What Do Low Yields Imply For Bond Allocations?

Yields are still low but the Federal Reserve is expected to lift interest rates further. Conventional wisdom says that this scenario makes bonds a toxic asset class going forward. Maybe, but the analysis is more nuanced when we consider fixed-income from an asset allocation perspective, as a recent report from AQR Capital Management advises.

The analysis starts by recognizing that projecting total returns generally is difficult, but it’s easier for bonds. If you buy a 10-year Treasury Note at a 2% yield and hold till maturity, it’s reasonable to assume that you’ll earn a 2% return. It follows, then, that low current yields imply low returns for bonds. Does that mean that we should cut bond allocations to the bone or avoid the asset class entirely? Not necessarily, as analysis by AQR Capital Management reveals. The main takeaway: holding a broadly diversified portfolio across asset classes remains no less compelling in a low-yield environment that may or may not give way to sharply higher yields in the near term.

“The odd environment that prevailed in 2016 and persists in 2017 does not contradict the strategic case to maintain a diversified asset allocation,” note the authors of Asset Allocation In A Low Yield Environment. “Rather, it highlights the continued need for investors to diversify across more traditional and alternative return sources and size those return sources so they matter in their portfolio.”

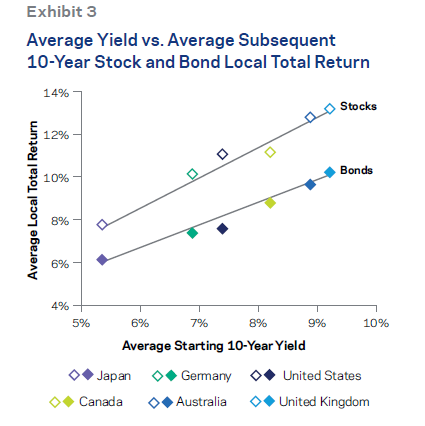

The entire study is worth reading, offering valuable insight on the relationship over the last half century between yields and returns for asset classes. Let’s focus on one part of the paper, namely, the historical record since 1966 on starting yields and subsequent returns via two charts.

The first graph summarizes what should be obvious: current yield tells you most of what you need to know about a bond’s expected total return. Lower (higher) yields tend to be associated with lower (higher) returns in the following decade. Note that the relationship is quite strong for bonds and stocks.

The results above reflect the performance in local currency terms for investing in each market separately. What’s interesting is that the relationship between starting yield and subsequent return changes when the analysis focuses on investing in all markets simultaneously (a proxy for an asset allocation strategy), based on excess return (total return less the risk-free rate, e.g., T-bills in the US). Indeed, as the second chart below reveals, the relationship is considerably weaker between starting yield and subsequent 10-year excess return for a global investment portfolio.

The result in the second chart is a key insight for asset allocation, and one that’s not obvious if you only study the relationship between bonds and total return. As the AQR paper advises: “markets with lower average yield levels have not delivered lower excess returns. It follows that recent low yields don’t mechanically imply a low Sharpe ratio (and hence reduced allocation) for fixed income.”

In other words, yield levels don’t appear to be main driver of excess return for bonds. Why does this matter? Because excess return – risk premia – are more important for asset allocation decisions vs. total returns (risk premia plus the risk-free rate).

This insight leads to the obvious question: What’s the source of excess return for bonds? Two key factors: the term premium and capital gains/losses from unexpected changes in yields.

The term premium is the excess return bond investors expect to earn for taking duration risk ‒ that is for holding a long-term asset whose price can rise and fall with yield levels, rather than just buying a near-riskless asset like a 3-month Treasury bill.

The term premium itself has a (positive) average level but may also vary over time and across markets. How do we observe and measure the average term premium given its variation? We start by recognizing that the slope of the yield curve (difference between long-term and short-term yields) reflects some combination of the term premium and the expected future path of short rates.

The main insight from this analysis: “bonds’ positive long-term excess returns (their risk premium) originate from the average upward slope of yield curves, not the level of yields,” the AQR study explains.

The critical analysis for bonds for making asset allocation decisions, then, is estimating risk premia for fixed income, which is largely related to evaluating the yield curve rather than current yields.

This conclusion leads to the notion that bonds can still be useful for asset allocation in a rising yield environment. That may strike some as counterintuitive. But consider one scenario that could unfold in a low-yield environment: the arrival of a new recession. In that case, it’s possible that the Federal Reserve may cut interest rates, perhaps pushing them into negative terrain. As a result, bond excess returns could be surprisingly robust at a time when equity returns could be low or negative.

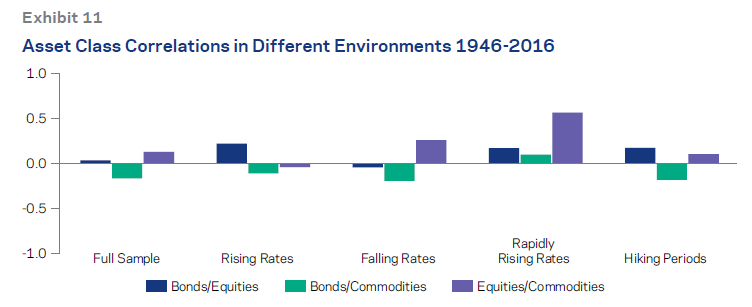

In other words, correlations between bonds and other asset classes aren’t likely to rise close to 1.0 (which would indicate perfect positive correlation) even if interest rates rise. Consider the correlation history for bonds vs. stocks and commodities in varying rate environments. As AQR’s analysis reminds, the correlation between bonds/stocks and bonds/commodities has remained relatively low when yields trend higher. That’s a reminder that it’s short-sighted to dismiss fixed-income in an asset allocation context simply because you expect rates to rise.

In summary, the AQR analysis offers two key observations. First, low yields alone don’t automatically imply a low expected risk premium for bonds. Two, monitoring/analyzing the slope of the yield curve is far more useful for modeling fixed-income’s risk premium. Considering this evidence suggests that it’s premature to assume that bonds deserve an unusually low or zero weight in a diversified asset allocation plan.

Disclosure: None.