What Impact Could The NATO Defense Spending Renegotiation Have On EU Budgets, Bonds And Stocks?

Given the mutual relationship of the NATO treaty, it could be argued that for many years the US has been footing the lion’s share of the bill for defending Europe. Under the new US administration, this situation is very likely to change.

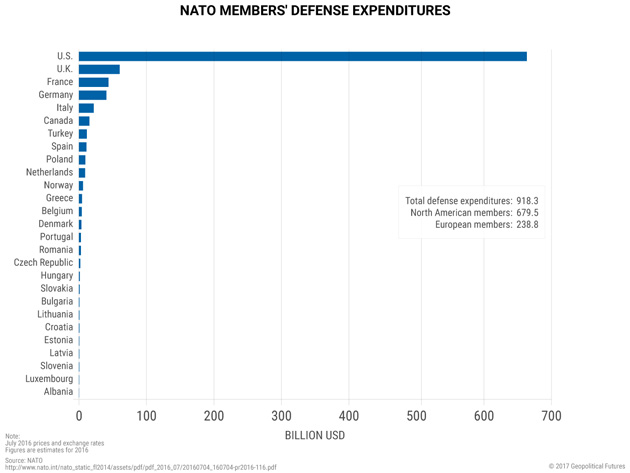

The July 2016 Defence Expenditures of NATO Countries (2009-2016) presents the situation in clear terms. At the Riga summit back in 2006 NATO members agreed to raise defense expenditure to 2% of GDP. In that year only six countries met the threshold - Bulgaria, France, Greece, Turkey, the UK, and the US. Eight years later, at the NATO meeting in Wales, members renewed their commitment to this target. Last year only five members achieved the threshold - Estonia, Greece, Poland, the UK, and, of course, the US.

The original NATO treaty was signed on 4th April 1949 by 12 countries, it was expanded in 1952 to include Turkey and Greece and in 1955 to incorporate Germany. In 1982, after reverting to a democracy, Spain also joined. Further expansion occurred in 1999, again in 2004 and most recently 2009.

Back in 1949, Europe was still recovering from the disastrous social and economic impact of WWII. Today, in the post-Cold War era, things look very different and yet, whilst defense spending has waxed and waned over the intervening years, the US still spends substantially more on defense, both in absolute terms and as a percentage of GDP, than any of its treaty partners. The table below reveals the magnitude of the current situation:-

Source: Geopolitical Futures, Mauldin Economics

US defense spending last year amounted to $664bln which equates to 3.61% of US GDP based on current estimates.

Setting aside the political debate about whether we should be spending more or less on defense, it would appear that the US continues to do more than its fair share, in economic terms, in defense of its NATO allies.

The next table looks at the budgetary implications of making the NATO budget equable. Firstly, all NATO countries committing 2% of GDP to defense (which would dramatically reduce the total NATO budget) or, secondly, maintaining the current level of spending, which would imply all countries contributing 2.58% of GDP. In both scenarios the US is a clear winner in economic terms:-

Source: NATO, UN, IMF

I have excluded the smaller, mainly Eastern European, countries from this analysis – their combined contribution is less than $13bln/annum. I do not wish to appear disparaging, on a percentage of GDP basis many of these countries contribute more than their larger European neighbors. My purpose in this analysis is to look at the relative increases or decreases under each scenario. Below are the Budget to GDP and Debt to GDP ratios before and after adjustment to the less demanding 2% defense expenditure target:-

Source: NATO, UN, IMF, Trading Economics

The Maastricht Treaty incorporated certain criteria in order to satisfy Germany, along with other cautious countries, of the fiscal rectitude of all countries seeking to join the Eurozone. Although they were never really taken seriously by politicians, these fiscal restrictions included a maximum Government debt to GDP ratio of 60% and a Budget deficit to GDP ratio of less than 3%. Applying these arcane criteria, only three countries – Denmark, Norway and Turkey – are in the enviable position of being able to undertake the required defense spending increases with equanimity.

The burning question going forward is how the largest countries in Europe will react to the US compliant that they have failed to increase spending since 2006. As George Friedman of Geopolitical Futures - The Evolving NATO Alliance succinctly explains:-

…the US accounts for about 50% of NATO members’ total GDP and 32% of their total population—and yet the US makes up about 72% of defense spending.

…Western European countries (excluding the UK) account for 31% of NATO members’ GDP and 33%of their population, and yet they contribute 16%to NATO members’ total defense spending.

Eastern European countries, which account for 4.2% of NATO members’ GDP and 12.7% of their population, are much poorer and smaller than Western European countries. Eastern Europe contributes 2.7% to defense spending. In effect, Eastern Europe contributes closer to its share than its far wealthier and stronger neighbors to the west.

According to SIPRI Milex data for 2015, Russia spent 5.4% of GDP on defense. Other notable defenders of their realms include Pakistan (3.4%) and India (2.3%).

