What Is Truly Left Of The 'Recovery'

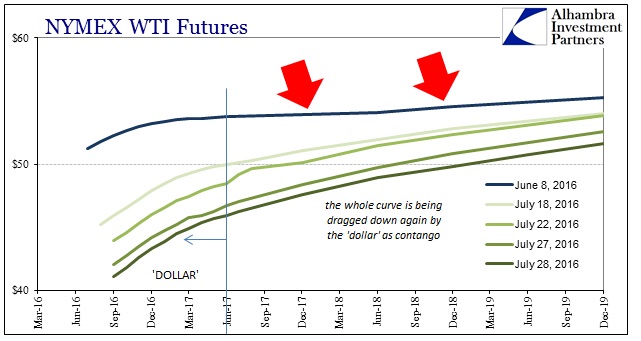

Oil prices are like an unfolding train wreck, as it is nearly impossible to look away now. Day after day, not only are spot prices down but the entire WTI curve is now moving lower in almost perfect unison. Prices have dropped six days in a row, more than $4, and at just above $41 seems a much different world than $51 on June 8.

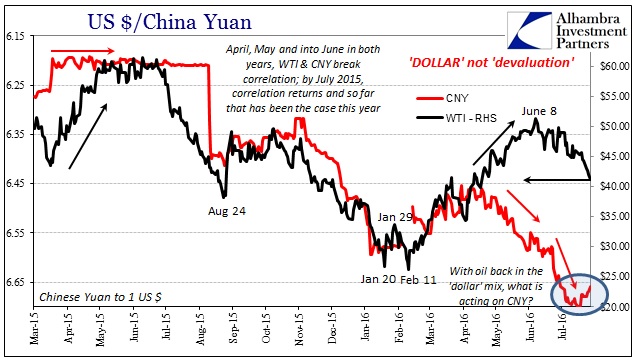

Yet, despite the persistent funding pressure indicated here, CNY actually moved sharply higher today without any support whatsoever from JPY (and by implication Japanese banks and their “dollar” flow). It further proposes what I suggested a few days ago, that the PBOC is once more interfering (“selling UST’s” or “selling dollars”) in the exchange rate and very likely because global funding is once more a serious concern.

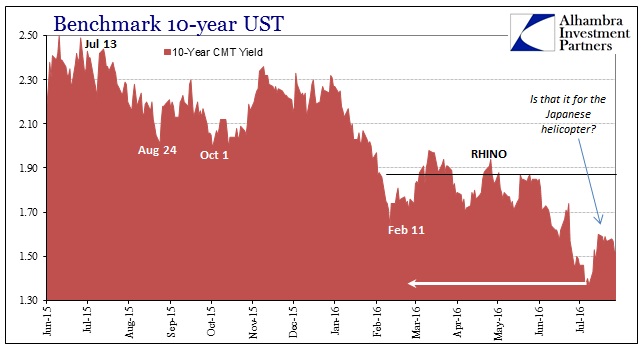

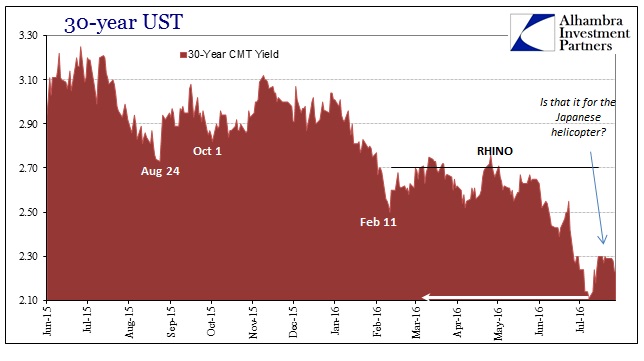

We will find out later tonight exactly what the Bank of Japan has in mind (though I still think the risks are more that they disappoint), but until then there has been a curious lack of serious response to the possibility. In terms of evidence and realistic interpretations, that is as it should be given that there is nothing to suggest further “stimulus” will actually behave like stimulus. The stock market may be impressed, but the bond market is not.

The long end of the UST bond market dropped to record low yields in mid-July, only to reverse somewhat sharply at the first whispers of Japanese “helicopter money.” But that retracement wasn’t very impressive, stopping in the 10s at around 1.60%; 2.30% for the 30s. These reversals were nothing more than what we have seen time and again, the regular variability of market behavior where nothing moves in a straight line. Nominal rates have fallen back again more recently, with the 10-year at 1.52% and still significantly less than the worst part of the liquidations at February 11.

