We have nailed some huge calls using our BAD BEAT Investing philosophy. Occasionally however, we like to highlight names that do not exactly fit with this philosophy but should be on your list. One of those names is OpenText (OTEX), a very well-established company with a strong brand name and a large list of reliable partners and clients that has continued to grow over the last couple of years.

Source: Opentext website

We are bringing it to your attention because a number of our colleagues on the Street continue to tip us about this name. The purpose of this column is to share with you the company, a few highlights, and let you decide if you want to research this one further. It appears to be looking to bide time before either breaking out higher, or falling back to $30:

Source: Yahoo Finance

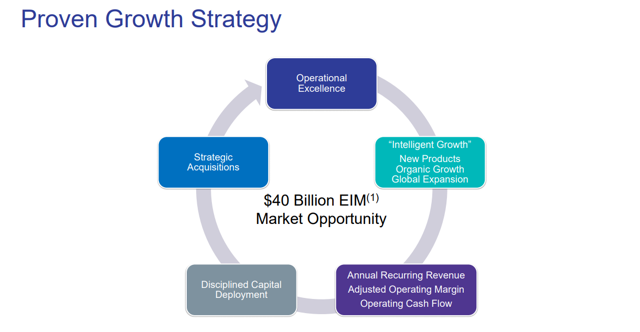

This name is an industry leader in application software and cloud services that has established an impressive portfolio of large clients and has a clear growth strategy that has continuously proven to be successful through mergers and acquisitions, and supplemented by organic growth. We believe it is undervalued as a growth prospect, and think it can move higher in the coming months. A look at their strategy:

Source: Investor Q4 presentation

Within this strategy, it is focused on delivering returns and expanding its margins significantly.

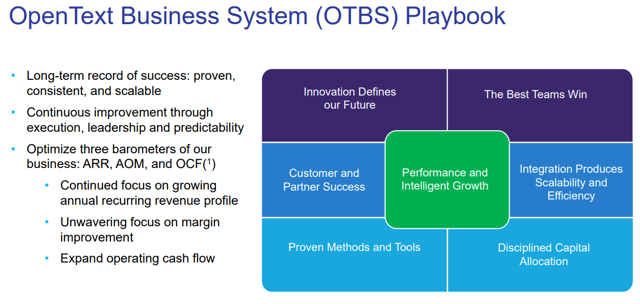

Source: Investor Q4 presentation

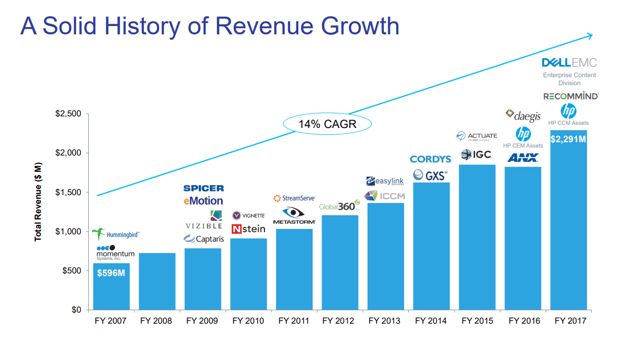

This playbook is working. OpenText reported a strong quarter two months ago, and the company continues its reliable growth. In the open we mentioned that it is growing, and it is growing at a 14% CAGR:

Source: Investor Q4 presentation

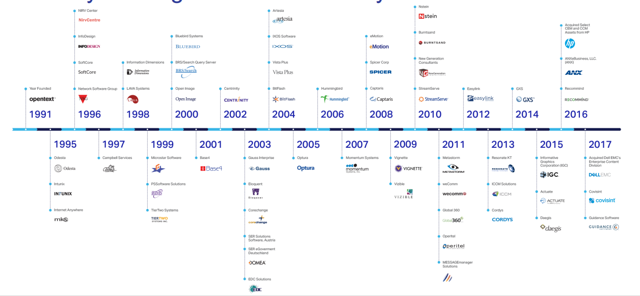

That is impressive. OpenText is a acquiring names left and right and consolidating operations, but it definitely has a product strategy that offers its clients a unified set of solutions for its many customers. However, there is no denying that the company has really pushed for inorganic growth, as there is a well-documented history of integration:

Source: Investor Q4 presentation

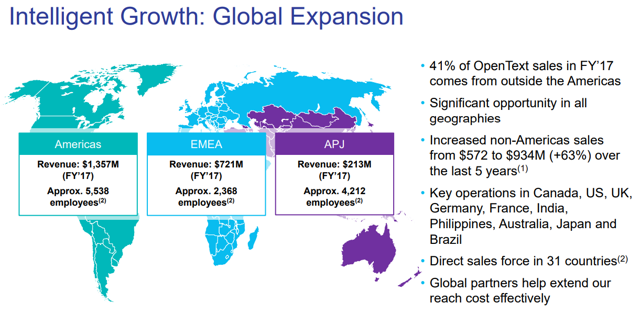

While inorganic growth is common in this sector, organic growth needs to be a focus moving forward. In addition, the company is expanding its operations globally, and should drive revenue growth for years to come:

Source: Investor Q4 presentation

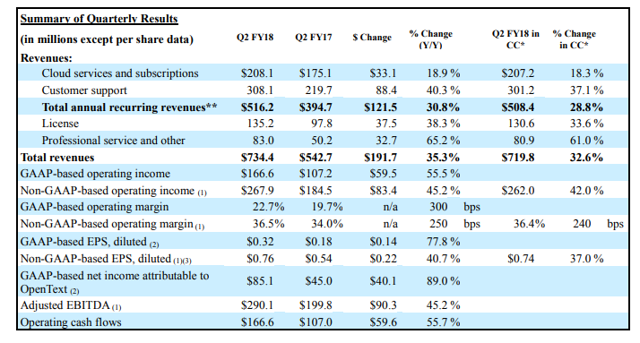

As the company moves forward, the question is whether the improvement in the company’s relative valuation via share price growth versus earnings appropriately reflect the changing growth environment, and future potential of the company. The growth in fiscal metrics is evident:

Source: SEC filings

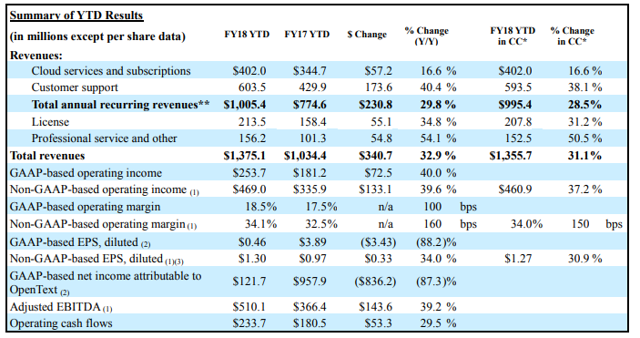

And it was not just a year-over-year quarterly improvement:

Source: SEC filings

Virtually every metric has improved. We further believe that with ongoing acquisitions and international expansion, the numbers will continue to improve. This is not baked into share prices in our opinion, and as such, we believe there is still further appreciation potential into 2020.