company operates in three segments: U.S. domestic package, international package, and supply chain & freight. The company offers a spectrum of the United States domestic guaranteed ground and air package transportation services. The company’s international package segment includes the small package operations in Europe, Asia, Canada and Latin America, the Indian sub-continent, the Middle East and Africa. UPS offers a selection of guaranteed day and time-definite international shipping services. The supply chain & freight segment consists of the company’s forwarding and logistics services, truckload freight brokerage, UPS freight and its financial offerings through UPS Capital. UPS offers a portfolio of guaranteed and non-guaranteed global air freight services.”

Over 200 countries. They are all over the place. I was at an airport and I could see one of their flights coming in to ship products. Just amazing. Further, this comes in at a time when it has occurred again – it has been well over 30 years since I've purchased a stock, getting antsy, just one more time but I will be using our great Dividend Diplomat Stock Screener metrics to boot. Let’s get into the details on UPS, and their competitor FedEx.

UPS Analysis

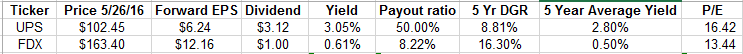

1.) Dividend Yield – UPS is definitely in that “happy” range of over 3% currently and definitely takes the pie here, whereas – FDX has a much lower yield at 0.61% – which could put them in discussions with low yield high dividend growth stocks. I like UPS’s yield here, for sure!

2.) Payout Ratio – Here we go! This was just analyzed in a recent article by me on why it is such an integral part of your screener during difficult times, given the lower earnings growth or even declining period we are embarking upon. We love that 40-60% range and bam UPS is right in the middle at a perfect 50%, given their forward EPS of $6.24. Obviously FDX has a high forward EPS figure currently based on estimates and only pays out a small portion of their investment. FDX’s current EPS, though, is at $4.07, so definitely a huge change there. However – both companies have ample room to grow their dividend, I love it.

3.) Dividend Growth Rate – This is a big proponent here, as we know – I love the impact the dividend growth rate has on a portfolio and it’s very wonderful to see with these 2 stocks. Now, UPS has increased their dividend for going on 7 years now (as during a few economic difficult times, they maintained, no cuts), and FedEx has gone on for multiple years as well. What I love is no cuts here. Further – the 5 year growth rate is solid at 8.81% for UPS and 16% for FedEx. However, given how low the yield is for FedEx – one would expect a big DGR. I like the balanced approach of UPS here, for some odd reason. UPS over the last 3 years (8.26%) is also very similar to the 5 year, therefore, consistency has been fun to see with them.

4.) 5 Year Average Dividend Yield – Both are beating their 5 year average yield – with UPS at 20 bps and FDX at 10 bps. I like UPS here, given they have a bigger basis point margin to boot. This is another sign of undervaluation, which we love as dividend investors.

5.) Price to Earnings (P/E) Ratio – This is where it gets interesting. Based on UPS forward EPS, the P/E ratio is at a 16.42. Undervalued against the market and I will have to say against the industry, because of what I said in #2 point above – FedEx has a very interesting forward P/E. Analysts were showing between $11.50 to $13.00, therefore I split in the middle essentially. Both show undervaluation, but such a difference in FDX. Therefore, I rely more on the UPS data, and their track record of consistency.

This is interesting. UPS is trading at a fairly nice level right here. You can grab a solid yield at above a 3%, and a solid DGR above 8%. They have been consistent and are about to pay their next dividend come 6/1. Therefore, there is plenty of time until the ex-dividend in August for the 3rd quarter payment. They also raise their dividend during the February time frame, therefore, that ship has sailed already from a dividend increase standpoint. This stock is very interesting. Further, the share count are down approximately 1.6% from 3/31/15 to 3/31/16. Which is intriguing, and they have a nice share buy back policy of, ” In May 2016, the Board of Directors approved a new share repurchase authorization of $8.0 billion, which has no expiration date.” Just buying back shares.

Conclusion on United Parcel Services, Inc.

Well, well, well… I love the share repurchase program, the climbing EPS, the consistency of the dividend and dividend growth – it’s hard not to buy this. Further, a dead smack in the middle payout ratio and an attractive P/E. It’s hard to beat right now and given the market, this stock hasn’t been beat up too bad and actually has stood tall. I am definitely adding it to my watch list for the time being and am very, very excited about seeing if I can make a move on this shipping vehicle.

What do you think of UPS? Like FedEx better? Do you think one or both are attractive? Which one? Also – is there something I’m not seeing here? Thank you for coming by and reading everyone, cannot wait to hear your thoughts. Please comment below and we’ll get some discussions going. Happy Investing!

-Lanny

Disclaimer: None

What about how #Amazon launched it's own truck shipping company and its 20% stake that it purchased in #AtlasAir last month for air deliveries? Seems to me that they are looking to ditch #UPS. I would think that would be a major threat to the company and it's bottom line. $AMZN $AAWW $UPS

What percentage of total $UPS deliveries are made up by $AMZN? Is it really that significant?

I found a 2013 $UPS 10-K filing with the SEC which stated "No single customer accounts for 10% or more of our consolidated revenue."

Amazon spent $3 billion on deliveries in 2014 and that increased 30% in 2015. Sounds significant to me and will only continue to grow.

Saw this discussion on the homepage activity feed and had to add my 2 cents. @[Craig Newman](user:7650), while that amount is significant, #Amazon only uses #UPS for about 30% of it's deliveries.

30% of #Amazon's $3 billion equates to about $1 billion in revenues for $UPS. #UPS has about $60 billion in revenues so losing $AMZN’s business would reduce UPS’ revenues by only 1.67%. Hardly significant.

Thanks for all your comments. And while you are all correct, I suspect that $AMZN is looking to vertically integrate and become a competing shipping industry. Just as they decided to become their own web hosting company and became a dominant player in that space. I suspect they will not only drop UPS, but will begin to compete with it. That could crush $UPS.