Weekly Wrap-Up: SPX, Nasdaq, GLD, XLE, FAS, FDN, GS, VLO, MS, AXP, HAL, IBM, NFLX, FFIV, EBAY

Stocks recorded another losing week last week. In my Market Forecast, I wrote:

“We will definitely get a feel from the financials, which could drive the broader market one way or the other. We have support at SPX 2000 and resistance at 2080.”

Indeed, financials were very weak and dragged down the broader market. Things fell on Monday. Tuesday was a volatile day with a “head-fake” pop in the morning, only to close lower. Wednesday and Thursday were a struggle to hold below SPX 2000. Finally, on Friday, some buyers trickled in and the market saw a little bounce.

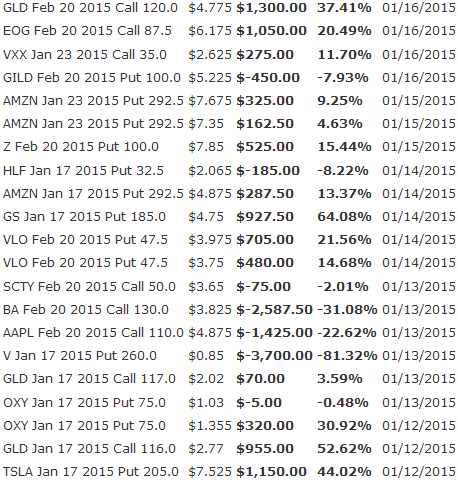

We had a busy week. Gold calls and energy puts gave us some nice profits. Here are the closed trades:

For the week, the Dow was down 225.8 points; SPX fell 25.39 points; Nasdaq lost 69.69 points. Gold, once again a “safe haven”, got a nice pop, closing at around $1277/ounce. Oil traded down to below $45/barrel, but, clawed its way back to close just below $50/barrel. At the time of this writing, Asian markets were mostly higher, although on Monday, China was down nearly 7% on new margin regulation for stock brokerage accounts. Here’s where the US markets stood after Friday’s close:

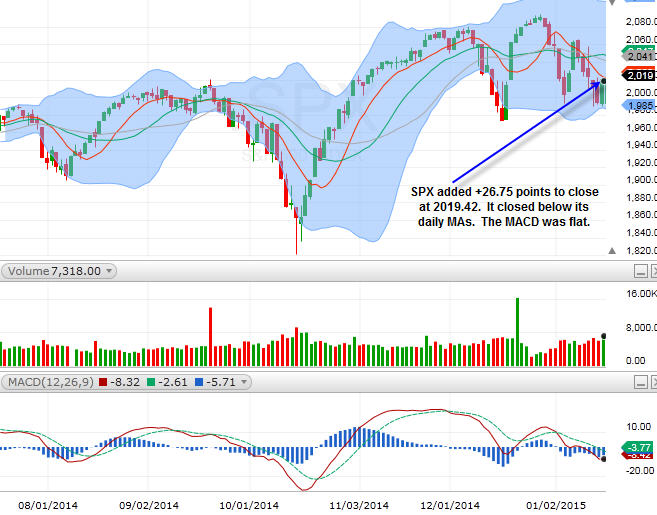

SPX

On Friday, SPX added +26.75 points to close at 2019.42. It closed below its daily MAs. The MACD was flat.

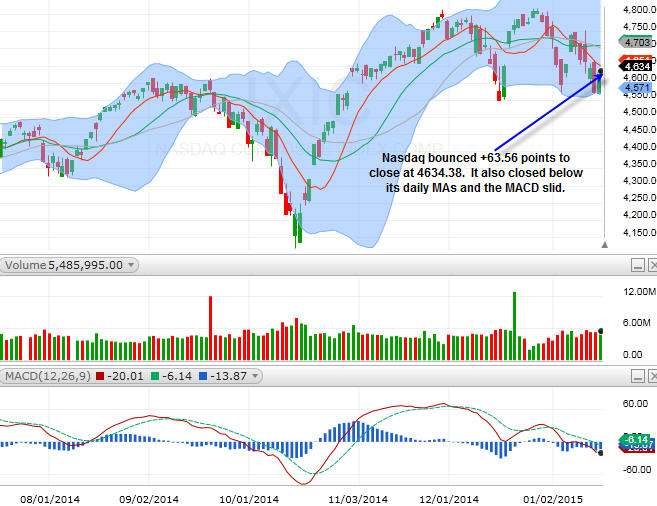

Nasdaq

Nasdaq bounced +63.56 points to close at 4634.38. It also closed below its daily MAs and the MACD slid.

Both SPX and Nasdaq closed below their respective daily MAs. For the new week…

Disclosure: None