Gold And Safe Haven Confusion

Ever since the 2008 credit crisis sent droves of investors diving into safe havens, there has been much disagreement on just what is a safe haven. Real estate has always been a nice alternative to the other markets, but lately it's been the genesis of all our other problems. Bonds have likewise been the alternative to a shaky stock market, but now bonds are a dirty word, being the embodiment of the dirtiest word of all - debt. Then there is gold. But the '08 credit scare smacked it around alongside everything else, except the US dollar.

So is the USD, the traditional safe haven, the one to turn to now? It is the world's dominate reserve currency. And even though "currency" is something of a dirty word now, isn't the USA and its currency the prettiest pig in the pen? There are detractors of the USD who point to things like the Swiss franc because Switzerland has little of the debt issues of the US, Europe, or about any other major currency printer. Currency in general is an attractive safe haven because of its relative stability. If it goes the wrong way, you won't get hurt too badly.

Just perusing some actual headlines over the last couple years or so, I get dizzy following the fingers pointing me to a safe haven:

"Is Gold Now The Last Safe Haven Standing?"

"Gold Squashed By US Dollar Safe Haven Buying"

"Swiss Franc Is Now A Cheaper Safe Haven"

"Neither Gold Nor The Swiss Franc Retains A Safe Haven Status"

"The Dollar Has Become The Currency Of Last Resort"

"US Dollar Losing Safe Haven Status"

"Gold Not a Safe Haven - Don't be Fooled"

It makes my head spin.

OK, let's think about this logically. Or would that be our first mistake? Whether it's logical or not, gold has to be considered a currency. While most of gold's demand is jewelry, the thing that moves the price needle in times of investor upheaval is investor demand. Despite Ben Bernanke's congressional denial, gold is money, which is why banks and governments hold it in reserve instead of, say, aluminum. The US dollar index is a measure of the US currency strength relative to a weighted basket of 6 competing major currencies.To be fair, gold should really be included among the dollar's competitors. Instead, the euro is given a whopping 58% weight in the basket.Can you imagine what the dollar chart would look like if you substituted gold for the euro at a 58% weight? It would be one ugly chart indeed over the last 10 years.

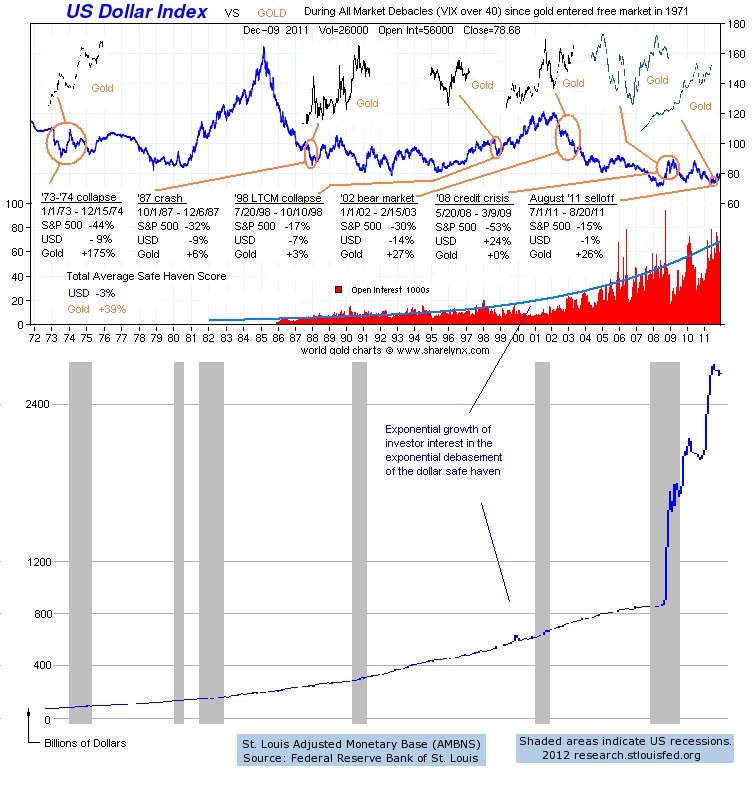

If you grant the US dollar the position of safest paper currency in the world over the last 40 years, and I think even the current detractors of the greenback would do that, then what would happen if you compared it one-on-one with gold as an event safe haven? If you were to construct a chart of all the modern stock market scares, defined as those events which ran the market's fear gauge, the VIX, to values over 40, and looked at the US dollar index performance relative to gold over the time frames of the debacles, what would be the safe haven score between the two? This would be strictly a currency comparison - the best of the paper issues versus the metal one. But since currency is usually the most stable of all the other safe havens, even real estate, art collections, or what have you, this would be a track record of the best of the best of the safe havens. Here is what such an ultimate safe haven chart would look like: (click on image to enlarge)

There was no VIX back in 1973; it was invented in the '80s. But if there had been, it almost certainly would have run to well over 40. So I have awarded it an honorary position on my chart of debacles. The '73 bear has only been equaled by the '08 horror.

