Wasn’t September Supposed To Be A Bad Month For Stocks?

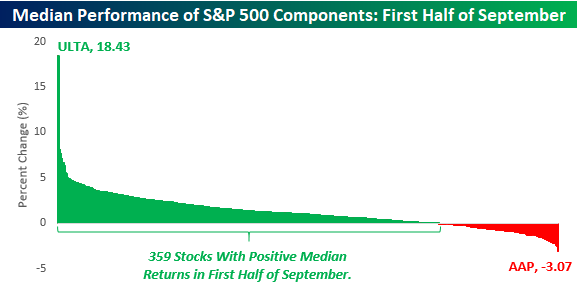

For all the talk about how bad a month September has historically been for US equities, this September surely isn’t fitting the mold. Through Monday afternoon, the S&P 500 has gained 1.4%, which is a good return for the first half of any month, let alone the month that has historically been weaker than any other month. Looking a little bit deeper, though, it should be noted that the first half of September has historically been considerably stronger than the second half of the month. The chart below shows a distribution of the median returns for every stock in the S&P 500 during the first half of September over the last ten years. As you can plainly see, well over half of the stocks in the index have seen gains during the first half of the month; 359 to be exact. Overall, the median return for each stock in the S&P 500 is 1.02% with Ulta Beauty (ULTA) leading the way higher with a median gain of 18.43%, while Advanced Auto Parts (AAP) brings up the rear falling 3.07%.

(Click on image to enlarge)

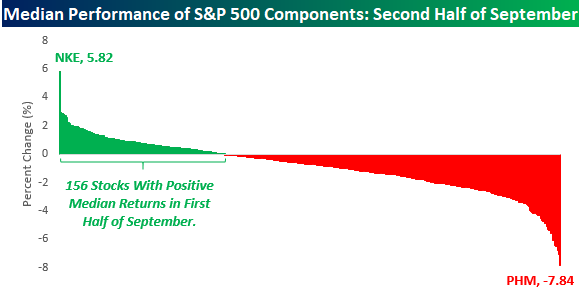

The first half of September may historically be positive, but the picture changes considerably in the second half of the month. During this period, just 156 S&P 500 components have positive median returns, and the median return for all 500 stocks is a decline of 0.72%. Leading the way higher during the second half of September, shares of Nike (NKE) have seen a median gain of 5.82%, while Pulte Group (PHM) leads the way to the downside with a median decline of 7.84%. Just to further illustrate how much weaker the second half of September has been relative to the first half on a historical basis, while just one stock (AAP) has seen a median decline of 3% during the first half of the month, 52 stocks in the index have been down more than 3% during the second half of September.

(Click on image to enlarge)

Disclosure: Gain access to 1 month of any of Bespoke’s membership levels for $1!

Disclaimer: To begin ...

more