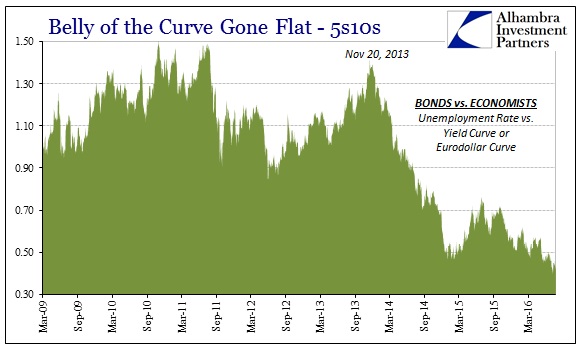

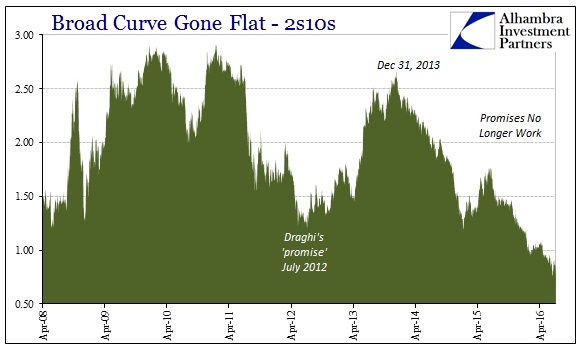

It’s not just the nominal CMT rates, however, as the treasury yield curve shape is also compressing and shriveling. A grotesquely flat yield curve, as money curves, is an indication of “tight” money conditions (in the real economy where it truly matters) suggesting even more economic difficulties ahead.

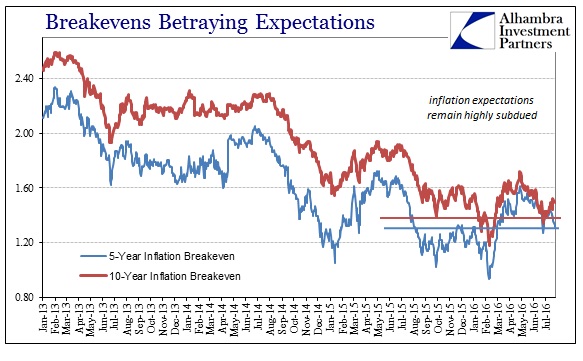

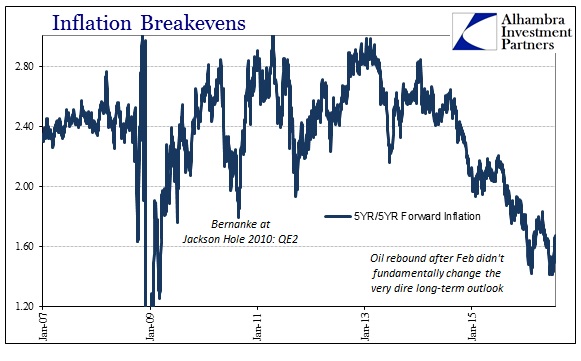

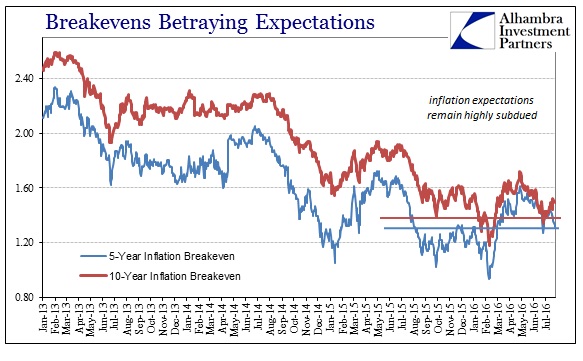

Even inflation breakevens, which you might think would be more in line with renewed optimism in stocks if not at least the oil rebound after February 11, have remained noticeably, conspicuously subdued. The 5-year, 5-year forward inflation rate actually hit a new multi-year low on July 5 just before the BoJ rumors.

From this perspective, you can appreciate why the PBOC might determine that trying again in CNY is the least worst option. There is a whole lot of “dollar” negativity specified here that right at this moment depends on the Bank of Japan, more than anything else, getting something right. It’s about as no-win a scenario (whatever knee-jerk notwithstanding) as you can imagine, and really spotlights the media’s continued deference to “stimulus.” All central banks have accomplished after all these years is to kill money.

That is the only way to interpret especially the 5-year, 5-year forward rate; the extreme low or even still near it says that no matter what the Fed, or any monetary policy globally, might do in the 0-5 year range it won’t have any lasting effect in the 6-10 year period that look increasingly flat and devoid of basic economic positivity like time value and income opportunity. Nominal UST rates and the yield curve are making the same case, as is, of course, the WTI curve (just not out that far). It’s a very bleak financial outlook combined with the wrong side of seasonality and all set against nothing more than hope in the BoJ. This is what’s actually left of the “recovery.”

Disclosure: None.