According to sources the government of Ontario is investigating whether Teva (TEVA) made "illegal" payments to stock its opioid medications:

The Ontario government is investigating allegations that a drug company offered pharmacies “illegal” payments to stock its opioid medications fentanyl and oxycodone.

Reacting to the findings of a Star investigation, Health Minister Eric Hoskins said he has ordered a probe into drug giant Teva.

The Star has obtained emails showing a Teva corporate accounts manager offering to pay an Ontario-based pharmacy group a rate of 15 per cent of the drug price if it stocked the company’s prescription opioids.

Opioids continue to dominate the news cycle. U.S. lawmakers are marshaling all resources to tamp down their usage. Will Teva get caught in lawmakers' dragnet?"

The Situation

Payments from a drug company to induce a pharmacy to stock that company's drugs are known as rebates in the drug industry. They can also take the form of financial payments or other inducements. Over a decade ago Canada's prices for generic drugs were considered some of the highest in the world. In 2006 the country passed Bill 102, the Transparent Drug System for Patients Act, to expose and correct some of the drug industry's hidden practices that might have contributed to high prices:

For complicated reasons, Canadian prices for generic drugs — copies of brand-name drugs which have lost patent protection — are among the highest in the world. (See Patented Medicine Prices Review Board, Non-Patented Prescription Drug Prices Reporting, 2006.) ...

The province banned rebates that generic manufacturers were paying to pharmacies to induce them to stock their company’s version of a generic drug —rebates estimated to average 40% off the invoice price. In essence, pharmacies obtained the drugs at low wholesale prices but invoiced the government at the often significantly higher prices listed in the provincial drug formulary.

At the same time, Ontario slashed the amount it will pay pharmacies for the generic forms of drugs from an average of 63% of the list price for the brand-name version to 50%.

The rebates and other practices used to inflate prices is reminiscent of Valeant's (VRX) relationship with Philidor, its specialty pharma. Philidor was accused of engaging in aggressive sales practices to entice insurers to continue to pay high prices for drugs that had come off patent. The myriad of ways drug makers keep prices high has since come under scrutiny in the U.S.

Will Teva Police Itself Or Will Ontario Have To Act?

This is not the first time Teva has been the subject of such scrutiny in Canada. In Q4 2016 Teva was the subject of a probe where it was suspected of paying rebates to Costco employees for stocking its drugs. Secondly, the drugs in question of its most recent accusation involves opioids. In the U.S. the spike in opioid-related overdoses is considered a national crisis.

Some believe the proliferation of opioid prescriptions and drug makers' aggressive marketing have contributed to the crisis. Earlier this year two California counties accused Teva of misleading marketing practices pursuant to its sale of opioids; it paid $1.6 million for substance abuse training to settle the lawsuit. The question remains, "Will Teva police itself or will Ontario (or other jurisdictions) have to devise their own punishment?".

Valeant chose the former. It cut ties with Philidor and changed its business strategy of growth via acquisition. It also vowed to repair its image as a price gouger. It has been painful too. Valeant's revenue and EBITDA has been in free fall due to a loss of exclusivity in certain products, and a loss of pricing power for in others. Teva might have taken a step in the right direction with the recent hiring of new CEO Kare Schultz.

However, I believe the potential exists that Canada will hit back at the generics giant. Government officials might purposely reduce the country's purchases of drugs sold by Teva and/or advise certain pharmacies to de-stock Teva's products. Any hit to sales would come at the worst possible time for the company.

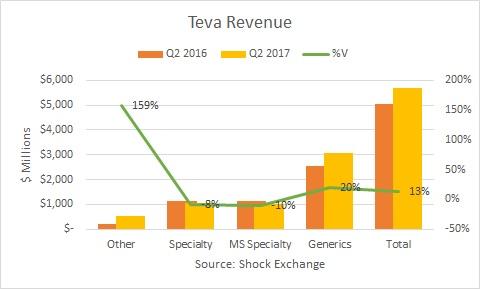

Its Q2 revenue was up 13% Y/Y, yet EBITDA only rose 4% due to margin compression in its generics segment (54% of total revenue). It recently lost exclusivity for Copaxone, its blockbuster multiple sclerosis drug that represents 18% of revenue and an estimated 47% of EBITDA.

The Specialty segment houses Teva's pain-related drugs like Actiq (Fentanyl Citrate) and Fentora (used to treat pain associated with cancer). Revenue from this segment fell 8% Y/Y. The stock is down 66% Y/Y, yet I do not believe the hit to pending hit to Copaxone is priced into the shares. Any headwinds to Specialty could be devastating to Teva. The company's debt/run-rate EBITDA is at 5x and I expect the metric to deteriorate as its potential earnings erosion slowly becomes a reality.