Fed Governor Cements Looming Economic Destruction

Federal Reserve Governor Lael Brainard is on the loose. Of course, when the Fed is on the loose, the it signals a tightening of liquidity, ultimately leading to economic destruction. Tim Duy has exposed it in a fairly involved article. I will try to isolate the main points of this exposure and illustrate the effects with some charts:

1. Rate hikes are not stopping anytime soon.

2. The Fed won't pause at neutral. Brainard defines neutral:

Intuitively, I think of the nominal neutral interest rate as the level of the federal funds rate that keeps output growing around its potential rate in an environment of full employment and stable inflation.

3. There are two neutrals. Short term neutral and long term neutral, as she is quoted by Duy:

Focusing first on the “shorter-run” neutral rate, this does not stay fixed, but rather fluctuates along with important changes in economic conditions…In many circumstances, monetary policy can help keep the economy on its sustainable path at full employment by adjusting the policy rate to reflect movements in the shorter-run neutral rate. In this context, the appropriate reference for assessing the stance of monetary policy is the gap between the policy rate and the nominal shorter-run neutral rate.

Turning to the shorter-run neutral rate, although the estimates are model dependent and uncertain, we can make some general inferences about its recent evolution that are largely independent of the details of specific models. Estimates suggest the shorter-run neutral rate tends to be cyclical, falling in recessions and rising during expansions, and our current expansion appears to be no exception. [Emphasis Mine]

The Duy Chart clearly shows employment for 24 to 54 age group is rising. That must mean that the neutral rate must be rising at this time (according to Brainard). It could be a data point the Fed is tracking. Here is the labor chart:

Brainard is a hawk. Hawks fear even a little inflation. Doesn't matter if it is overblown. Hawks are in charge of the Fed.

Duy goes on to pick apart the speech. Brainard says in the next few years, the short term neutral rate will rise higher than the long term neutral rate. Therefore he says, the Fed will choose recession over inflation. The Fed won't care about the yield curve inversion at all.

The problem is, that the Fed has allowed much higher rates of growth in the past. Growth will continue to be slow, and of course, it is all about the protecting the collateral, IMO.

Of course, Brainard is factoring in tax cut and spend stimulus, which is pushing increased demand. But, Jeffrey P. Snider believes that whatever growth we have is simply not comparable to historical growth. Snider proves that there is not a shortage of workers. He proves that growth is subdued compared to historical growth. So for him, what is the fuss? But for Brainard, there is a big fuss and the Fed has the foot on the brakes even though the car is only going 40 miles per hour on the freeway.

Here we are in 2018, and soup kitchens all over the nation are seeing heightened demand. Housing affordability is declining at record pace. There is still severe weakness in the US economy. In fact, the financial economy, that Trump once criticized in a campaign, is doing better while much of the real, physical economy he promised to help is not. Wages and cost of living are the issue for over half the population.

Corporate debt is also an issue in the USA. Jesse Felder has said:

Interest rates have been rising for nearly two years now and the Fed seems to have turned its attention from cultivating a wealth effect in the economy by supporting asset prices via quantitative easing to reining in inflation by unwinding those policies and raising the Fed Funds rate. In the process, by way of the Minsky Hypothesis, they may end up undoing everything they strived so hard to achieve over the better part of the past decade.

For Felder, zombie companies crowd the stock market and will create a Minsky Moment. They are not the leaders. They are subject to speculation and could weaken under the interest rate onslaught. Just another concern regarding a Fed on the loose.

And that doesn't even take into account the massive emerging market bubble that is vulnerable to Fed interest rate increases. It wasn't a bubble but it becomes a bubble when dollars cost too much and are therefore scarce as a means to pay dollar denominated debt.

Tim Duy is exasperated. He clearly believes that this Fed mumbo-jumbo is wrong headed. He does not like Brainard saying that for the next year or two, the Fed will be raising rates. Duy is the one who once warned us that 2 percent is a ceiling, not a floor. And these hawkish Fed speakers prove it time and time again.

I am wondering why the Fed does not factor in the historically low participation rate hovering around 62 percent compared to the historical norm of 66 percent in attempting to determine what the neutral rate is. What if the short term neutral rate is not properly observed or calculated?

