WhatsTrading Recap - 02/05/2015

The S&P 500 rallied at the open and then traded in a narrow range from that point forward. After climbing in three of February’s first four trading sessions, and adding 17.68 to 2059.17 today, the index has recouped last month’s losses and is again in positive territory year-to-date.

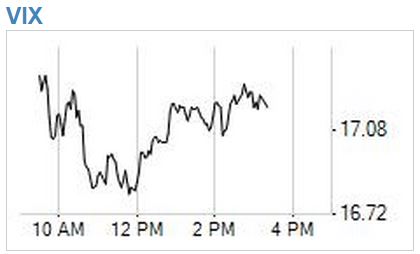

With 40 minutes left in the regular session, CBOE Volatility Index (VIX) is down 1.14 to 17.19 and well off Monday’s intraday high of 22.81.

Treasury bonds are seeing rangebound action ahead of tomorrow’s monthly jobs report. Gold is also flat at $1265, but crude oil bubbled up $2.20 to $50.65 per barrel.

All nine S&P sectors are in the black, being led by basic materials (XLB), energy (XLE), and industrials (XLI).

Overall volumes remain light. In the options market, for instance, projected volume is roughly 14 million contracts for the day and 3 million less than the recent daily average.

Weekly (3/6) 215 calls on the S&P 500 Trust (SPY) are the most active options of the day with more than 70,000 contracts traded.

A lot of the action in individual equity options remains focused on past and future earnings reports. For instance, Weekly (2/6) 16 puts on Pandora (P) are seeing high volumes Thursday, as players hedge their bets ahead of the internet radio company’s earnings this afternoon.

CME Group (CME) is worth watching as well. The exchange is reporting its results and announced late-yesterday that it is closing most of its futures pits in Chicago and New York. The move is certainly a sign of the times, as most trading is now electronic and the open outcry model is long outdated. Certainly the vibe on the CME floor will be a lot different with fewer trading pits. Indeed, entertaining and controversial commentators like CNBC’s Rick Santelli won’t have the same backdrop for reporting on the daily market action in the equity and interest rate futures markets.

In the words of Bob Dylan, Times They Are A Changin…

Disclosure:None