Yields Busting Out

Global bond yields have been on the rise all night and all morning continuing the trend that started in US Treasuries yesterday. Equity futures are trading lower in reaction, and semis will be an area to watch again as Deutsche Bank is the latest in the chorus of sell-side firms to cut numbers on the group. Despite the uptick in negative analyst commentary, the Philadelphia Semiconductor index has traded up for five straight days. If the sector can squeeze out a sixth straight day of gains in spite of the negative commentary, that could signal a turn for the group.

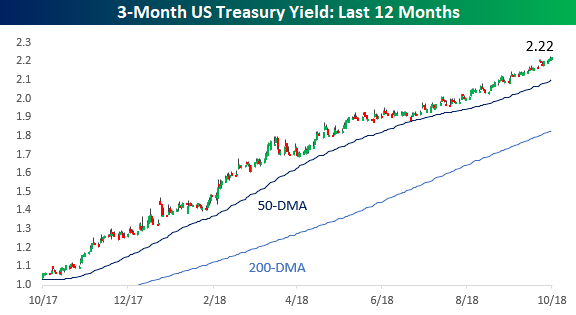

As mentioned above, interest rates are the main focus today. At the short end of the curve, the 3-month Treasury yield continues to move steadily higher hitting a level of 2.22% this morning.

There’s been nothing ‘steady’ about yields at the longer end of the curve, though, as the 10-year yield broke out to 3.22%- its highest yield since 2011!

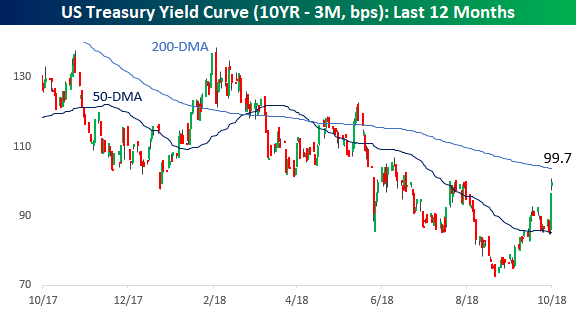

With that breakout in the long end of the curve, the yield curve has spiked from its recent lows in the 70-bps range to just under 100 bps today.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more