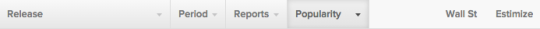

Five Stocks To Watch This Week - PLAY, KKD, COST, SWHC, ADBE

Tuesday, December 8

Thursday, December 10

Krispy Kreme Doughnuts (KKD)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports December 8, after the close.

The Estimize consensus calls for EPS of $0.21, 4 cents above the Wall Street estimate. Even revenue estimates of $132.89 are higher than the Street’s expectation for $132.77.

What to watch: In five of the past seven quarters, Krispy Kreme has missed earnings expectations. Despite showing total revenue growth of 5.6% last quarter, the revenues still missed analyst projections by more than $4M. As health concerns are taking over the US, sugary indulgences like donuts have an uncertain future as demand continues to wane. Despite this uncertainty, the company continues to expand as new stores are popping up and same store sales increased annually by 5.5%. If the company is experiencing revenue and sales growth, what is the problem? Part of Krispy Kreme’s earnings dilemma is its business model. Unlike major competitor Dunkin Brands, Krispy Kreme does not operate a full franchise model. Rather, a majority of stores are company owned. Furthermore, operating margins are weak, hovering around 10%. Krispy Kreme shares are down roughly 30% year to date.

Smith & Wesson (SWHC)

Consumer Discretionary - Leisure Equipment & Products | Reports December 8, after the close.

The Estimize consensus calls for EPS of $0.23, three cents above the Wall Street consensus. Revenues of $139.68M are slightly above the Street’s expectation for $137.90M.

What to watch: For a good part of 2012 and 2013, fears in the US that tighter firearm laws were on the horizon helped drive sales for Smith & Wesson. As those fears began to dissipate in 2014, sales of guns and ammunition suffered. This year, however, Smith & Wesson has returned to year-over-year earnings and revenue growth, putting up double-digit EPS growth of 23% and sales growth of 12% in their latest quarter. During that period the company saw higher sales in both the firearm and accessories divisions, with firearms driven by robust orders for “M&P 15 Sport rifles, Thompson/Center Venture bolt-action rifles and M&P Shield polymer pistols.“ That growth should have carried over into the reporting quarter, as Q3 2015 Federal background checks were up 4% year-over-year, with the FBI processing a record of 1.98M applications in October alone. Even so, competitors such as Sturm, Ruger & Co. reported a 13 cent miss on EPS when they reported two weeks ago, yet beat on sales.

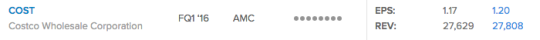

Costco Wholesale Corporation (COST)

Consumer Staples - Food & Staples Retailing | Reports December 8, after the close.

The Estimize consensus calls for EPS of $1.20, three cents above the Wall Street consensus. Revenues are a little more muted, with Estimize looking for $27.81B – only $179M, or less than 1%, above the Street’s expectation.

What to watch: Costco will have some momentum heading into its report next week. Just yesterday the bulk grocery chain posted better than expected same store sales for the month of November. Comparable store sales for the last month of the fiscal Q1 2016 only came in flat, but that was better than the -1% analysts were anticipating. The retailer has been hurt by lower gasoline sales due to price deflation, as well as the negative impact of foreign currency translation. Excluding both of those factors same store sales ended up at 6% versus the year-ago period. Costco has been able to maintain a steady traffic pattern due to its loyal membership base, although there have been concerns around deep discounts and promotions as they engage in a pricing war with competitors such as Wal-Mart (WMT) and Target (TGT). American Express (AXP) was recently dropped as the exclusive credit card accepted at Costco due to the high transaction fees, the company instead striking a deal with Visa (V) and Citigroup (C). This new deal will cut credit card fees close to zero and the savings will not be minuscule by any means. Investors should expect updates on the massive E. Coli scare that has affected Costco, many of it’s competitors, as well restaurants such as Starbucks and Chipotle, and has lead to the recall of over 155k items.

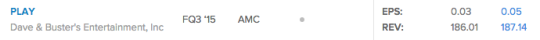

Dave & Buster’s Entertainment (PLAY)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports December 8, after the close.

The Estimize consensus calls for EPS of $0.05, two cents higher than the Wall Street consensus. The Estimize community is looking for sales of $187.1M, $1.1M above what the Street is expecting.

What to watch: Since IPOing roughly one year ago, Dave & Buster’s share price has surged 143%, from $16 to $38.87 as of December 3rd. The company has excelled in getting customers in the door through great menu offerings and game promotions. Last quarter, PLAY was able to increase total revenues by 20% and comps grew by 11%. To further execute its expansion plans, in late October, D&B announced a new international development project. According to the plans, the company has a franchise agreement with Dubai based Apparel Group. Apparel Group will have the rights to develop Dave & Busters locations within the UAE, Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia. Seven locations are scheduled to open within 7 years. Newer locations tend to struggle as opposed to established ones, but the idea of what D&B could do in the Middle East is promising for investors.

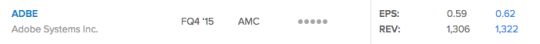

Adobe Systems (ADBE)

Information Technology - Software | Reports December 10, after the close.

The Estimize consensus calls for EPS of $0.62, three cents above the Wall Street consensus. Revenues of $1.322M are slightly above the Street’s expectation for $1.306M.

What to watch: For the last four quarters, Adobe has successfully beaten analysts’ estimates on the bottom line and reported year-over-year growth in the double digits. Revenues have lagged slightly, but still managed to put up growth in the 9% to 21% range for the past three quarters. In Q3 the company reported record revenue due to success in their Marketing Cloud and Creative Cloud segments. As a result, Adobe issued guidance that Marketing Cloud bookings would increase 30% in fiscal 2016, driving total revenues to $5.7B and EPS to $2.70. Just last week, the company’s stock hit a 52-week high after announcing the some exciting new product offerings in its cloud business. One area of focus is the Document Cloud business, with the recent introduction of new features as well as a partnership with Dropbox that will allow users of Adobe Acrobat to efficiently access files stored on Dropbox from Adobe apps.

(Photo Credit: Kazuhiro Shiozawa)

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.