IPO Preview - E.L.F. Beauty, Inc.

e.l.f. Beauty, Inc. (Pending:ELF) filed its S-1/A with the Securities and Exchange Commission on Sept. 12, 2016, setting the terms for its initial public offering. The company estimates net proceeds from the offering to be approximately $52.3 million through its sale of 8.3 million shares at a price range of $14 to $16 per share. Of the 8.3 million shares being offered, approximately 4.3 million of shares will come from the company insiders who will sell their shares at the IPO. This represents approximately 52 percent of shares that are held by insiders. The company has 1,250,000 shares that are over-allotted.

The company is expected to price on Wednesday evening (9.21). If it prices at the range's midpoint, the company's fully diluted market value will be $737 million. This includes shares outstanding and shares that would be available through the conversion of stock options. ELF has a price/sales multiple of 3.46.

Underwriters for this IPO include: JPMorgan (NYSE:JPM), Piper Jaffray, Morgan Stanley (NYSE:MS), Wells Fargo Securities, William Blair, Cowen & Company, BMO Capital Markets, Stifel, and SunTrust Robinson Humphrey.

Business summary

Founded in 2004 and headquartered in Oakland, California, e.l.f. Beauty, Inc. provides high-quality cosmetic products with the majority of its items retailing for $6 or less. The company sells its products in national and international retailers, online, and in e.l.f. stores. Its largest retail customers are Target (NYSE:TGT), Walgreens (NASDAQ:WBA) and CVS (NYSE:CVS). The company was originally founded in New York before moving its headquarters to Oakland in 2014.

TPG Growth, LLC, a global private equity firm, purchased a majority stake in the company in 2014. The objective of its investment was to further scale and transform the company. Today, the company has approximately 159 employees and retail locations in the San Francisco Bay area and New York. During the last twelve months ended June 30, 2016, e.l.f. generated $213 million in sales.

Executive management team

Tarang Amin joined e.l.f. Beauty in January 2014 as the Chief Executive Officer. Amin was brought in concurrence with the acquisition by TPG Growth, LLC, because of his significant experience in consumer products. In August 2015, Amin was named as the chairman and CEO. Before joining e.l.f., Amin served as the president and CEO of Schiff Nutrition International, Inc. from March 2011 until January 2014, as the vice president and general manager of Clorox Co. (NYSE:CLX) from May 2008 until February 2011 and in a variety of different roles at Proctor & Gamble (NYSE:PG) from 1991 to 2003. He holds both a Bachelor's degree and a Master of Business Administration from Duke University.

John Bailey serves as President and Chief Financial Officer at e.l.f. Beauty. He joined the company in August 2015 and is also a Principal at TPG Growth LLC. He has worked in various positions for TPG Growth, LLC since 2010. He previously worked for North Castle Partners LLC and for Credit Suisse First Boston PF Europe Ltd. Bailey graduated from the University of Michigan Law School and holds a Bachelor of Business Administration.

The co-founder and former CEO of e.l.f. Beauty, Joseph Shamah has served on the board of directors since 2012. He is a graduate of New York University and served as the company's CEO until January 2014.

Comparison with industry peers

At an estimated market capitalization value of $737 million and using sales for the 12 months ended June 30, 2016, e.l.f. will trade at approximately 3.46x sales. This is in line with competitor Ulta Salon, Cosmetics & Fragrance (NASDAQ:ULTA) which trades at a price/sales multiple of 3.40x. At the same time, e.l.f's revenue growth between 2014 and 2015 was 32 percent versus 21 percent for ULTA.

Overall, the cosmetics industry is highly concentrated, with 60% of cosmetic retail sales in 2015 generated by brands owned by four companies: L'Oreal S.A. (OTCPK:LRLCF) (OTCPK:LRLCY), The Estée Lauder Companies Inc. (NYSE:EL), The Procter & Gamble Company, Revlon Inc. (NYSE:REV) and Shiseido Company, Limited (OTCQX:SSDOY). These companies own multiple brands which cater to customers at different price points. In addition to these larger multinational companies, e.l.f. also competes with small independent companies which continue to enter the market.

Financial highlights and risks

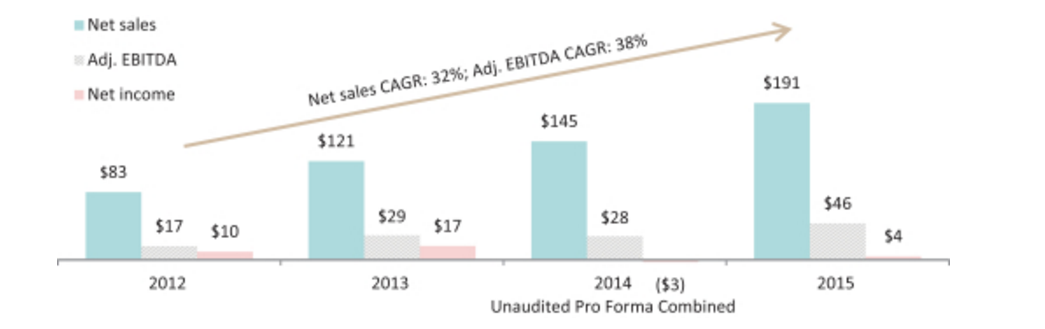

e.l.f. Beauty's focus on offering luxurious cosmetic products at low prices has made it one of the fastest growing cosmetics companies in the U.S. In 2014, the company reported net sales of $144.9 million. In 2015, net sales were $191.4 million, a year-over-year increase of 32 percent. The company's Adjusted EBITDA increased from $28.1 million in 2014 to $46.2 million in 2015, representing a 64 percent increase. Despite all this fast growth, the company reports that its net sales represent only 2.3 percent of the burgeoning $8 billion U.S. cosmetics industry. The company reported a net loss of $2.9 million in 2014, which grew to a net profit of $4.4 million in 2015. In 2015, e.l.f. reported Adjusted EBITDA margin of 24 percent and net income margin of 2 percent. The company's primary sources of revenue are its retail cosmetics, with Target (TGT) and Wal-Mart (NYSE:WMT) accounting for 28 percent and 23 percent, respectively, of net sales in 2015.

(Click on image to enlarge)

(E.l.f. Beauty Inc., S-1 Form, SEC Filing)

The company envisions bringing high-end inspired cosmetics to discerning customers who have lower disposable incomes. It looks to draw new customers through innovation, to encourage customers to buy more products by driving loyalty, to leverage the supply chain in order to offer more products and to expand its line into skin care products in addition to cosmetics. The company notes it has presence in 19,000 retail stores in the U.S., a fraction of the number it believes it can enter. The company looks to expand into such stores as Walmart in order to reach an even larger segment of the population.

e.l.f. indicates that the sheer competitiveness of the cosmetics industry might mean that it will not do as well as it anticipates. It also points to the fact that it sells its products through a select few retailers, and if it loses one, its sales could suffer major setbacks.

Conclusion: Consider a Buy As The IPO Market Heats Up

IPOs have had strong showings, and ELF has a solid earnings history and record for growth. In the second quarter of 2016, 34 IPOs raised $5.5 billion. First day returns for IPOs averaged 9.4% and the average IPO continued to trade up in the aftermarket. In addition, 71% of deals ended June 2013 above offer price.

e.l.f. has shown a committed focus on bringing high-quality cosmetics to customers at low price points and has shown effectiveness in doing so. We believe that investors should consider purchasing shares of ELF in its IPO.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ELF over the next 72 hours.

I ...

more