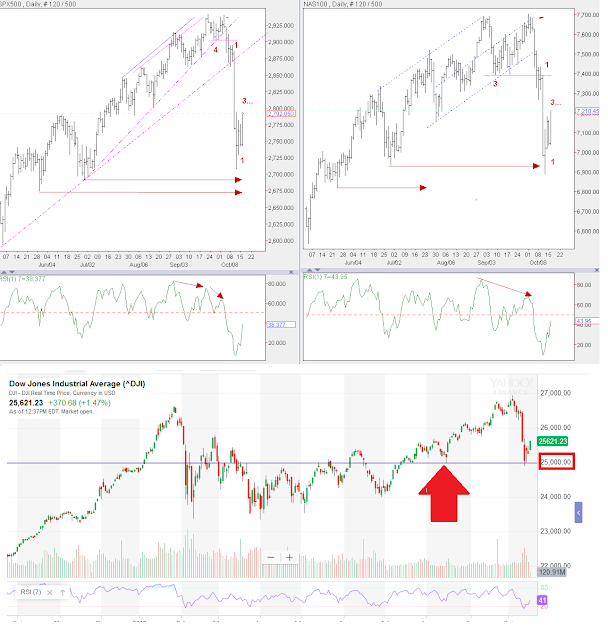

Dow 25K Supports For Now

The US equity indices exhausted recent selling pressure late last week and now seem poised to put in sizable retracements. The markets finally witnessed some panic selling, but managed to stabilize both last Thursday & Friday as the Dow Jones Industrial Average probed the key psychological 25,000 level, which supported price-action back in August.

Since then global markets have rallied smartly and if the US equity indices can maintain strength through Wednesday, it should signal further evidence that the worst may be behind us. That said, recent gains are still in corrective territory with respect to the latest decline, so the risk of a downside thrust towards recent lows still exists.

Watch price action carefully if the 50% retracement of recent weakness is tested towards the end of the week, as it could indicate some time symmetry and signal an end to the latest rally in equities. If the 26,000 region caps the rally in this case it could jeopardize the recovery and could quickly re-open the 25K region for the Dow once again.

Disclosure: None.

As stated last week. If the market rises up the beginning of this week the market should be fine in the near to intermediate term. I still hold this conviction and that a lot of the end selling was trading to try to take advantage of the auto sell prices people put in at the recommendation of bad brokers "to protect themselves". This just makes them fish to get played with in terrible ways.