Trump Tax Cuts And Yellen's New Normal

This discussion will get to trump's tax cuts and how they fit in with the present day financial situation. But first it is necessary to report on Janet Yellen. Yellen, on her way out as Fed Chairman, affirmed the New Normal in response to Neel Kashkari's fear of rising 10 year rates. She had this to say:

I think there are good reasons to think that the relationship between the slope of the yield curve and the business cycle may have changed.

Both agree that the yield curve is flattening, that long term rates are not going up anytime soon. Yet Yellen offered this additional insight, that it no longer mattered much what the slope of the yield curve looks like because it doesn't affect the business cycle anyway!

If you believe that the supply and demand of 10 year bonds has more to do with other factors, such as safety and use as collateral in the interest rate swaps markets and other financial markets, you could come to Yellen's conclusions.

And Kashkari is so desperate to see the 10 year yield go up, that he has voted against the three short term Fed increases. He thinks it is those increases that will put a damper on inflation.

So, who is right? I believe they are both right.

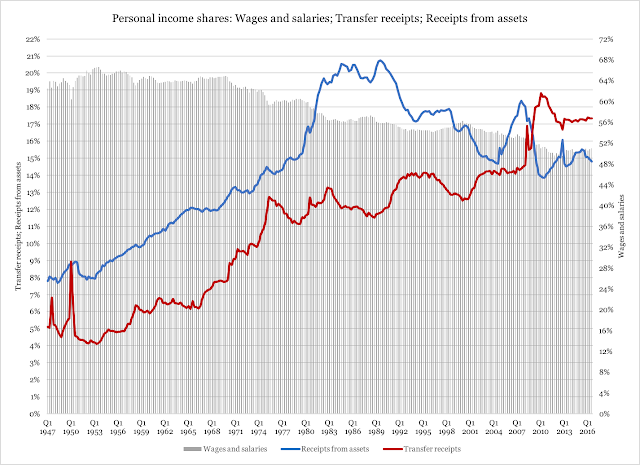

It appears that Janet Yellen is right, if we are to look at the tax base as it relates to income from workers. It has steadily declined, with some leveling off with Reaganomics, then the Dot Com Bubble and then the Reflation under Obama since 2009. But wage decline as a portion of the tax base appears to be relentless as the following chart shows. It is worth watching as time goes on:

|

Source: Economic Analysis Bureau Dept. of Commerce |

Transfer receipts in red are entitlements, which have actually stuffed the coffers of government. In 2008 mass layoffs increased unemployment insurance, causing a spike in taxes. Baby Boomers retiring have paid more out in taxes through social security than earnings.

House price appreciation spiked the blue line, asset taxation on soaring home prices for middle America, after the Dot Com crash.

So, we are not exactly in a wage boom. Kashkari may very well be right that this is what the Fed wants, to tamp down wages. This is exactly why Yellen's analysis is correct as well, since tamping down wages and wage inflation also helps to guide interest rates on longer bonds towards stability and even decline.

The Fed must do this to save the banking system.

Banks are stuffed up to their eyeballs with interest rate derivatives. They can't see these spike in yield or they are going to be in need of a bailout and incur the never ending wrath of the American people, who actually remember the Great Recession. They at least have to rope-a-dope until many years have passed and that group of people are too old to care or six feet under. And even then interest rate derivatives would have to go out of style.

You have to remember two things:

1. The Fed never forgets.

2. Banks never forget.

Trump Tax Cuts

It could be that Trump's tax cuts are an effort to bust open the New Normal by giving small and median sized businesses such massive tax breaks that they will no longer need to borrow so much from banks, and therefore will no longer need to be forced to take fixed interest rate swaps from banks eager to keep rates low.

Mish Shedlock has revealed massive growth in Zombie Firms, which are defined as firms that depend on cheap Fed money. Well, the only way out for these firms is massive tax cuts.

One hopes that these firms and others who are dependent on loans that force them to use interest rate swaps as collateral will finally become debt free or nearly debt free. If none of these companies borrowed from the banks, theoretically interest rate swaps would disappear off the balance sheets of the big banks who control that market.

There really is no other way to bust the New Normal and that was the goal of Wilbur Ross. It is purely an experiment. And it may be set in motion at the wrong time in the business cycle!

The middle classes and poor could find themselves in a weakened position if the money that should be making these companies debt free goes into speculation on houses and commodities. This experiment, while we hope for the best for small business, could be a major failure that produces a catastrophic result.

As long as interest rate swaps do not decline from the balance sheets of Citibank, Goldman Sachs, Bank of America, JP Morgan and Morgan Stanley, we will know the experiment is a failure. We can leave it to the economists to determine the time table for knowing that it has failed. I hope that it doesn't fail.

Although we have to know that cuts to beloved entitlements are a very unethical tax scam for the benefit of the top 1 percent. This help for small business could be funded in other ways, not with programs regular people pay for.

Trump and his minions should understand that the New Normal is Alan Greenspan's clever but possibly diabolical creation, and it is not one that can easily overcome. And what is the price Americans have to pay to try?

Disclaimer: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice. The ...

more

I just want to emphasis the point of the article that when Yellen said the yield curve inversion no longer mattered it signals two things. First, it signals that the Fed is determined to impact short rates, but second, it acknowledges that the conundrum may well be with us as longer bonds won't be greatly affected. Is that a realistic view? I think it is possible.