What Explains The Trump Dollar?

Elevated real interest rates and policy uncertainty explain a dollar about 4% higher than election day.

For a formal assessment of the determinants of dollar exchange rates over lower frequencies, see this paper/post. But since the beginning of 2016, the daily value of the US dollar has been systematically related to these three factors.

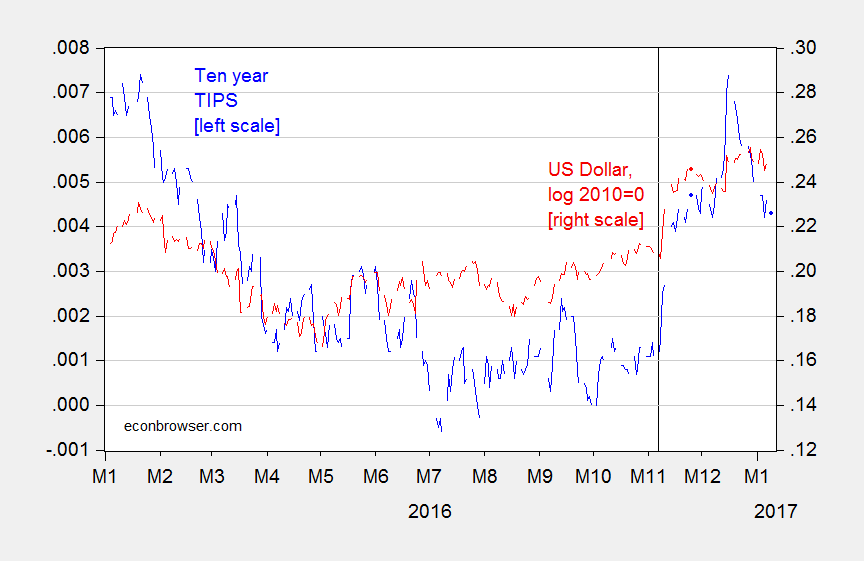

Figure 1: Ten year constant maturity TIPS yields, measured as 1% = 0.01 (blue, left scale), and log nominal value of US dollar against broad basket of currencies, 2010=0 (red, right scale). Up in US dollar denotes appreciation. Vertical line at US election. Source: Federal Reserve Board via FRED.

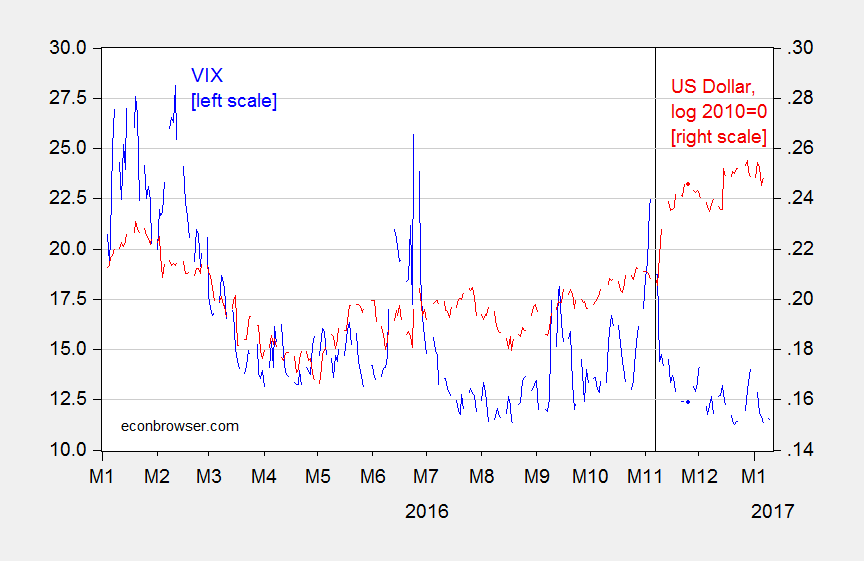

Figure 2: VIX (blue, left scale), and log nominal value of US dollar against broad basket of currencies, 2010=0 (red, right scale). Up in US dollar denotes appreciation.Vertical line at US election. Source: Federal Reserve Board via FRED.

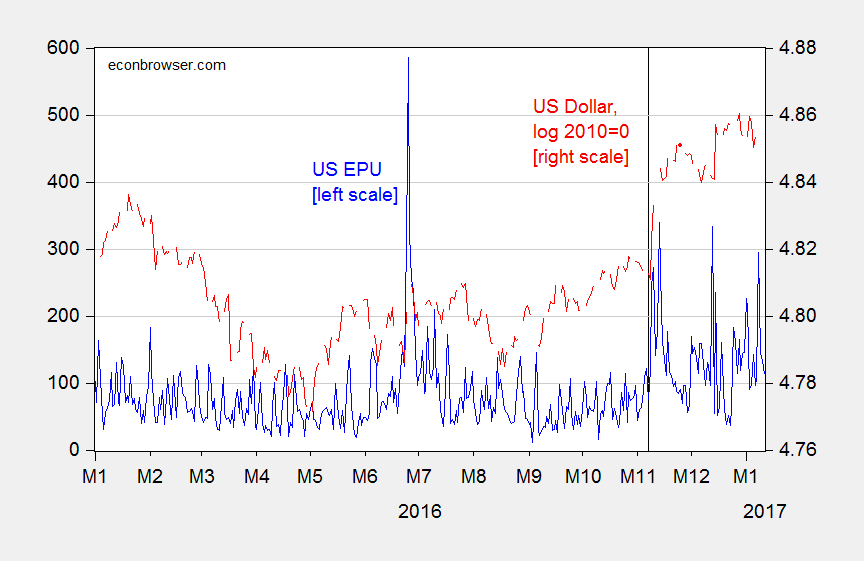

Figure 3: US Economic Policy Uncertainty index (blue, left scale), and log nominal value of US dollar against broad basket of currencies, 2010=0 (red, right scale). Up in US dollar denotes appreciation.Vertical line at US election. Source: Federal Reserve Board via FRED, Baker, Bloom and Davis (accessed 1/11/2017).

Note that the dollar has been substantially higher since the election, at the same time real rates and uncertainty have been elevated relative to the pre-election sample.

I estimate a regression on daily data over the 2016-17 period:

Δet = 0.0005 + 2.779 Δrt + 0.0005 Δ vixt + 0.003 Δ eput + 4.107 Δrt-1 + ut

Adj-R2 = 0.33, SER = 0.0036, DW = 2.11, N = 147. bold entries denote significance at 10% msl using HAC robust standard errors.

e is the log value of the USD; the interest rate defined as 1% = 0.01; the EPU index is divided by 100. A 1 percentage point increase in the real rate increases the nominal dollar (approximately the real dollar over this horizon) by about 5%. A rise in the US economic policy uncertainty index by 100 points leads to 0.3% increase the dollar’s value, while a 1 unit increase in the VIX leads to a 0.05%.

In terms of influence in affecting the exchange rate, standardized beta coefficients indicate the real interest rate (current and lagged) is about twice as important as economic policy uncertainty, and about four times as important as uncertainty as measured by the VIX.

Thus far, most of the dollar appreciation is accounted for by the higher real rate; only a small portion (maybe one-tenth) is accounted for by elevated economic policy uncertainty.

* Full disclosure: I am a former coauthor with Peter Navarro [ more

Thanks for sharing