So this is a Dodge City salon brawl between all the safe haven contenders, and it makes me wonder where the dollar's title of "chief safe haven" comes from. Granted that its -3% average over the 6 stock market dives isn't bad, but wouldn't gold's +39% have to be considered better? You could say that gold is undependable because it goes through bull and bear markets.But 2 of the 6 cases above were during bear markets in gold, and gold still outperformed the dollar.

Investors fairly new to the market may only remember the '08 crisis and how gold was shaded by a nice climb in the dollar.But over the course of this huge decline in stocks, gold actually winds up even - about what the dollar's long-term average is. So gold's worst showing roughly equals the dollar's average.

This anomaly of 2008 may not be easily repeated. This scare event was about a liquidity lock-up and a systemic failure. So gold, being less liquid than dollars to buy a hamburger with, was dissed in favor of dollars. We have a repeat of this banking crisis in Europe now, but this time it is a very slow motion train wreck in lieu of the very fast motion surprise version of '08. Now the banks are collateralizing and capitalizing as we kick the cans down the road to buy time and embark on a print-money-as-needed policy to slow down the train wreck to a case of stagnant economies and who knows what, but maybe not a repeat of the '08 horror. This may return gold to its more typical safe haven behavior as it did in the August 2011 case.

This chart also shows another major consideration. It pits a safe haven that has been outperforming paper currency over 40 years of sound money against a safe haven now frenetically being debased with the printing press. If gold has been the better haven in the past, when we had sound currencies, it certainly should be in the future, when we probably won't. Yet we see an exponential rise in dollar safe haven trading matched only by the exponential rise in the supply of dollars. Compare that with the flat gold production numbers we have in the world today.And the FOREX market cap dwarfs the stock market and even the bond market, with the entire gold industry market cap less than that of Walmart!

Investors diving into the dollar for safety from today's problems is like Dorothy climbing a windmill to escape the approaching tornado. If there is ever a radical reallocation of the flight to safety trade, market cap-wise, it will be like pouring a bucket into a thimble - potentially explosive for gold.

This radical reallocation is foreseen by many analysts, like Simon Black of Sovereign Man:

Dubai, Greece, Latvia, Ireland, Spain, UK, etc. all give investors a lot of reason to worry. Ironically, when things get really bad in the rest of the world, investors rush into the US dollar as the ultimate flight to safety.I know I don’t have to tell you that this line of reasoning is utter nonsense. Institutional money managers realize it too– the prospect of loaning money to the largest debtor in the history of the world for 30-years at less than 5% is certifiable lunacy.

With a stable currency like we've had for 40 years, the above graphic shows gold to be the superior safe haven. If we get the kind of currency meltdown many predict, we could see a radical improvement in gold's already best-of-the-best safe haven status. As Simon Black goes on to say:

In a flight to safety, institutional money still flows into the dollar. Gold will not truly break out until there is a bifurcation in investors’ mentality regarding safety. To put it more clearly, when worried investors start piling into gold instead of the US dollar to protect their assets, this is the sign that we are charging towards the top. For now, it’s not happening yet

But what if it's starting to happen now ?

Disclosure: I am long gold in general with some gold ...

more

My chart above doesn't click and enlarge very well for easy viewing here, but you can go to the copy of it at my blog "Good Stock Investing". Just google "Gold and Safe Haven Confusion" and click on the blog copy - the chart there enlarges very nicely. It shows the average gold performance of +39% vs the USD average of -3% over all the major stock market tumbles since 1971 - what actually works best as a safe haven.

OK, the google brings up the Seeking Alpha copy - the chart enlarges nicely there, too. It was bringing up the blog article earlier when I was doing some checking.

Yes,since Seeking Alpha doesn't link back to your original post, Google assumes they are the original source, and you copied it from them - as a penalty they push you down in the search results. Not a nice thing that they do at all. I see TalkMarkets does link back to your original post so I can see the chart easily by clicking there. Thanks.

The chart loads nice and large for me. Maybe it was a temporary glitch.

Also, I guess I should disclose that I am long gold in general with some gold miners and a royalty company.

Paper gold seems to have taken the shine off of gold, however, it seems like bankers are not willing to short gold that much more than they have already. If that is the case, then it should be good for precious metals. If rates rise significantly, due to rising inflation gold should do well. If rates don't rise because the Fed won't raise rates gold will do well as the dollar sinks. Even China is easing up on dollar bets although its being played out as a problem with China. China's problems will become our problems eventually. If China can't fund our bonds then our bonds must compete with other investments in the US creating contraction in liquidity first with junk bonds and then the whole market.

I agree that rates are a nonfactor with gold. So many people think rising rates means better dollar and lower gold. But that's just not the way it works in history. I have a chart I made showing interest rates vs gold through the '70s and it shows that rates and gold rose almost in lock step through those years.

Thanks for the comment. I have seen similar charts and agree with you that gold has risen for long periods in lockstep with the US dollar. I think many people's economic sensibilities are disoriented by the Federal Reserves absurd zirp, QE games that have turned the US economy into a zombie with TBTF banks dependent on the drug called artificial liquidity.