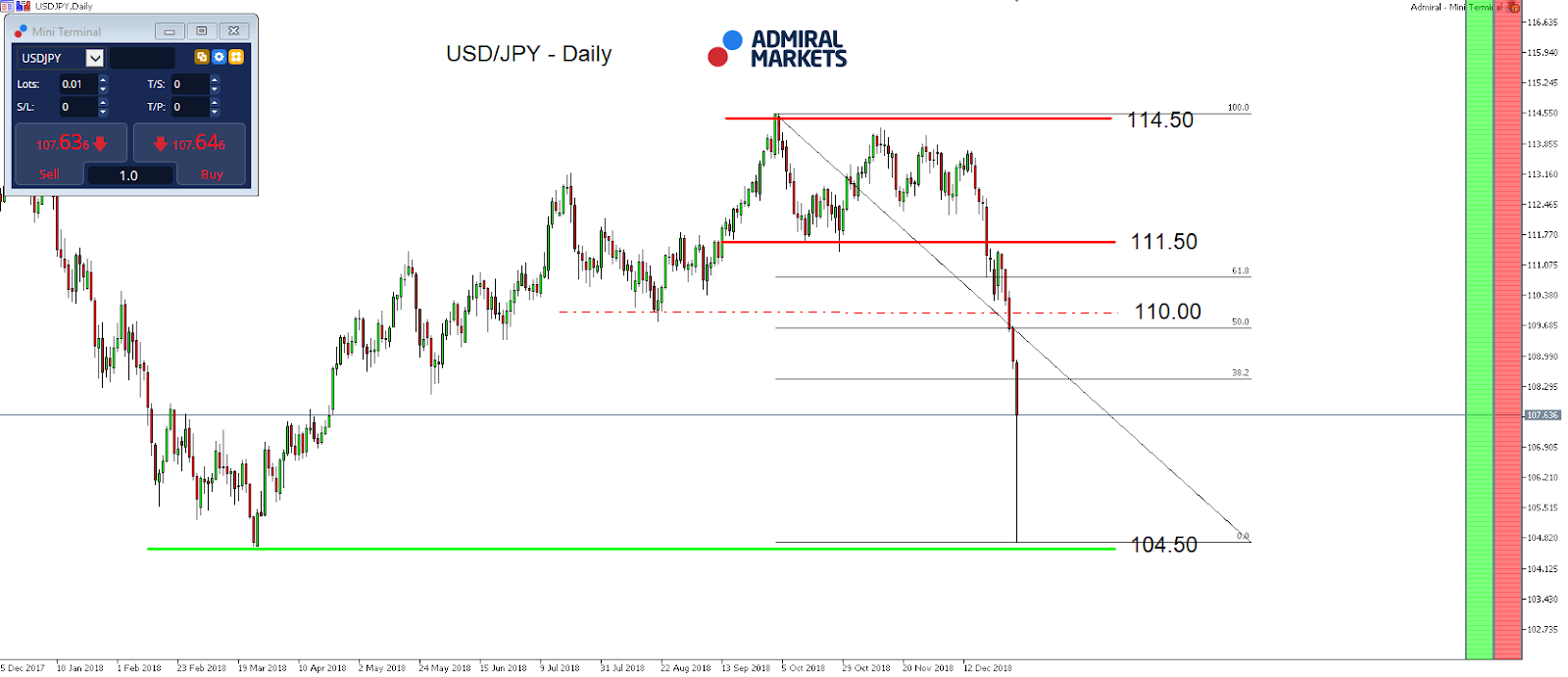

USDJPY - Will JPY See Another Flash Crash Thanks To The NFPs On Friday?

The year started with a "bang" in JPY crosses, with USDJPY dropping to around 105.00 JPY, the lowest levels since March 2018. The reason was a Flash Crash on the first day of trading in 2019 on Tuesday, most-likely initiated by Apple's revenue outlook cut for the first time in almost two decades. Apple CEO Tim Cook pointed straight and directly to China, stating that to the macroeconomic slowdown was almost-entirely responsible for the roughly 10% drop in revenue guidance.

Source: Economic Events 04 January 2019 - Admiral Markets' Forex Calendar

Followed by that, the JPY rose on a broad front, aggressively driven by the quietest and illiquid time of the day for FX markets. While the JPY and all other financial markets could stabilize on Thursday, with the NFPs ahead, and knowing about the importance of this months' employment report after the rising tensions between US president Trump and the Fed (here especially chairman Jay Powell after the rate hike in December), fear of thin respectively missing liquidity could trigger sharp spikes in both directions, especially on the downside.

(Click on image to enlarge)

Source: Admiral Markets MT5 with MT5SE Add-on USDJPY daily chart (between 15 Decmber 2017 to 03 January 2019). Accessed: 03 January 2019 at 10:00 PM GMT - Please note: Past performance is not a reliable indicator of future results, or future performance. - In 2014, the value of USDJPY increased by 13.7%, in 2015, it increased by 0.5%, in 2016 it fell by 2.8%, in 2017 it fell by 3.6%, in 2018 it fell by 2.7%, meaning that after five years, it was up by 4.1%.

This is especially true, if data comes in below expectation (< 170,000). As pointed out in our weekly market outlook, large speculators are still quite extended net-long on the US-Dollar, and a below expectation report could trigger another wave of USD selling, from which especially the yield-sensitive JPY could profit, and a re-test of the region around 105.00 JPY in the days to come becomes an option. On the other hand, a better than expected reading (> 185,000) could result in a sharper bounce higher in USDJPY back towards 110.00.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more