What's To Be Thankful For?

Some of you may recall last year that there was a slew of articles and blogs when bitcoin was near peak FOMO about how to handle crypto discussions at Thanksgiving dinner. Well, there doesn't seem to be any such articles this year. In fact, some are even advising to avoid the topic entirely.

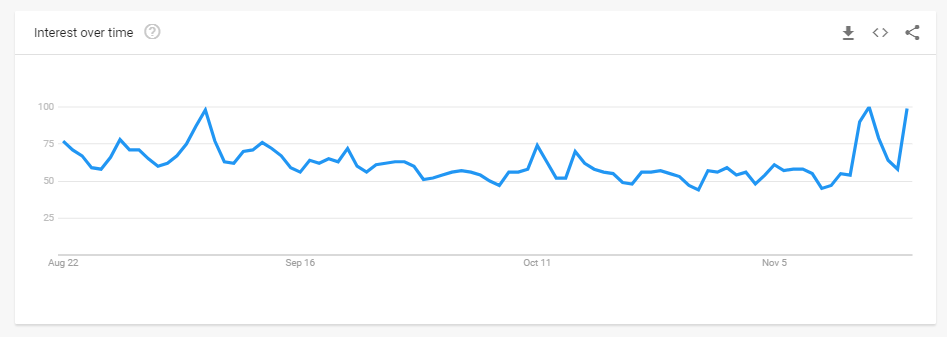

It's a shame too. Particularly now when the price action is weak education efforts should be increased, not decreased. The most recent dip has piqued public interest, so now is actually a really great time to talk about it.

(Click on image to enlarge)

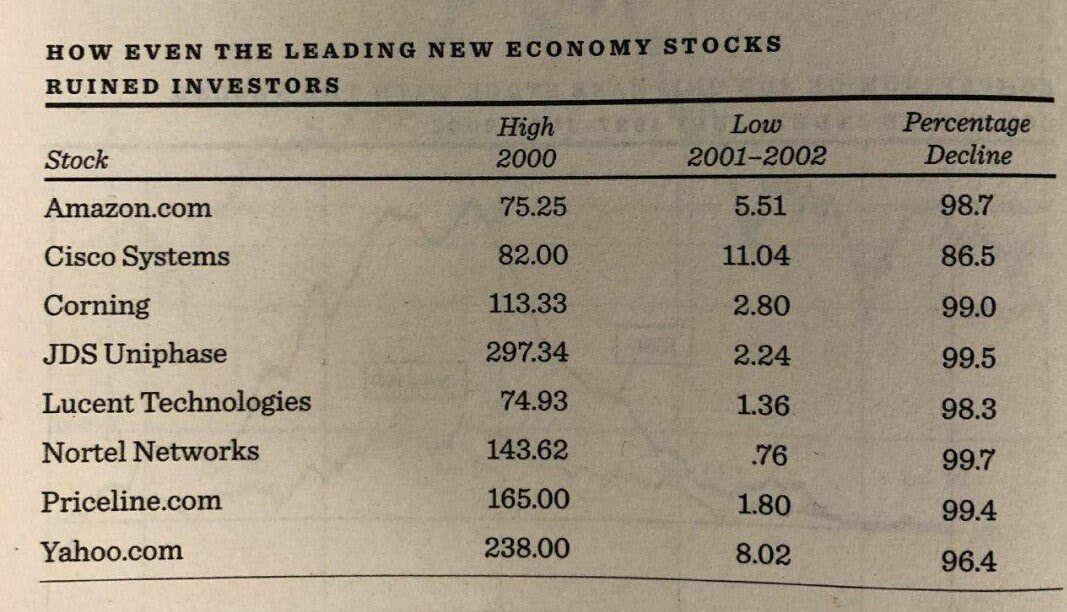

Being thankful isn't just about receiving things. Though I'm sure your aunt who invested in bitcoin might not be the happiest to hear about the financial revolution or the paradigm macroeconomic shift we may be about to witness, what might comfort her is that some of the most valuable stocks today have seen larger drawdowns than this.

Here's a handy reference table...

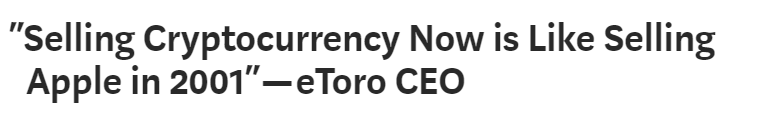

As with all investments, timing things perfectly is nearly impossible, which is why strategies like buy the dip and dollar cost averaging can be so effective. You'll also notice that not all of the above equities ended up being profitable, which is why it pays to employ proper portfolio diversification. As Yoni Assia famously stated....

Furthermore, and most importantly, those relatives that did take a leap of faith and purchased cryptoassets are hodlers now, so they're in the exact same boat as you and may even surprise you with how much they've learned over the last year.

Today's Highlights

- Markets are Tired

- Japanese Double Top

- Bitcoin Technical Analysis

Traditional Markets

It's been a rough week so far for nearly all asset classes and it seems that everyone is ready for a break. Volumes have been rather light so far today in Asia and Europe in honor of the upcoming Thanksgiving weekend, even though most of the world doesn't celebrate this American holiday.

Trading was rather flat throughout the morning, but it does seem that as I'm writing to you some of the key indices have continued further down making a full recovery from these new levels a bit less likely in the short term.

Also, notice that rather ominous looking double-top formation on the Nikkei (right graph).

(Click on image to enlarge)

Many stocks will be closed for trading this afternoon and other assets will have a downtime as well. Make sure to check the market hours page for the assets you're trading. Cryptoassets will remain open throughout as crypto trading is 24/7.

Cryptotrading

In crypto as well, the short-term price action this morning hasn't been entirely positive but the fact that we bounced off $4,000, to begin with, is something that gives me optimism.

One of the pitfalls of extreme volatility is that when bitcoin was on the way up, it, unfortunately, didn't build very many key levels of support. In fact, the only levels that we do have are the psychologically important round numbers of $5,000 and $3,000. These two levels did indeed play a critical role during the bull run as we can see here...

(Click on image to enlarge)

Notice how the price met resistance at $3,000 and had trouble breaking it for two whole months. When it finally did break through in early August it carried all the way to $5,000 and subsequently came back to test $3,000 before continuing forward.

The break above $5,000, on the other hand, led to the historic bull run of Q4-2017. This level has provided key support throughout the second half of this year but sadly has finally succumbed.

At this time, we're back in that familiar range that was traded briefly in 2017. Let's see where it goes from here.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more