We could be facing deflation instead of inflation and the Fed may not spot it. What if tariffs impact the neutral rate and the Fed is not watching? Trump may blink on tariffs, and seek to undo some of the damage he has done before his approval rate drops below 30 percent and Republicans are swept from power. So, there may be no need for the Fed to factor in tariffs. Still, even without tariffs slowing prosperity, the economy is not hot by historical norms.

As for Trump blinking, truth is, that is likely to be a trap, and Trump will want to be seen as being strong before the midterms. That could be a politically fatal error, but it could also mean a real full blown tariff war after the midterms. After all, the Trump ego is now being challenged by the Chinese. Investors in stocks should continue to watch this dog and pony show very carefully.

We see that the neutral rate cannot be observed or calculated. Shouldn't the Fed pay attention to what is going on in the real economy? The central bank is too quick on the trigger, in the view of many.

The problem, of course, is that without raising rates, prices of houses go berserk in many markets. While that is happening, wages stagnate. This effect squeezes many people. Both these issues must be fixed but need opposite solutions, unless the Fed were to carefully slow house price appreciation, while issuing helicopter money to the masses. Now that would be a real Goldilocks scenario for the people who toil and produce stuff.

The highly "moral" Fed would likely think that bailouts would create moral hazard among the lowly masses if it dispersed helicopter money. Of course, the Fed promotes moral hazard among the wealthy and big banks by bailing them out and getting the Swiss central bank to buy stocks and Blackstone and others to pump American real estate, etc. But they must be superior to the rest of us.

The Fed, it seems, would rather bury its head and just worry about an economic concept that is defined but not observable or capable of calculation. Seems like the Fed is more interested in liquidating everything than finding real solutions to the issues of the day. Hiding behind a nebulous neutral rate is one way for the Fed to wreck real havoc.

And don't think this stupidity by central banks is a one-off. The misplaced fear of inflation was central to causing the Great Recession. Inflation was stable, but the NGDP, Gross Domestic Product, was crumbling. Fear of inflation stopped the Fed dead in its tracks from quickly lowering interest rates. It contributed massively to the Great Recession.

Fear of inflation has been a Fed disaster in the past and will likely be so again in the near future. The circumstances are different now but the hawks' irrational fear of a little inflation is alive and well, and the Fed is on the loose towards wage destruction once again.

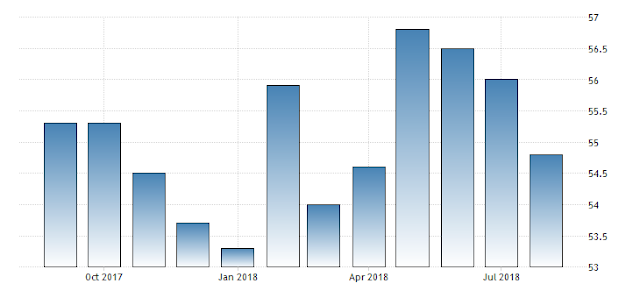

We can see growth but the rate of growth slowing in two indicators. Manufacturing PMI growth peaked in April and downhill since then. Over 50 indicates growth, but growth is slowing:

Services PMI rate of growth peaked in May:

https://tradingeconomics.com/united-states/services-pmi

There are other indicators. These alone may not tell us when the Fed will succeed in sowing the seeds of destruction, but they are certainly worth watching going forward. We all hope for a soft landing, but the Fed is built like an albatross. It soars magnificently, but was never taught to land properly. It simply isn't built into its DNA.

The Trump stimulus is not really doing much in manufacturing. It is just pumping the asset bubbles a little higher, so the pop will be loud when it does happen.

For further reading:

What Is Neutral Monetary Policy

Disclosure: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment ...

Inflation always seems to be PRICE inflation, never my wage inflating following it. Thus the inflation worshiped by many always hurts ME! Prices rise because easy credit allows those who can't afford things to buy them anyway. THAT was the cause of that crash in 2008, remember? Free credit to those who were unable to make it work bid up the prices of a whole lot of things, including houses, and that bid up the price of nearly everything. But many incomes did not follow. AND, of course, that free credit for the unqualified was allowed by that same fed, wasn't it?? So perhaps a better choice than fiddling with interest rates would be a lot more regulation of much of the financial sector.

Yes, wages have been flat while prices go up. You would think the Fed would get it.But they like asset inflation while there is no wage growth!

Duy labor chart is here: www.talkmarkets.com/.../fed-signals-will-break-the-economy-wait-til-trump-finds-out