Vertex Pharmaceuticals Incorporated’s Pipeline Drug Approved By FDA On July 2; Analysts Still Bullish

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) excited Wall Street on July 2 after the company announced that the U.S. Food and Drug Administration (FDA) approved its pipeline drug, Orkambi. For the first time in history, there is a medicine to treat the underlying cause of the most common form of cystic fibrosis (CF). Realizing the possible benefits of the drug, analysts are continuing to shed light on Vertex’s future.

CF patients over 12 years of age with two copies of the F508del mutation realized a fair fight against this rare, life-threatening genetic disease. Over 30,000 individuals suffer from CF in the United States, and thanks to Vertex, now 8,500 will be able to battle the disease. In only a few days, Orkambi will be ready to ship to specialty pharmacies across the United States.

Vertex CEO, Jeffrey Leiden, stressed the significance of the approval for “science, medicine and the CF community.” The CEO expresses that “ORKAMBI represents a fundamental change in the treatment of the most common form of CF, marking significant progress for us and the entire CF community.”

It’s been more than 15 years since Vertex scientists set out to hunt for such a cure. Robert Beall, CEO of the CF Foundation, expressed that many believed the challenge “would be impossible.” On July 2, they were proven wrong.

However, Orkambi can only help those patients who have access to the drug. That is why The Vertex Guidance & Patient Support (Vertex GPS) program provides a dedicated team of Vertex employees who help eligible patients understand insurance benefits and the resources that are available to help purchase the drug.

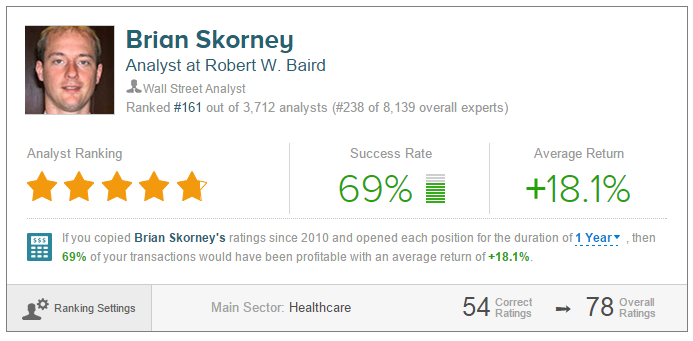

Robert W. Baird analyst Brian Skorney weighed in on Vertex following the approval of Orkambi, reiterating a Buy rating on the stock with a $160 price target on July 6. The analyst reported, “Orkambi approval came on time, marking a pivotal point in Vertex’s history with a product that we believe will drive the bottom into positive territory next year and remain dependably profitable for the next decade and beyond.” The analyst finished up by noting that the drug was priced more favorably than he expected.

Click on picture to enlarge

When measured over a one-year horizon and no benchmark, Brian Skorney has a 69% success rate recommending stocks and a +18.1% average return per recommendation. The analyst has rated Vertex a total of nine times since April 2010, earning an 88% success rate recommending the stock and a +19.7% average return per VRTX recommendation.

Also feeling bullish on Vertex is Piper Jaffray analyst Edward Tenthoff. Following the approval of Orkambi, on July 6, the analyst reiterated a Buy rating on the stock, boosting his price target to $161 from $146. The analysts believes the “approval will drive top-line results and profits.”

Tenthoff noted, “Vertex announced annual Orkambi pricing of $259,000, which was below our expectation.” He continues that the “ramp in sales will result in sustained profitability with non-GAAP EPS now at $3.15 in 2016 and $5.69 in 2017.”

Click on picture to enlarge

When measured over a one-year horizon and no benchmark, Edward Tenthoff has a 62% success rate recommending stocks and a +27.3% average return per recommendation. The analyst has rated Vertex a total of three times since July 2012, earning a 50% success rate recommending the stock and a +10.8% average return per Vertex recommendation.

Out of the 11 analysts polled by TipRanks, eight analysts are bullish on Vertex and three are neutral. The average 12-month price target for Vertex is $143.78, marking an 11.60% potential upside from where the stock is currently trading. On average, the all-analyst consensus for Vertex is a Moderate Buy.

Disclosure: To see more, visit more