Why ROIC Matters

ROIC and the impact on Value

Many equity analysts don’t fully appreciate the importance of ROIC. Wall Street likes to focus its attention on the more glamorous and commonplace metrics of revenue growth, margins and EPS. When ROIC is mentioned, it is usually as part of a brief comment buried deep in the analyst’s report. I believe this is a mistake. A thorough understanding of ROIC can give you deep insights into the nature of a business, how it generates value, and whether it’s likely to continue generating value in the future. Yes, it’s just a number, but understanding what’s behind that number will advance your knowledge in a way that you won’t by following Wall Street’s research. In fact, performing analysis without a thorough understanding of ROIC is to deliberately put yourself at as disadvantage.

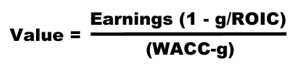

Let’s start with the McKinsey Value Driver Formula, which we explain in this short video.

As with all financial formula, it’s over-simplistic and assumes a number of things are held constant (not least constant growth and constant ROIC). However, this formula serves to illustrate an important truth: It is the interaction between growth and ROIC that drives value creation. Many analysts make the mistake of focusing exclusively on growth, and this leads to a deep misunderstanding of what a company is worth and what it should do to enhance that worth. Studying the formula above leads to two significant conclusions:

- A company with a high ROIC creates significant value for shareholders by growing it’s top line (as long as it maintains the same ROIC)

- For company with a ROIC below WACC, growth will destroy value. These companies should improve ROIC, rather than attempt to grow their top line.

To quote directly from the McKinsey “Valuation” text:

“In general, companies already earning a high ROIC can generate more additional value by increasing their rate of growth, rather than their ROIC, while low-ROIC companies will generate relatively more value by focusing on increasing their ROIC.”

To listen to Wall Street analysts (and the financial media for that matter), you would imagine that growth is the only thing that matters. Understanding the interplay between ROIC and growth will open your eyes to an entirely different mindset.

Sustaining ROIC

Identifying companies with a high ROIC is only the start of your analysis however. Maintaining a ROIC above WACC is not an easy task. In fact the nature of capitalism means that ROIC should trend back towards WACC over time. If a company is earning a high ROIC, this will naturally attract competition until excess returns are eroded away.

This is why Buffett and other successful investors are obsessed with the existence of moats (see piece here about how to identify a moat). An economic moat is the one thing able to keep competition at bay, and hold ROIC well above WACC for a sustainable period of time.

When I find a company with a high ROIC, I ask myself 3 questions:

- How does current ROIC compare to what was achieved historically? Pull up a chart of ROIC over the last ten years from Bloomberg or Ycharts. This tells you whether the current-year ROIC is typical of the historic pattern. Where current ROIC is much higher than in the past, seek to understand why.

- Compare ROIC to WACC. If ROIC is materially higher or lower than WACC, what is the reason? Is this due to temporary factors or something more permanent? Does the company have a sustainable competitive advantage or “economic moat”?

- Where ROIC is high, what are the chances it can be maintained? What forces are at play working to reduce that return?

It’s worth remembering that a high ROIC will always be under attack. Almost the entire purpose of a company is to defend a high ROIC where they have one, or to increase the ROIC where they don’t. The good news for high-return companies is that there are plenty of examples of companies with strong moats that have demonstrated the ability to maintain that moat over decades or more.

Empirical Evidence

The book Valuation by McKinsey reviews a wealth of empirical evidence on sustainability of ROIC. Chapter 4 of this book summarizes the key finding of their work, which covers more than 5,000 US nonfinancial companies from 1963-2008. It’s definitely worth spending 20 minutes of your time reading this chapter, but I’ll summarize the key conclusions here:

- The median ROIC of their sample between 1963 and 2008 was 10%, a figure that was relatively stable throughout the period

- ROIC varies drastically between companies, with only half of the sample having a ROIC between 5% and 20%

- Of the companies that earned a ROIC of over 20%, two thirds of them were still earning a ROIC of over 20% 10 years later. This provides strong support that a good number of companies can maintain a high ROIC.

Additionally, McKinsey perform some detailed work on the median ROIC of each industry, and the spread of ROIC within the industry. Pharma and Biotech have the highest median ROIC of 23.5%, while airlines and utilities have the lowest median ROIC (5.8% and 6.3% respectively). The persistence of returns was found to be highest in household and personal products, beverages, pharma and software. These are industries that benefit from natural barriers to entry, whether it’s brand loyalty, scale benefits or the existence of patents.

A final word of Caution

ROIC is a wonderful tool to help you to understand a company, but we should be aware of its limitations. Like most financial metrics, it is based on numbers taken from the financial statements. These accounting figures do not always provide (nor are they intended to provide) a "true" reflection of the underlying company. In addition the calculation of "invested capital" is not always straightforward (see this video for how to extract invested capital from the balance sheet). But, if you understand these limitations, and treat ROIC as just one analytical tool of many, you will have a clear advantage over those who choose to ignore it completely.

Disclosure: None.

Have something to say on a recent acquisition or merger? Let us know your views on the StockViews platform!

This is an excellent, concise piece on the merits of incorporating ROIC into one's cash flow analyses. Thank you for this.