Why Sell Puts?

This Sh*t Really Works

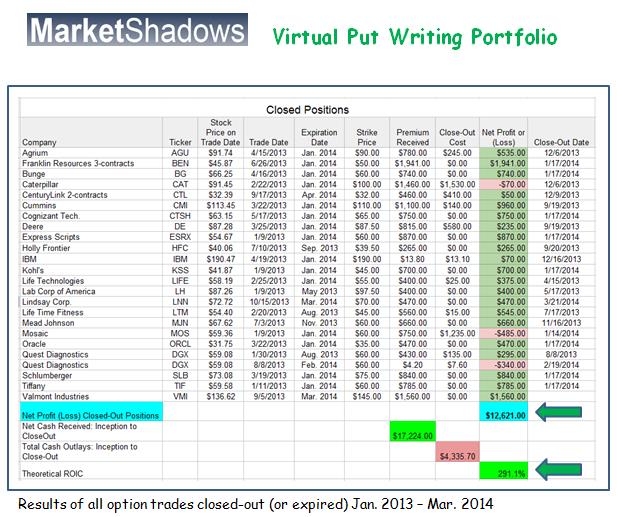

It has been a bit over fourteen months since Market Shadows started our Virtual Put Writing Portfolio. Readers who tagged along with our easy to follow option trades have been big winners.

24 of our put sales have now been completed, either through buying to close or expiration. 21 have been winners. That is a very acceptable 87.5% success rate. Our net profit through Mar. 21, 2014, stands at $12,621 on a final net outlay (total cash needed for all buy-to-close (BTC) trades combined) of just $4,336.

Those who insist on measuring this option writing-performance might call that gain as a 291.1% Return on Invested Capital (ROIC).

In real life, we sell our put options in a margin-type account using buying power derived from the paid-up value of our existing stock positions. The actual cash outlay was always a negative number making our true ROIC infinite and incalculable.

Today was the expiration date for two of our trades. Both underlying stocks closed above the selected strike prices, allowing us to pocket 100% of the put premium received when we first initiated the trades.

Back on Sep. 5, 2013, we sold one Mar. 2014, $145 put contract on Valmont Industries, when VMI shares were going for $136.62. The buyer paid us $15.60 per share for the right, but not the obligation, to make us buy 100 shares @ $145 per share. VMI closed at $147.59 today, making that option a permanently losing bet for the buyer and a $1,560 winner for us.

It is noteworthy that, since the trade's inception date, VMI rose by $10.97 per share yet we made 42.2% more per share. We did that with less risk than if we had purchased VMI stock outright. Our worst-case scenario would have been being forced to buy VMI at a net cost of $129.40 ($145 - $15.60 = $129.40 per share).

Our other expired option was one contract on Lindsay Corp. (LNN) at a $70 strike price. LNN closed today at $80.65 meaning we keep the $460 premium received without needing to buy any Lindsay shares.

We might have been too conservative on this one. LNN was $72.72 when we initiated the trade on Oct. 15, 2013. We could have made even more had we sold an in-the-money strike as we did with Valmont.

Our worst-case scenario on LNN was to be ‘put’ 100 shares at a net cost of $65.40 ($70 - $4.60 = $65.40 per share). Unfortunately we cannot make anyone sell us the shares . When selling puts your maximum profit is always limited to 100% of the premium collected upon the sale of the put(s).

It is never bad when your short put expires, though. Both the VMI and LNN trades have been shifted to our closed-out transactions list.

You can see what we’ve been buying and selling in our equity portfolio, along with our results since inception, by clicking on this link…

Heavy in stocks, I own no bonds