The Delusion Of A Four Percent Growth Rate

The incoming Trump administration touts its ability to deliver 4 per cent growth, a return to the halcyon days of the 1980s and 90s. Citing the removal of many restrictive regulations, the reduction in personal and corporate taxes and the introduction of other pro-growth policies, Mr. Trump anticipates that the runway is now clear for takeoff. The stock and bond markets have bought into this view. Almost daily the stock market hits new highs and bond yields steadily rise in anticipation of faster growth and accelerated inflation.

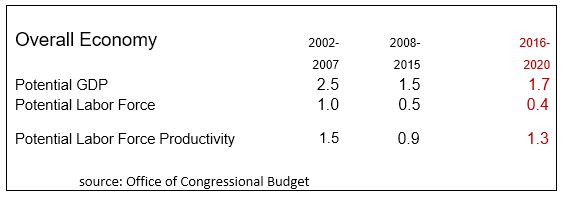

There are two factors that permit an economy to expand over rapidly time. One is a faster growing labour force that is also fully employed. Secondly, there has to be a more productive labour force that generates increases in output per worker.Together, the two add up to a potential growth rate[1]. In many ways, potential growth is axiomatic in the sense that it serves as a boundary that sets the upper limit that is physically possible to achieve. For the overall economy, potential GDP has slowed considerably in the 2008-15 period (1.5 %) compared to that experience in 2002-2007 (2.5%). The principal reason for the slowdown is the dramatic decline in the labour force and a weakening in labour productivity.

Projections for 2016-20, call for a continuation of potential GDP at less than 2 per cent, based on some improvement in productivity. However, the further slowdown in the expansion of the labour force continues. There is no getting around the math, especially when it comes to demography. Demographic changes take years to alter their course.

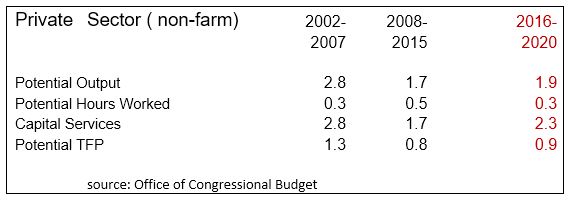

Turning to the private sector, the same trends exist. Potential growth has moderated considerably as total factor productivity (TFP) slumps.TFP is a measure of the efficiency of combining workers and capital equipment. TFP measures how intensely these inputs are employed. TFP is often seen as the real driver within an economy.

A lot has been written about the role of new technologies in generating economic growth.However, the value of all these technologies remains open to debate. So far there is no evidence in the productivity numbers. Leaving aside this debate, it is clear that business investment has slowed considerably, resulting in lower productivity in the private sector. The forecast for 2016-2020 anticipates some improvement in capital utilization, but overall potential output remains below 2 per cent.

So, the question remains: how can growth double? Moreover, given that the U.S. unemployment is 4.6 per cent—many consider that this represents full employment—the ability to double the growth rate is pure political rhetoric, not sound economics.

[1] The equation is : Labour Force growth + productivity growth = Potential growth

I think a lot of people who have dropped out of the workforce are rural folks. So, getting them back into the workforce could be very difficult.