Weak Bounce

The bounce wasn't particularly strong and volume was down on yesterday. Today's action keeps resistance in play, and maintains the dominance of Monday's sell off. The S&P tagged 2080 resistance, before reversing. Technicals remain net negative.

The Nasdaq was contained by 5038 resistance, confirming this level and delivering a net bearish turn in technicals.

The Russell 2000 was no different, although it is looking to defend support at its 50-day MA. However, the latter has offered inconsistent form in recent months and therefore unlikely to be of help to either side. As with the Nasdaq, the Russell 2000 is net bearish too.

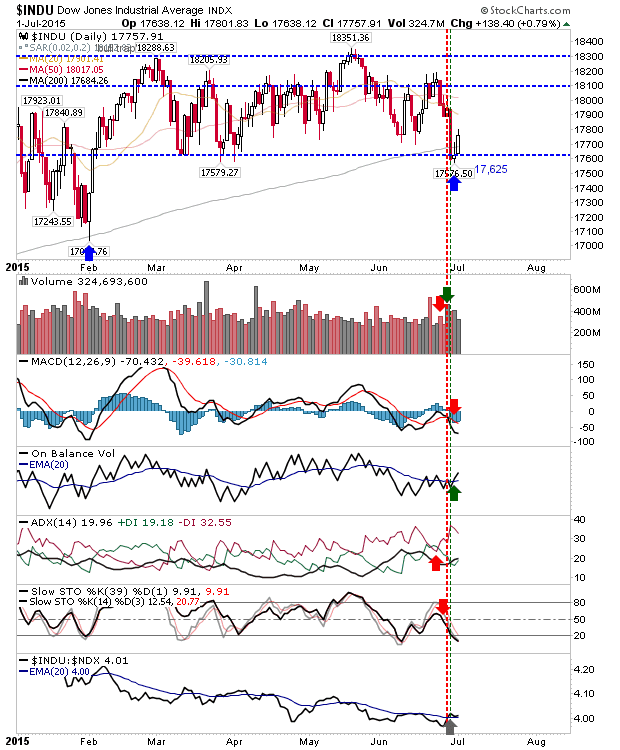

The Dow may offer bulls the best opportunity. It had threatened a break from its trading range, coinciding with a loss of 200-day MA support. Instead, it has managed to dig in and offer a platform for a more sustainable rally.

The other index to present itself at its 200-day MA is the Semiconductor Index. It is dealing with a channel breakdown, but has experienced heavy losses which offer opportunity for a relief bounce (if not more).

NFP data tomorrow could be the catalyst to launch rallies in the Dow and Semiconductor Index. However, Greece and China overshadow everything, and with such doubts in the market bulls may find it hard to commit for the long haul.

Disclosure: None.