Why The Best Long Term Benchmark To Use Is The Dow Jones Conservative Index.

“Why do we compete against the Dow Jones Conservative Index (P20GLB) and not the S&P 500 Index (SPY)?” That is a question I am often asked by my clients. The reason is because I judge my performance over a long term period, through multiple bull and bear markets. I do so because markets, despite what many people may believe, don’t always go up all the time and usually have previous bull market gains wiped out completely in bear markets. By having the ability to not be fully invested at all times, the Dow Jones Conservative Index has been one the best performing Indices over the last 15 years.

Most investors do not invest for just 1 or 5 or even 10 years, but invest over a lifetime, so it is thus important to use a strategy that will allow one to have consistent returns over a decade or two, through multiple bull and bear markets. Here is the actual 15 year track record for the Dow Jones Conservative Index (P20GLB) (BLUE LINE) vs the S&P 500 Index (SPY) (RED LINE).

The Dow Jones Conservative Index has gone up +125.79% through two Bull and two Bear Markets, while the S&P 500 Index has gone up only +27.50% during that same time frame. Thus by being conservative, the Dow Jones Conservative Index has beaten the S&P 500 Index by over +457% in relative performance since 1999.

Now after reading that, you are probably asking yourself, why not just sell when a bear market starts and then buy back in when a bull market starts? Well from many decades of analyzing the markets, I have never been able to find anyone with the ability to achieve that feat consistently, as one never knows when the markets will crash or how far they will go up in bull markets. Warren Buffett, the greatest investor in history, has the following track record vs. the Dow Jones Conservative Index over the last 15 years:

As you can see his Berkshire Hathaway (BRK-A) has underperformed the Dow Jones Conservative index about 90% of the time over the last 15 years and in the 2008-2009 bear market its stock price percentage gains went from having a near 100% profit to fall to 0%. So had you bought Berkshire Hathaway Class A stock in 1999 and held it to 2009 you would have made a zero percent gain during that time frame, while you still would have been up about 70% with the Dow Jones Conservative Index. So with even Warren Buffett not having the ability to predict bull and bear markets with exact accuracy, it becomes rather useless to attempt to do so.

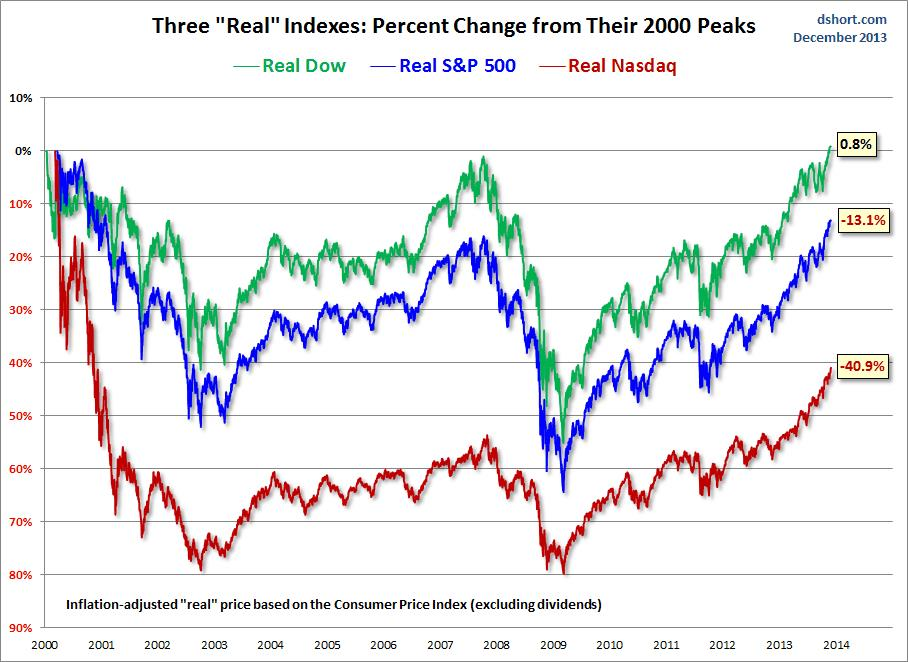

Nevertheless it is important to have consistent gains over a long term period in order to beat inflation and the effects of a devaluating US Dollar. This is a chart of the “Real” returns of the three major US Indices from their 2000 peaks when you factor in inflation.

