Wall Street Traders Report October 29th

Wall Street Traders Report October 29th

Welcome to my first blog for several months. I took a few months off from trading to work on my trading plan and to focus on fine tuning my exit strategy. It ended up occurring at an opportune time with the markets dropping heavily in the months of September and October when I was not invested in any trades. As a trader I think it’s good to have a break from trading and to sit back and see how the market behaves without the emotion involved in holding trades.

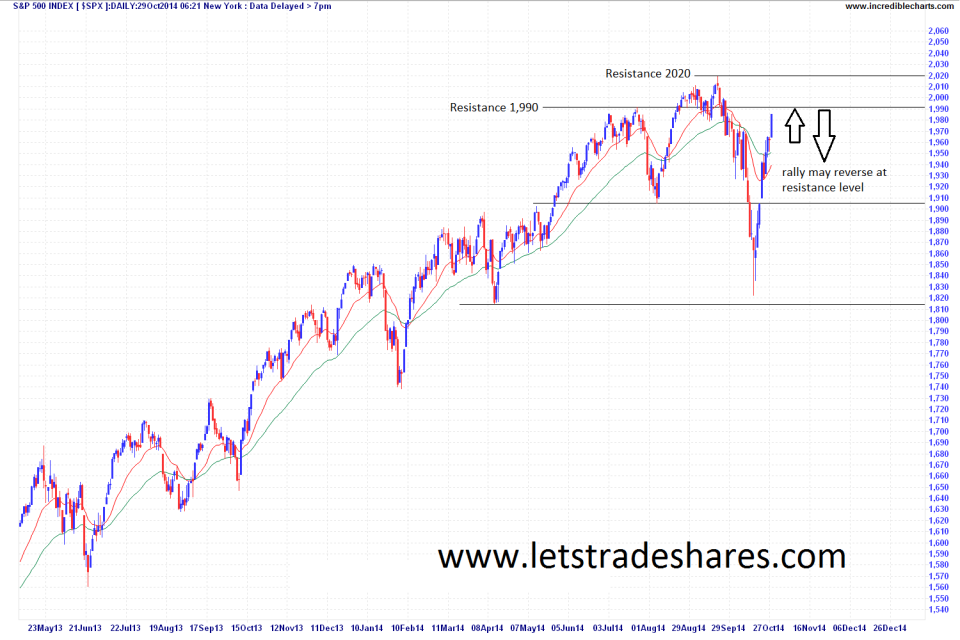

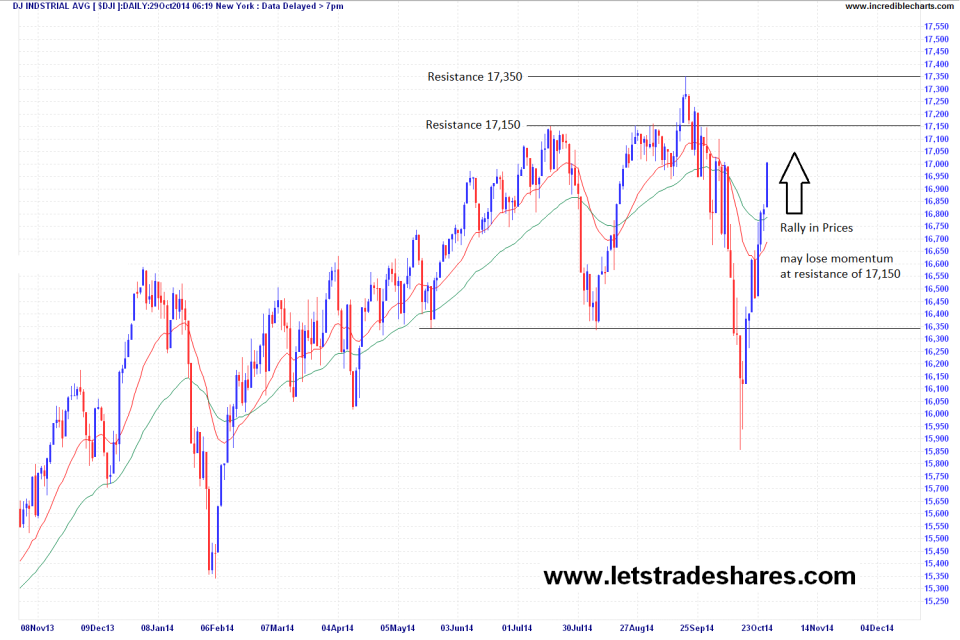

Looking at the Dow Jones Index and the S&P500 index below it can be see that the markets were heavily sold off in late September and into October. The markets have since rallied from mid October and are closing in on the first resistance levels as depicted in the charts below. After such a strong rally prices may start to blow off and sellers may be tempted back into shorting positions with buyers also off loading long positions.

At this stage I am going to be sitting on the side-lines until either the first resistance level is overcome with the more likely scenario being that I will not enter the markets again until all time resistance in both the Dow Jones and the S&P500 is cleared.

I look forward to providing more regular blog articles in the coming weeks.

Happy Trading

Flavio

S&P500 INDEX

DOW JONES INDUSTRIAL AVE INDEX

Disclosure: None.