At the Munich Security Conference which took place last weekend, the prospect of Germany finding an extra Eur20bln per year for defense spending was raised, but, being an election year, little more was heard on the topic. The conference was fascinating, however, here are some of the key quotes:-

A stable EU is as much in America’s interest as a united NATO – Ursula von der Leyen – Minister of Defence – Germany.

American security is permanently tied to European security – James Mattis – Secretary of Defence – USA.

The role of Germany in Europe is always to be a bridge – between North and South and East and West – Wolfgang Schauble – Minister of Finance – Germany.

Make no mistake, my friends. You should not count America out – John McCain – Chairman of Senate Committee on Armed Services – USA.

Let us not forget that NATO is the backbone of our value system – Jeanine Hennis-Plasschaert – Minister of Defence – Netherlands.

NATO is not an obsolete organisation. It is an organisation to which additional mandates should be added – Fikri Isik – Minister of National Defence – Turkey.

The United States of America strongly supports NATO and will be unwavering in our commitment to this Transatlantic alliance – Michael Pence – Vice President – USA.

Europe’s defence requires your support as much as ours - Michael Pence – Vice President – USA.

Things look very different if we add up our defence budgets, our development aid budgets and our humanitarian efforts all around the world – Jean-Claude Juncker – President – European Commission

The post-war generation rose to their challenge, we must rise to ours – Jens Stoltenberg – Secretary General – NATO.

The European Union is much stronger than we European’s realise – Federica Mogherini – Vice President – European Commission – High Representative for Foreign Affairs and Security Policy – EU.

No one has any clue what the foreign policy of this administration is – Christopher Murphy – Member of the Senate Committee on Foreign Relations.

From a negotiating perspective, it would not be entirely unreasonable for the US to demand that the 2006 commitment of 2% spending be honored retrospectively, in addition to the 2% commitment going forward. The table below shows how NATO members have performed in this respect since 2005, apart from the US, only Greece and the UK have been above target over the entire period. American frustration with its NATO partners is hardly surprising:-

Source: NATO, Geopolitical Futures

The tone of US comments at the Munich conference appear slightly more conciliatory than of late. Europe’s defence ministries have, nonetheless, been seriously shaken by the change in attitude which has accompanied the change of US administration.

According to commentators, who purport to have more of a clue than Christopher Murphy, US defense spending is likely to rise by between $500bln and $1trln under the new administration. This is no “Get Out of Jail Free” card for NATOs parsimonious majority, Europe will be pressured to defense spending at a time when budgets are already uncomfortably bloated. They have had more than a decade to comply with the Riga commitment.

Looking at the bigger picture for a moment, this sudden rise in spending is a small uptick in a downward trend. Defense budgets have been falling in all the major NATO countries, as the chart below indicates. In 1989 excluding the UK and US the average budget to GDP across NATO countries was 2.9% by 1998 it had fallen to 2% but since then it has steadily declined to an average of 1.4% today. This may be good from an economic perspective – as Frederic Bastiat argued most eloquently in relation to the cost of a standing army in his essay What Is Seen and What Is Not Seen:-

A hundred thousand men, costing the taxpayers a hundred million francs, live as well and provide as good a living for their suppliers as a hundred million francs will allow: that is what is seen.

But a hundred million francs, coming from the pockets of the taxpayers, ceases to provide a living for these taxpayers and their suppliers, to the extent of a hundred million francs: that is what is not seen. Calculate, figure, and tell me where there is any profit for the mass of the people.

Nonetheless, the economic burden of defense spending borne by the US is undoubtedly going to shift, or else, NATO will cease to be tenable going forward:-

Source: SIPRI

Conclusion

I believe it is likely that Germany, France, Italy and Spain will find an additional $64bln/annum for Defence and Aid budgets. They may also have to pick up part of the bill for the smaller countries to their East.

Will this impact European bond markets? It seems like a drop in the ocean beside the Asset Purchase Program of the ECB. President Draghi announced in January that they will be reducing the monthly purchases from Eur 80bln per month to Eur 60bln starting in April. I suspect the impact will be limited but it might prolong the Asset Purchase Program somewhat.

The implications for defense contractors and their stock market valuations will be more direct. Here are some of the largest listed names in Europe. Not all of them have been darlings of the stock market of late:-

Source: Investing.com, LSE, NYSE Euronext

For those who, like myself, who prefer to analyze the sector rather than individual stocks, the STOXX Europe TMI Aerospace & Defense (SXPARO) may appeal; here is a three-year chart:-

Source: STOXX

The combination of increased military spending by the US and the pressure being brought to bear on Europe should see the defense sector outperform over the longer term. During the last 12 months, the SXPARO has risen 15%. Its US equivalent, the iShares US Aerospace & Defense ETF (ITA) is up by 20% over the same period, whilst the Euro has declined by around 3% against the US$. As a general rule, I prefer to buy Leaders rather than Laggards, but the logic of buying European if European governments are forced to honor their defense obligations remains compelling.

Disclosure: None.