WhatsTrading Recap - 01/28/2015

Weakness in the energy sector is again weighing on the S&P 500. SPDR Energy ETF (XLE) is off 3.5% and the biggest loser among the nine SPDR Sector ETFs after crude oil broke below previous support at $45.

Meanwhile, Treasury bonds are seeing solid gains in the wake of the latest FOMC meeting and the longer-term Treasury ETF (TLT) is ripping to new highs.

The S&P 500 opened higher on upbeat earnings from a number of large caps, but is now down 12.75 to 2016.80 and probing session lows.

CBOE Volatility Index (VIX) hit a morning low of 16.92, but is now up 1.70 to 18.92.

Trading in the options market remains light, however. In the VIX pit at the Chicago Board Options Exchange, for instance, 228,000 contracts traded and that’s about half the normal levels.

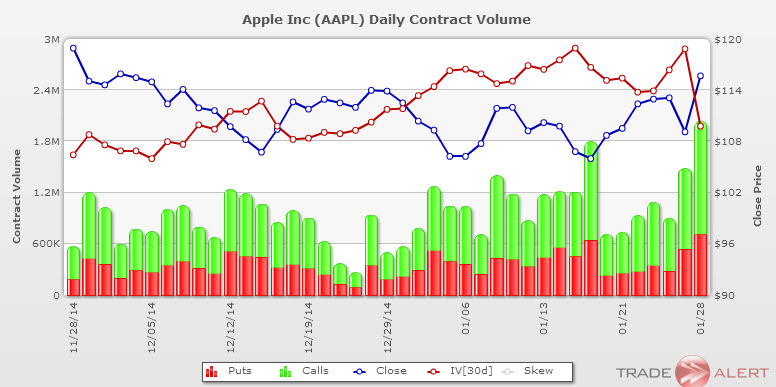

Yet, Apple (AAPL) seeing a flurry of activity as the stock adds $7 to $116.14 on record earnings results. 2 million contracts traded in Apple (or about 14% of the day’s total options activity across all listed options!) Weekly (130) 120 and 118 calls are the most active options of the day.

Microsoft (MSFT) Feb 43 calls, Delta (DAL) Sep 70 calls, and Yahoo 50 calls are among today’s most actives as well.

Disclosure:None