Gold Daily And Silver Weekly Charts - All Manipulations Fail, And Sometimes With A Bang

"The basic tool for the manipulation of reality is the manipulation of words. If you can control the meaning of words, you can control the people who must use the words."

Philip K. Dick

"All through history the ways of truth and love have always won. There have been tyrants, and murderers, and for a time they can seem invincible, but in the end they always fall. Think of it--always."

Mohandas K. Gandhi

I am not as sure about the short term winning odds for truth and love, things being what their are these days. If goodness paid off like a cash machine, everyone would be virtuous, as some theories like to assume.

But in thinking about the more mundane, day to day world, common economic reality has a way of asserting itself against abusive and foolish human power, and sometimes with a vengeance.

Gold broke out of its downtrend today with a higher high. There was intraday commentary, with a strong cautionary note on this, here.

There were more explanations for what happened this week with regard to the foreign exchange markets. Zerohedge featured a menu of reasons for this.

I sorted them out to the 'what' and the 'when.' And most of them were about 'when.' What caused the Swiss franc to Euro peg to fail at this particular time. And most of them were good guesses.

But that is not what is really the most important thing, the real reason.

The Swiss National Bank had to stop their protracted rigging of the currency markets because it was no longer practically sustainable. That is what happened.

Well, it *could* have gone on longer if the ECB were cooperating more aggressively, and willing to sacrifice its own people to the needs of the Swiss. After all, this is what the US has been demanding of its client states like Japan for quite some time.

But with its own QE looming, and a desire to create monetary inflation by buying bad debts at non-market prices, the ECB seems bent on sustaining the unsustainable, the existing European Union as it is currently constituted, by printing money. In this sense they are following the US, which is pursuing a similar strategy with regards to the preeminence of the US dollar as a global reserve currency par excellence.

I forget now who said it, but all that is unsustainable will not be sustained.

Yes it is a tautology, but a good reminder nonetheless that the overestimation of the power of central banks is yet another illusion of the modern era.

A central bank that is willing to expand its Balance Sheet and buy sovereign debt at non-market prices, even if it passes through an illusion of marketplace discipline with the cooperation of crony banks, is operating a money machine. And history informs us that this is unsustainable.

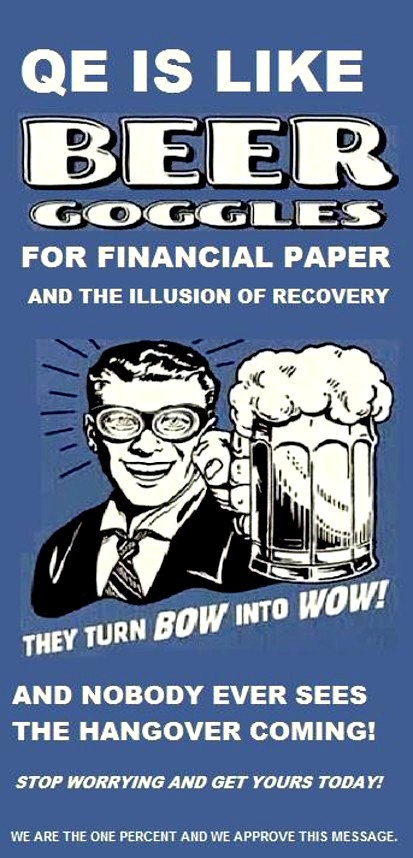

This is not stimulus. QE is not good for the overall real economy. It is a subsidy for the financial sector. It is, at best, a very inefficient form of 'trickle down' stimulus. For the most part it fosters corruption, malinvestments, and inequality.

This is wealth transferal through the use of money and the financial system. It is a policy error of the first order, the self-serving abuse of power by the well positioned and the well to do. Yes, well-meaning people may go along with this sort of folly, in the vain hope that the people who create the money will distribute it to the poor. But it never works out that way.

The Swiss franc was under pressure because economic reality was inducing the currency to become stronger relative to the euro. And the Swiss National Bank resolved in September 2011 to fight this with a currency peg, for the benefit of their export industry.

The US has been leading a cartel of banks, not unlike the old London gold pool, to manipulate gold as a currency, seeking to artificially peg it lower to the Dollar. That is what has been happening for some time now.

China and a few other countries are taking up that wager, and draining the global inventory of gold at artificially low prices. This is not all that unlike the play that Soros and the Swiss Bankers made against the Bank of England to hold the British Pound at an artificial valuation. And they sold the quid, over and over, until it was no longer unsustainable.

We see the collateral damage that the failure of the Swiss peg has caused to some traders and their firms, and I suspect that it is a bit more widespread than has been disclosed.

When the gold to the dollar rig fails, and it will, the resulting dislocation in the financial markets could be even more impressive.

Unless the central planners can establish and maintain a single, autocratic world government it will fail. It will. That is beyond doubt.

Have a pleasant three day weekend.

None.

LOL those that say the Swiss are killing their market are gravely mistaken. They are insulating themselves from the markets engaged in socialistic QE behavior that will eventually destroy their economies. Theoretically there is a way out of QE, but so far there has been no successful example of mass QE with Japan proving that not just the end result is terrible, but the path leading up to it is equally horrific.