I run conservative portfolios for my clients and the way I do so is by only buying stocks that show up in my research as having a high margin of safety. When stocks hit my sell price (or are fully valued) and I cannot find anything to replace them with I go more to cash and thus let my research dictate whether I am bullish or bearish and take emotion completely out of the picture. Currently I am having great difficulty finding anything to buy and thus am in a high percentage of cash. Here is an article I recently wrote for TalkMarkets that explains how my research works. At times I also purposely go more to cash when negative macro-events enter the picture (such as Russia’s invasion of Crimea) and thus take most the risk of such an event hurting my client’s portfolios. I may be wrong in doing so nine out of every ten times, but the one time that I am right, more than makes up for the other nine(Lehman Brothers, SupPrime etc.).

I run conservative portfolios for my clients and the way I do so is by only buying stocks that show up in my research as having a high margin of safety. When stocks hit my sell price (or are fully valued) and I cannot find anything to replace them with I go more to cash and thus let my research dictate whether I am bullish or bearish and take emotion completely out of the picture. Currently I am having great difficulty finding anything to buy and thus am in a high percentage of cash. Here is an article I recently wrote for TalkMarkets that explains how my research works. At times I also purposely go more to cash when negative macro-events enter the picture (such as Russia’s invasion of Crimea) and thus take most the risk of such an event hurting my client’s portfolios. I may be wrong in doing so nine out of every ten times, but the one time that I am right, more than makes up for the other nine(Lehman Brothers, SupPrime etc.).

The secret to being a successful investor is to first avoid losses and then only when it is safe to do so, to then invest only when there is a large margin of safety, where one can buy stocks at a discount. This may involve going against the crowd at times, but with most investors having a very short memory span and doing little if any research at all prior to buying stocks (since they had no clue why they bought a stock in the first place) they tend to panic sell when bear markets show up. Therefore for those who practice patience and actually do understand why they are buying a particular company’s stock, opportunities tend to spring up from time to time, which allows them to load up on stocks that have a great margin of safety. Unfortunately the opposite is true today as my research is showing that there is very little margin of safety currently and that most stocks are fully valued or overvalued.

The stock markets would have probably gone down 80-90% in 2008-2009 if the Central Banks of the world had not stepped in and I thank them for their actions, but unfortunately in my opinion, have overstayed their welcome and are now creating one of the largest asset bubbles in history. I say this because many investors are now trading on Margin Debt or borrowed money to buy stocks as a result of the US Federal Reserve (THE FED) keeping interest rates at historically low levels for too long. Since THE FED (from recent comments) has indicated that it has no plans to raise interest rates until 2015-2016, it is thus important to try and invest in only high quality stocks with the greatest margin of safety. The following chart clearly shows that margin debt is now greater than what we had in the 2000 tech bubble and the 2008 housing bubble. So caution is definitely warranted.

In Bull Markets of course the strategy I have outlined above underperforms, but when you also include Bear Markets into the equation it dramatically outperforms, as the evidence in the first chart above clearly demonstrates. In my registered investment advisory business Mycroft Research LLC I invest mostly for retiree’s, who cannot afford losses, as they no longer have an income stream or earnings power to dollar cost average if markets fall. In the end it’s all a matter of how risk averse or conservative you are as an investor. Those of you who suffered large losses in the crashes of 2001 and 2008 understand quite clearly how dangerous markets can be when Bear Markets thunder and thus learned firsthand what the words “Risk Averse” mean.

Always remember that these are the results of our research based on the methodology that I have outlined above and in other articles previously published. This research is provided as an educational ...

more