How Will March Retail Sales Affect The Retail Sector Stocks?

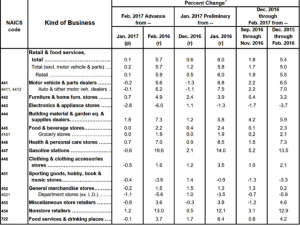

This week is going to be a very critical week for the retail sector. With many retail stocks expressing low valuations due to poor fundamental metric performances, that valuation may worsen or improve with monthly retail sales data coming out on Friday. The Census Bureau will report March retail sales on Friday before the opening of the trading day on Wall Street. After a deceleration in February retail sales, growing only .1% MoM and 5.7% YOY, many retail names came under increasing pressure and found new 52 week lows.

Many of the retail names in question are centered in the department store segment of the retail business segment. Non-store retailers have significantly outperformed traditional brick & mortar department store retailers for several years now, taking market share and sales dollars. Some of the retail brands that have continued to underperform since the February retail sales results were released include, Bed Bath & Beyond (BBBY), J.C. Penney (JCP) Target (TGT), Macy’s (M) Kohl’s (KSS) and even Wal-Mart (WMT) until a positive upgrade came out on the retailer last week. There have actually been some conflicting analyst reports lately on Wal-Mart with BMO Capital warning investors that the retailers Q1 sales comp may not be achieved based on pricing data gathered. However, Telsey upgraded Wal-Mart from Market Perform to Outperform with a price target of $82.00 (from $73.00). Analyst Joseph Feldman says WMT looks to be regaining dominance in the physical retail game and sees the company exerting new strength in the digital market citing stronger sales. He expects Sams's Club to regain strength under new leadership.

Last week Bed Bath & Beyond reported YOY declines for most every metric of relevance for the Q4 2016 period while issuing FY17 guidance that express negative EPS growth and further gross margin contractions. Having said that, shares of BBBY took the poor performance and guidance in stride, actually rising on a rather subdued earnings report. Having said that, it remains to be seen if this surge in stock performance can stand the test of time. Even with shares of BBBY surging last week, the share price is still below $40 and did not retest that level after achieving it on the reaction to its Q4 2016 earnings report. Shares are trading at less than a 10 PE, which is a post financial crisis low trading multiple for shares, but in-line with gross margins trading below financial crisis territory. While many might look at BBBY’s valuation and view it as cheap, given the steady decline in earnings and gross margin performance, cheap could become cheaper in the future and unless the fundamental performance of the company improves.

Coming back to the week that lay ahead, it remains to be seen how these retail names perform for investors and traders. While many investors and traders may be of the opinion that a bounce for the sector is long over due, the opposing view suggests that the sector has been steadily revalued to reflect the fundamentals that have plagued brick and mortar retailers and especially department store names in the retail sector. Moreover, within these retailers’ reported Q4 2016 results was guidance for 2017 that offered worsening earnings per share performance. From that perspective one could easily argue that the revaluation for these retailers is not only fair, but forward looking and as such “cheap “would be found as an error in characterizing the value of these stocks presently.

I outlined my thoughts with regards to some of the retail names mentioned in a recent interview with David Moadel.

Target is one of the retailers highlighted in this interview as shares of TGT have recently found a new 52-week low. Target is coming under increasing pressure for several fundamental reasons. The company has issued FY17 EPS that reverts all the way back to 2013 levels. Comp store sales may also prove to decline once again for the retailer as the company is dedicated to taking a $1bn in pricing/gross margin out of its sales in order to compete in a rapidly transitioning retail landscape. That landscape is proving to transition brick & mortar retail sales dollars to on-line sales.

Regardless of the many initiatives Target has implemented in recent years and the billions of dollars spent to offset this trend toward on-line sales, Target has steadily lost market share. Unlike Wal-Mart, who recently accepted the inevitable fate for retail sales proliferation with the purchase of Jet.com, Target has yet to act in kind. Instead, the retailer has curbed its retail exposure or pain points to no avail. Target has exited Canadian retail operations as of 2015, sold its credit card business segment and more recently sold its pharmacy business segment. None of these actions have improved the retailer’s performance however and to the benefit of shareholders. In 2015 the retailer embarked upon a cost savings initiative of $2bn that it would ultimately reinvest. It was in 2015 that I wrote the article titled Target Executives Outline The Retailer's Path To Future Growth.

Target will simplify the way they work, eliminate complexity, control cost and free up the resources to fuel the investments in the four growth opportunities described. Target has identified opportunities to reduce both expenses and cost of goods sold going forward. By applying these principles over the next two years, Target expects to save an incremental $2 billion, which they plan to reinvest in growth and profitability for Target and for shareholders.

Unfortunately for all that Target offered to investors and analysts alike, growth was fleeting and now proves all of the efforts put in place were for not. In other words, Target’s efforts were not incremental enough and therefore not lasting. Target may need to act in the manner that Wal-Mart has and with a major acquisition. This doesn’t necessarily mean the retailer needs to acquire a like on-line retailer, but it does mean that Target needs to more broadly address where the consumer dollar is moving.

If we take Target ‘s EPS guidance from the high-end of the range ($4.20), TGT shares are presently trading at roughly 13 X FY17 guidance. That’s not necessarily cheap when we review the historic 14.5 PE of the company, albeit cheaper than the historic valuation. TGT shares are trading at these levels for very logical and fundamental reasons; there is no growth and the likelihood of near-term growth is more improbable than probable. Even with a 4% dividend yield, shares of TGT have grossly underperformed the benchmark S&P500 for many, many years and making shares of TGT a dividend aristocrat underperformer. Investors would be wise to look beyond the dividend yield when considering shares of TGT for their portfolio.

In summation, this week will prove all-too-important for these retail names with March retail sales being released on Friday. Department store retail sales fell 1.1% MoM and 5.6% YOY in February while non-store (on-line/e-commerce) sales rose 1.2% MoM and 13% YOY in February.

Given the late tax return disbursements that occurred in March, the reporting of retail sales might be somewhat skewed. As such, the results may prove fleeting and be explained away so to speak. Unfortunately, given brick & mortar sales underperforming trends any bad news may not be as easily explained away.

Disclosure: